Labor Market Crosses Critical Threshold: For First Time Since 2021 There Are More Unemployed Than Job Openings

Ahead of today’s JOLTs reported, which as usual lags the monthly jobs report (due Friday) by one month, markets were largely focused on it as an indication of whether and how big negative prior month jobs revisions would be (as a reminder, July and June saw the biggest negative 2-month jobs revision since Covid, prompting Powell to go full dovish at Jackson Hole).

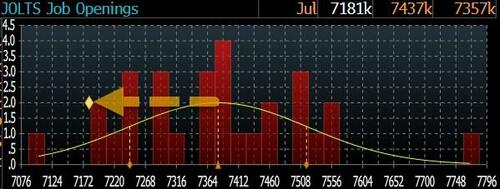

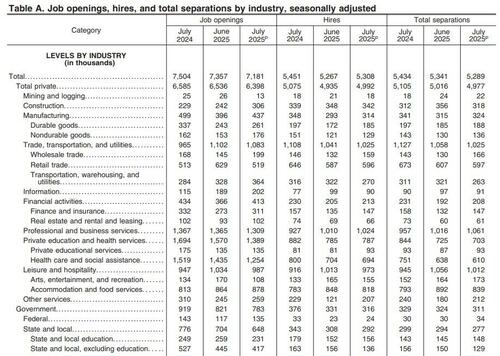

Well, moments ago the BLS reported that in July the number of job openings tumbled by another 176K from a downward revised 7.357MM(originally 7.437MM), to 7.181MM, which not only came in far below the median consensus estimate of 7.380MM and below 28 estimates from the 29 economists polled by Bloomberg…

… but was also the second lowest going back to the covid crash, with just Sept 24 lower.

Regular readers will surely recall what other notable event took place in Sept 2024 which needed a sharp deterioration in the jobs market as validation (for those who don’t remember, please reread this „Brace For Another Huge Negative Payrolls Revision, Greenlighting A 50bps September Rate Cut„). Yes: that’s when the „apolitical” Fed „unexpectedly” cut a jumbo 50bps, just two months before the election, and the collapsing labor market served as cover… Just as it does again now.

Going back to today’s report, according to the BLS, the number of job openings decreased in health care and social assistance (-181,000); arts, entertainment, and recreation (-62,000); and mining and logging (-13,000).

Of the industries noted above, government was the highlight: as shown in the chart below, government job openings crashed to pre-covid levels as demand for parasites has evaporated.

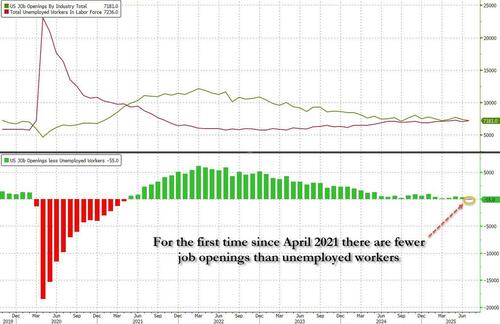

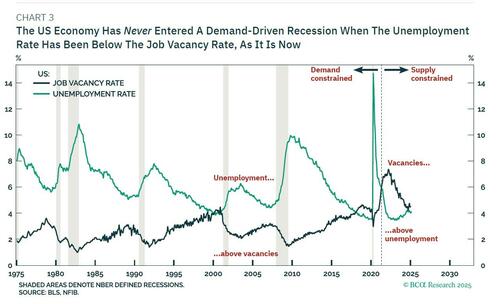

In the context of the broader jobs report, it appears the after four years of the US labor market dodging the bullet, luck may have run out because whereas in June the labor market was still supply-constrained, when there were 342K more openings than jobs in the US, in July we are finally back to demand constrained, with 55k fewer job openings than unemployed workers, the first negative print this series since April 2021.

As we discussed previously, The US never entered a recession in a period when there were more job openings than unemployed workers (i.e. the job market was supply constrained). As of this moment, we know it is no longer supply constrained and is instead demand constrained.

Said otherwise, in July the number of job openings to unemployed finally dropped back under 1.0x.

While the job openings data was very ugly and potentially the first harbinger of the coming recession – things were more normal on the hiring side where the number of new hires rebounded by 41K to 5.308MM from the lowest print in a year, while at the same time the number of people quitting their jobs was unchanged at 3.208MM.

How to make sense of this ongoing deterioration in the labor market?

It likely has to do with the DOL – which recently lost its previous commissioner after Trump fired her last month – starting to factor in the collapse in the shadow labor market, the one dominated by illegal aliens, and the replacement of illegals with legal, domestic workers which in turn is pushing the labor market into a demand-constrain imbalance. The question is how long until this appears in much weaker than expected payrolls prints – we may find out as soon as this Friday when we get the full jobs report for August, and more importantly, the full year revisions on Sept 9 just days later, which if we are correct will show another 600K-900K in jobs that were never there and were simply imagined by the Biden DOL, in the process greenlighting not only a 25bps rate cut, but potentially a jumbo 50bps… just like exactly one year ago.

Tyler Durden

Wed, 09/03/2025 – 10:45