One autumn day, 2011 Jeffrey Epstein entered JPMorgan Chase's office at 270 Park Avenue and took an elevator to the executive level where their offices had bank heads, including CEO Jamie Dimon. Epstein, who 3 years earlier confessed to a sex crime in Florida, had a message for the leading bank lawyer, Stephen Cutler: He said he "opened a fresh card"And powerful friends can vouch for him. "Talk to Bill Gates about me."

Key conclusions:

Epstein was affiliated with Israeli Prime Minister Benjamin Netanyahunot just with erstwhile Prime Minister Ehud Barak

He transferred "hundreds of millions of dollars for payments for Russian banks and young women from east Europe'

Accounts for young women were opened without individual verification (in 1 case the SSN number could not be confirmed)

Jes Staley He constantly interfered in cases involving compliance by Epstein and JPM

At the proposition of Jes Staley, the compliance spoke to Epstein's lawyer, Ken Starr, who insisted that "no crimes were committed".

Epstein held accounts in the JPM for at least 134 (!) entities

JPM organ financed/provided work related to Ghislaine Maxwell (millions, including $7.4 million for Sikorsky helicopter) and helped finance MC2, modeling agency linked to Jean-Luc Brunel.

For over a decadeJPMorgan pursuit processed over $1 billion in transactions for Jeffrey Epstein – of which hundreds of millions directed to Russian banks and payments to young women from east Europeopened at least 134 Accounts related to him and his associates, or even helped decision millions to Ghislaine Maxwell – including $7.4 million on Sikorsky helicopter - while anti-money laundering workers repeatedly signaled large cash withdrawals and transfer schedules in line with known rates of trafficking, according to the fresh study NY Times After a six-year investigation which included "about 13,000 pages" of legal and financial documentation. It's comic how they've been doing this so far - possibly it's from with related, but keep reading.

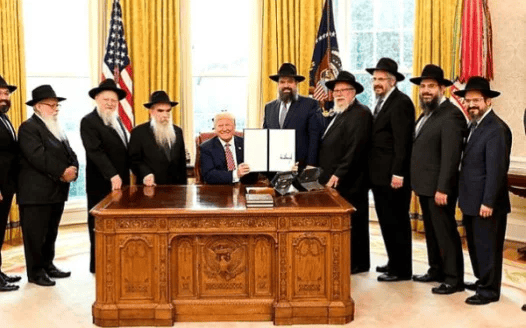

In JPMorgan The debate on whether to keep Epstein as a client has been cooking for years. Epstein was lucrative. His accounts included over $200 million and generated millions of fees, and he himself opened the door to rich prospects and planet leaders. In 2004, he helped the midwife buy Highbridge Capital Management by the bank, earning $15 million. Older bankers attributed him to an introduction to specified personalities as Sergei Brin and Benjamin Netanyahu.

Indeed, as more and more bank employees were losing patience with Epstein in 2011, he began spreading more gadgets. In March of this year,to the pleasant surprise of JPMorgan's investment bankers in Israel, they were given an audience at Netanjah.Bankers informed Staley about this, who sent their email to Epstein with a one-word message: "Thanks.". (Bank spokesperson said JPMorgan "did not request nor search Epstein's aid in meetings with any government leaders"). Around the same time Epstein created an chance that, like the Highbridge agreement many years earlier, had the possible to become transformative.

This time it was about Bill Gates.It's only late in Epstein's interest orbit. In an apparent effort to delight – and even more active – your relation with your bankers and Microsoft co-founder,Epstein persuaded Erdoes and Staley to make a immense investment and charity fund with assets worth about $100 billion. - fresh York Times

Compliance leaders called on the bank to "exit" the criminalAfter the anti-money laundering staff noted a long-term pattern of large cash withdrawals and continuous wires that in retrospect matched known indicators of trafficking in human beings and another illegal behaviour.Instead, top management rejected objections at least 4 times, allowed young women to open accounts with small verification and paid Epstein straight – mentioned $15 million related to the hedge fund agreement and $9 million as part of the settlement. Even in 2011, as concerns grew, interior notes referred to the decision "waiting for consideration by Dimon", while Jes Staley, Epstein's elder manager and trustee, exchanged sex subtext messages ("Say hello to Snow White.") and shared confidential banking information with the client.

$1.7 million in cash (2004-05) and previously $175 1000 in cash (2003).

$7.4 million transferred to acquisition Sikorsky Maxwell's helicopter.

A credit line of US$50 million approved in 2010, even after the suit was filed; ~ $212 million then in the bank (about half of its net assets).

USD 176 million transferred to Deutsche Bank after leaving the EU in 2013.

The JPM of course regrets everything - calling their relation to Epstein "a mistake and in retrospect we regret it, but we did not aid him commit his hideous crimes" - wrote Joseph Evangelisti, JPMorgan's spokesperson in a statement. "We would never proceed our business with him if we believed he was active in an ongoing sexual trafficking operation.". The bank dropped a large condition of the blame on Jes Staley, then the rising manager and close trustee Epstein. "Now we know that this trust was poorly located," said Evangelisti.

Too valuable to lose

Epstein's ties to JPMorgan reached the end of the 1990s erstwhile the then CEO of Sandy Warner met him at 60 Wall Street and urged Lieutenant, Mr. Staley, to do the same. Epstein shortly became 1 of the main gross generators of the private bank. The 2003 interior study estimated his assets at $300 million and attributed him this year over $8 million in fees.

