Peak Earnings Pulse: Consumer Pullback Theme Gains Momentum

A series of disappointing earnings (with peak earnings season this week) from fast-food chains, beverage giants, and consumer companies underscores persistent financial strain on low- and middle-income consumers—pressured by lingering Biden-era inflation and increasing fears over tariffs and mounting economic uncertainty under the current administration.

On Thursday, McDonald’s reported same-store sales that tumbled 3.6% in the US, the largest year-over-year decline since the second quarter of 2020. The decline was mainly because of sagging visits at stores nationwide.

McDonald’s CEO Chris Kempczinski wrote in a statement that consumers „are grappling with uncertainty.” He noted that McDonald’s will be able to „navigate even the toughest of market conditions and gain market share.”

Citi analyst Jon Tower told clients that McDonald’s soft sales should „come as little surprise” to investors, with the fast-food chain „speaking to a muted outlook/challenged global consumer back in mid-February and category high-frequency data/other company 1Q updates all suggesting lower-income guests were pulling back.”

On Friday morning, Wendy’s slashed its sales outlook for the year, signaling consumers are dialing back their store visits and ticket spending.

Wendy’s CEO Kirk Tanner stated that the US market faced a „challenging consumer environment.” The fast-food chain warned that the pullback in spending was more acute with customers making below $75,000.

Last week, Chipotle missed first-quarter revenue estimates and reported that same-store sales had fallen for the first time since 2020.

Chipotle CEO Scott Boatwright warned investors that a „slowdown in consumer spending” materialized, forcing it to lower the top end of its full-year same-store sales growth outlook.

At the beginning of the week, Starbucks reported disappointing global comparable sales and profit, with sliding US demand.

Starbucks CEO Brian Niccol’s turnaround strategy for the coffee chain appears to have stumbled after the company reported four straight quarters of declining sales.

„Our financial results don’t yet reflect our progress, but we have real momentum with our 'Back to Starbucks’ plan,” Niccol told investors.

Yum Brands, the parent of KFC, Pizza Hut, and Taco Bell, also reported this week. Yum posted a mixed first quarter, with a sales slowdown that began to soften in January but improved through February and March.

In the consumer goods space, Procter & Gamble reported mixed quarterly results as demand for its products fell. Executives of the company, which owns Tide and Charmin, slashed their full-year outlook for earnings per share and revenue based on consumer slowdown and tariff uncertainty.

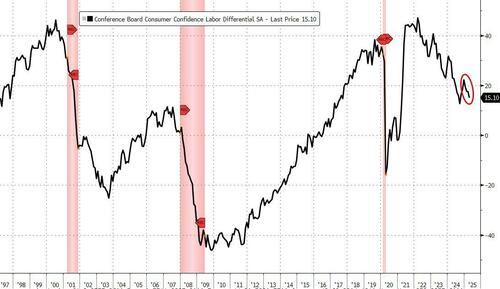

The broader pessimism from QSRs and consumer-facing companies mirrors the sharp downturn in the Conference Board’s confidence index, which just sank to a 14-year low.

Labor market conditions also weakened.

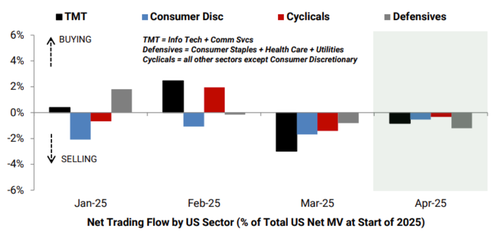

In markets, Goldman analyst Nelson Armbrust said consumer discretionary stocks were „net sold for a fourth straight month, driven by short sales outpacing long buys ~5 to 1.”

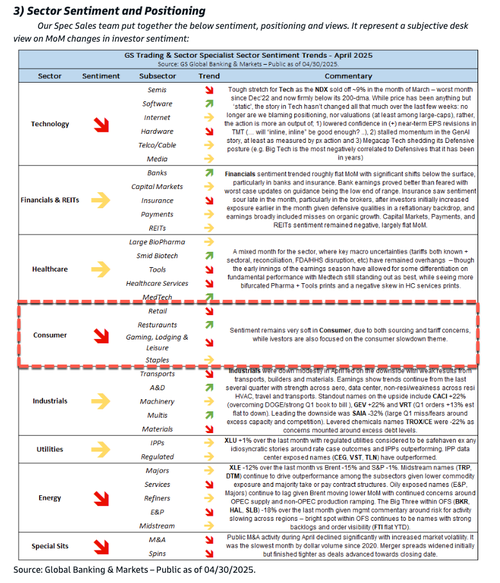

Goldman’s take: „Sentiment remains very soft in Consumer, due to both sourcing and tariff concerns, while investors are also focused on the consumer slowdown theme.”

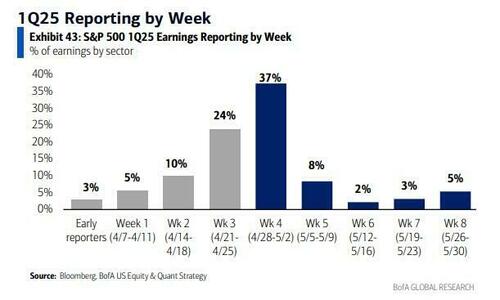

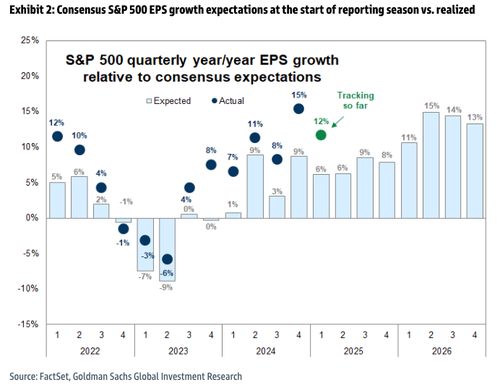

More broadly, with peak earnings season now behind us, Goldman Chief Equity Strategist David Kostin told clients Friday that results have held up relatively well:

1Q 2025 year/year earnings growth is tracking at 12%, 6 pp higher relative to the start of the reporting season. Better than expected margins have driven the positive surprise so far with the average earnings surprise tracking at 5% vs. an average sales surprise of 1%.

Kostin also noted:

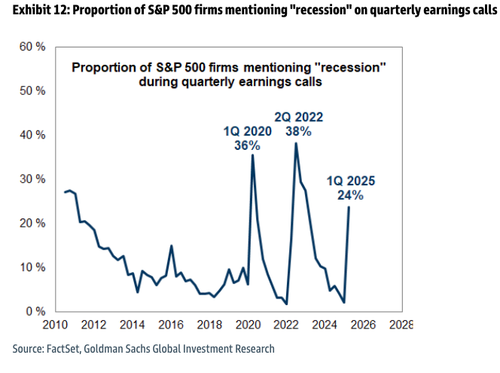

One lingering question heading into May is whether the slide in consumer spending and sentiment will worsen—or if it can be reversed by a series of positive trade headlines.

Tyler Durden

Fri, 05/02/2025 – 15:00