Bad-Loans Hit Record-High As Used-Car Prices endure Worth Bear-Market Ever

A bear marketplace in the utilized car marketplace was confirmed in November and has since written through April. At the same time, negative equity values are hitting fresh evidence highs while car insurance rates have soared the most since the mid-1970s. While gas prices at the pump are chosen, the environment to operate a vehicle is proven 1 of the worst ever. Just list to Gen-Z and millennial users on X bitch and brass about $1,000 monthly car payments and another absurd costs associated with driving.

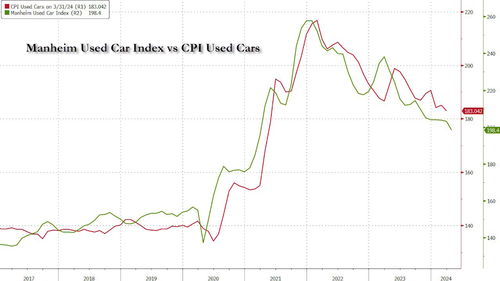

The Manheim utilized Vehicle Value Index Fell is 198.4 in April, and 14% drop from 1 year ago. This is the index’s low print since the first 4th of 2021. As for the bear market, the index is down 23% from the advanced and rapidly falling – there could be air pockets given the fast upward moves 3 years ago – and that request has been supported given a high-interest rate environment.

All vehicle segments of the Manheim utilized Vehicle Value Index experienced seasonally updated prices that we were down double digit year over year in April. Luxury was the only section that was not hit by the hardest, down just 12.9%. The Worst-performing section was compact cars, down 17.6% combined with last year, followed by midsize cars, down 16.8%, and pickups, down 15.2%. EVs were down 17.5%.

This is simply a crucial warry for millions of Americans who bought cars during the pandemic mania, which fundamentally active spending free money provided by the national Reserve, only now discovering that their loans are plunging into underwater territory.

According to a fresh Edmunds note, 20% of fresh vehicle sales engaging a trade-in had negative equity during the October-through-December period—the highest level since 2021.

Negative equity values soared to a fresh evidence advanced of $6,064 during the period, a massive 46% increase from summertime 2021.

We valued readers in 2023 about the Worsening negative equity situation for heavyly integrated drivers:

- Negative Equity Surges: More Consumers Find Themselves In Underwater car Loans

- Number Of Americans In Upside-Down car debt Continues To Worthen

Adding to the financial stresses for drivers, there’s besides the performance that Joe Biden’s sticky inflation continues to send auto insurance rates to the highest levels since the inflation shitstorm in the mid-1970s.

We’ve pointed out that ridiculous repair bills for newer vehicles (cough, ough, EVs) are likely the main reason rates are higher.

- Rivian Owner Shocked By $41,000 Repair Bill For insignificant Damage

- "Shocking Number": Rivian Owner Sees $42,000 Repair Bill For insignificant Accident

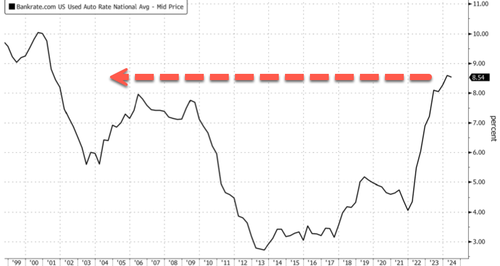

Right now, drivers are paralyzed as the average utilized car car loans tracked by Bankrate surged again – now excellence 8.5%.

The average fresh car debt has reached a evidence advanced of $40,000.

In fresh months, Joseph Yoon, consumer insights analyst for Edmunds, told Bloomberg:

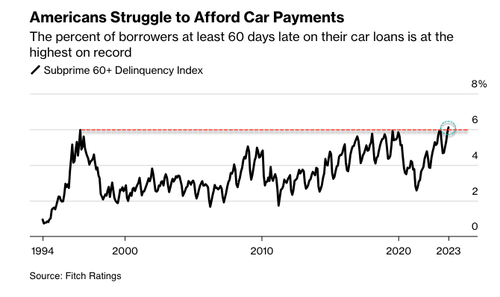

“We’re in this situation where combined with the cost of the vehicles being so advanced and the curious rates being so historically high, you have quite a few people who are in bad car ranks.”

To Yoon’s point, the percent of subprime car borrowers at least 60 days past due in September topped 6.11%, the highest ever.

Source: Bloomberg

Source: Bloomberg Out of all this planet and doom for drivers. There’s good news on the inflation front: Falling Manheim utilized car prices will only consequence in a lower future print for the US CPI utilized car index.

So the large question is erstwhile will the bear marketplace in utilized car prices bottom?

Car owners should certaily not be looking for any bailouts from The Fed anytime shortly (or Biden, who is besides busy paying off student loans). Higher rates and hanger is the theme, no substance the jawboning, with little than 2 cuts now priced in for the full of 2024 (down from over 7 at the start of the year).

Tyler Durden

Tue, 05/07/2024 – 20:40