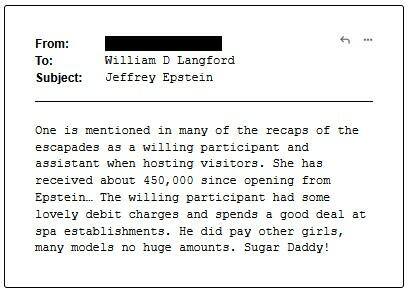

Even then there were informing signs. Only in 2003 he paid over $175,000 in cash. Bank staff saw the request to study large cash transactions to national observers, but did not treat withdrawals as a signal of deeper risk. In subsequent years, compliance workers have repeatedly expressed concerns about Epstein's transfers, cash activities and requests to open accounts for young women in the minimum verification. One of the interior notes, describing large transfers to an 18-year-old for a full amount of "about 450,000 since opening", was "Sugar Daddy!".

Nevertheless, the impact was important. Epstein was valued not only for his individual balance sheets, but besides for the business he introduced. Through his network of hedge fund founder Glenn Dubin and constellation of billionaires and officials, he presented possible customers and helped form the bank's strategy. The Highbridge deal was hailed as "probably the most crucial transaction" in Staley's career.

Internal opposition, repeatedly suppressed

Between 2005 and 2011, bank heads repeated respective times about Epstein. In 2006, after being accused in Florida of accusing a teenage girl of solicitation by her, JPMorgan convened a squad to decide whether to leave the client. The bank rapidly disposed of another client, actor Wesley Snipes, erstwhile he was charged with taxation charges. He didn't do the same to Epstein. Instead, he imposed a narrow regulation – not to "proactively seek" fresh investments from him – while continuing to borrow and decision his money.

In the bank, even a casual exchange of opinions revealed Epstein’s tendency. "So painful reading," wrote Mary Erdoes in her e-mail, presently head of asset and asset management, after proceeding the news of the indictment. Mr. Staley replied that he had met Epstein the erstwhile evening and that Epstein "absolutely denies" engagement in dealing with minors. At another times, the speech became nonchalant. Describing a fund-raiser in the Hamptons, Mr. Staley wrote that age differences between couples "would fit well with Jeffrey", to which Mrs. Erdoes replied that people "make fun of Jeffrey".

In 2008, after Epstein pleaded guilty and registered as a sex offender, force increased to end the relationship. "No 1 wants it," wrote 1 of the bankers. Mr Cutler, chief legal counsel, later said that he saw Epstein as a threat to his reputation - "He's not an honorable individual in any way. He shouldn't be a client.. However, he did not insist on expulsion and the case was not handed over to Mr. Dimon. Epstein remained.

In early 2011, William Langford, head of the compliance department and erstwhile taxation officer, insisted that Epstein be "deposed". He warned that very wealthy customers could pervert judgment, and the patterns in Epstein's accounts match those of the human trafficking network.

Bank compliance chief William Langford was peculiarly concerned. "There is no patience for this," he wrote in an email to a colleague. Langford joined JPMorgan in 2006 after years of prosecution of financial crimes for the Treasury Department. He knew – and warned his colleagues – that companies could be prosecuted for money laundering if they deliberately ignored specified actions of their customers. He saw ultrarich customers as a peculiar dead spot; All the time that private bankers spent drinking wine and eating meals, these lucrative customers may have obscured their judgments on their credibility. It seemed like that was what was happening with Epstein. One of Langford's achievements in the JPMorgan was the creation of a task force to combat trafficking in human beings. The group noted in the presentation that frequent large cash withdrawals and bank transfers – precisely what workers saw in Epstein's accounts – were totems of specified illegal activity.

...

Langford said in his evidence that he started by rapidly explaining the human trafficking initiative. In this contextHow can the bank justify working with individual who has confessed to sexual crime and is now under investigation into sexual trafficking?

Mr. Staley answered.Passing Epstein's insistence that the charges will be overturned. A fewer days later, the bank agreed to leave the accounts open.

Money, access and a second chance

Even as interior scepticism grew, Epstein remained in contact with his erstwhile private banker, Justin Nelson., and continued to appear in attendance meetings Leon BlackA billionaire customer. Staley stayed close to Epstein for years, exchanging individual messages and visiting his residencesEven erstwhile he took over as chief of Barclays. In 2019, after Epstein was arrested on national sexual trafficking charges, and then died of suicide in Manhattan prison, investigators, journalists and regulators turned to his banking unions again.

JPMorgan conducted an interior review of task Jeep's cryptonym and reported late suspicious activity, marking Epstein's about 4700 transactions with a full value of over $1.1 billion. The bank made a civilian settlement with Epstein's victims for $290 million and with the United States Virgin Islands for $75 million, without admitting guilt. no of the managers lost their jobs. Dimon, who testified that he did not remember to know about Epstein before 2019, remains 1 of the most powerful figures in American finance.

For Bridgette Carr, a law prof. and expert on combating trafficking in people employed in the Virgin Islands, the issue raises a bigger question about incentives. She felt that JPMorgan had enabled Epstein's crimes. "I am profoundly afraid that the eventual message to another financial institutions is that they can inactive service traders," she said. "Still it is profitable given the deficiency of crucial consequences".

Translated by Google Translator

source:https://www.zerohedge.com/