Walmart Remains Winner In Supermarket Price Wars In September

The latest September grocery pricing survey from Goldman Sachs analysts shows that Walmart remains the leader in the price war among retailers, including Kroger, Albertsons, Sprouts Farmers Market, Whole Foods (WFM), and Dollar General.

A team of Goldman analysts led by Leah Jordan wrote in a note to clients on Monday their key takeaways from the September grocery pricing survey. The survey reveals that overall, month-over-month pricing among tracked retailers remains stable, with Walmart continuing to offer the lowest prices, despite price gaps widening.

An excerpt from Jordan’s note reads:

WMT continued to have the lowest prices

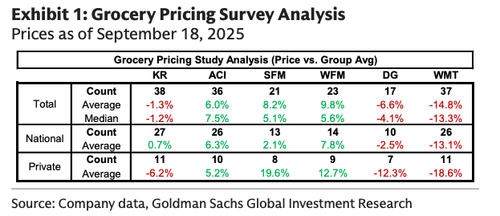

As highlighted in Exhibit 1, WMT had the lowest prices at -14.8% vs. the group average (widened from -13.6% last month), followed by DG at -6.6% (vs -3.7% last month). WFM had the highest prices in the group at +9.8%, followed by SFM at +8.2%. KR had the highest SKU availability for the products surveyed at 38, followed by WMT at 37.

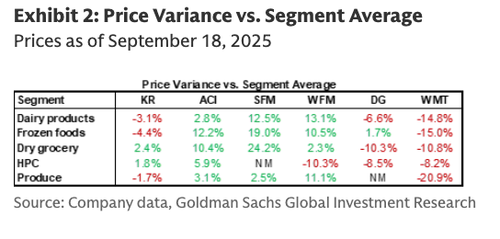

Looking by category (Exhibit 2), WMT had the lowest prices in dairy (-14.8%), frozen foods (-15.0%), dry grocery (-10.8%), and produce (-20.9%), while WFM had the lowest prices in HPC (-10.3%). On the other hand, WFM had the highest prices in dairy (+13.1%) and produce (+11.1%), SFM had the highest prices in frozen foods (+19.0%) and dry grocery (+24.2%), and ACI had the highest prices in HPC (+5.9%). That said, we note limited SKU availability for SFM in frozen and dry grocery.

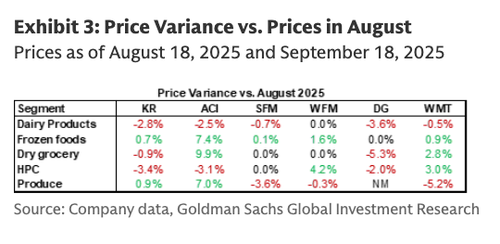

Prices overall were relatively stable sequentially

We compare how prices for our select SKUs have changed since our last survey in August 2025. The overall average basket was relatively stable m/m with increases in dry grocery and frozen foods largely offset by decreases in produce and dairy. By retailer, we observed the most sequential increases from ACI and WMT with 3 out of 5 categories, and the most sequential decreases from KR and DG with 3 out of 5 categories

Price gaps widened

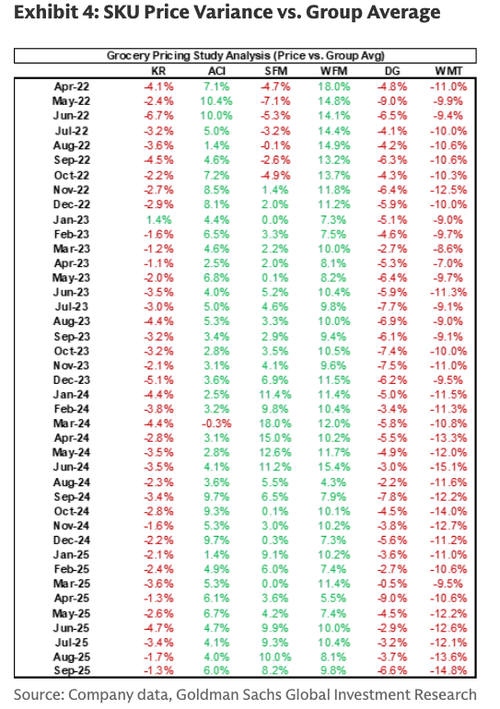

Considering how the price gap has evolved, we compare the price variance against the group average and learn that price gaps widened m/m for 4 out of 6 retailers in our survey including ACI, WFM, DG, and WMT, while KR and SFM narrowed. Compared to the group average, prices were relatively higher vs. last month for KR, ACI, and WFM, while SFM, DG, and WMT were lower.

Additionally, price gaps widened vs. a year ago for SFM, WFM, and WMT, while KR, ACI, and DG narrowed. Compared to the group average, prices were relatively higher vs. last year for KR, SFM, WFM, and DG, while ACI and WMT were lower.

The full note, along with consumer survey data from HundredX, can be found in the usual place for ZeroHedge Pro Subs.

With the back-to-school season underway, investors remain concerned about low-income consumers, although overall spending appears to be stable. Earlier this month, Deloitte’s holiday sales forecast raised concerns about a potential slowdown later this year.

Goldman’s top sector specialist, Scott Feiler, provided clients over the weekend with four tactical thoughts on the health of the American consumer.

As for the supermarket price war, Walmart has been leading for well over a year, as recent trends have shown wealthier consumers traded down from Whole Foods and other upscale supermarkets to Walmart at the tail end of the Biden-Harris regime’s first term.

Tyler Durden

Mon, 09/22/2025 – 18:50