AI Adoption Momentum Slows As Hardware Investment Accelerates

As the third anniversary of ChatGPT’s launch quickly approaches, Nvidia’s market value has surged more than tenfold, leaving institutional investors pondering whether the AI data-center buildout nationwide is merely hype or if there is actually substance.

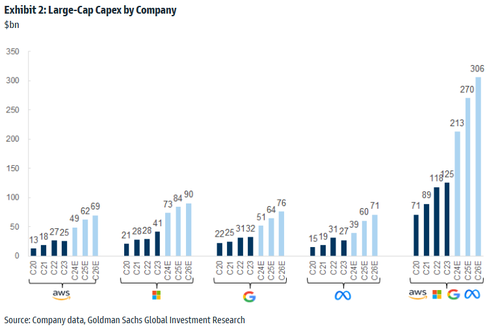

Hyperscalers have poured hundreds of billions of dollars into AI infrastructure, capital expenditures that will soon need to demonstrate clear returns; failure to do so risks undermining the lofty valuations for the so-called Magnificent Seven stocks.

On Monday, Goldman chief economist Jan Hatzius published a note with new insights into the bank’s quarterly AI adoption tracker through September. The report indicates that while AI investment continues to accelerate, adoption rates at large firms are starting to slow down.

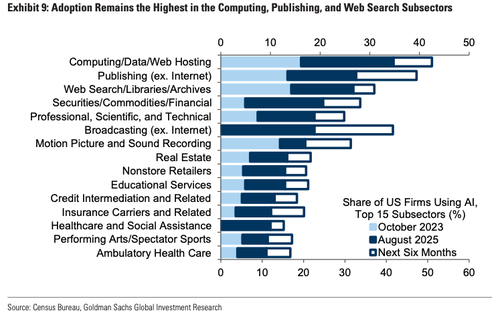

Hatzius said the AI adoption growth rate slowed to 9.7% of U.S. firms using AI in the third quarter, up from 9.2% in the second.

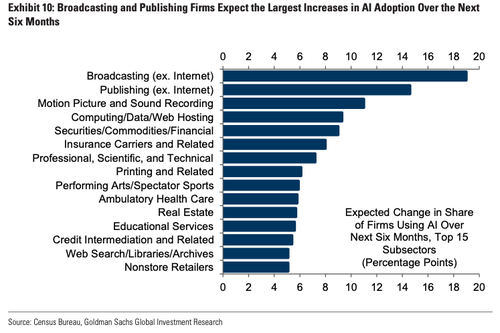

Finance and real estate had some of the largest gains, while educational services reported a decline. Meanwhile, broadcasting and publishing are expected to experience the fastest adoption over the next six months.

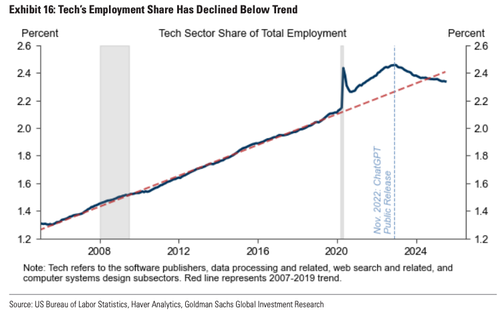

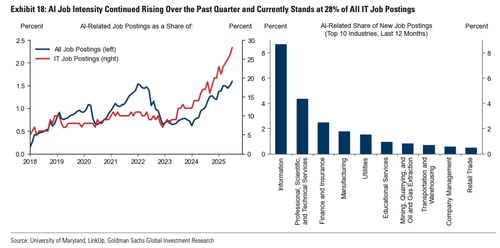

Labor market effects are still muted, according to Goldman’s chief economist. He noted that job displacement is emerging across tech, design, and customer service. AI roles made up 28% of IT job postings, while AI was cited in layoffs affecting 10,375 workers since the previous update. Goldman expects that full AI adoption across corporate America could displace 6% to 7% of all workers.

More charts from Hatzius’ note:

ZeroHedge Pro subscribers can access the full note and additional charts in the usual place.

Furthermore, a must-read from DB analyst Adrian Cox:

-

The Summer AI Turned Ugly: Part 1

-

The Summer AI Turned Ugly: Part 2

. . .

Tyler Durden

Mon, 09/08/2025 – 19:40