GURUGRAM- IndiGo (6E), India’s largest airline by market share, has seen dynamic trends across its top 20 busiest domestic routes in recent years. An analysis of passenger volumes and market shares highlights shifts in the airline’s strategic focus and competitive performance.

While passenger numbers continue to dominate on key routes like Mumbai (BOM)-Delhi (DEL) and Bengaluru (BLR)-Delhi (DEL), evolving trends over the past three years and the last 12 months reveal both growth opportunities and challenges.

Photo: Eurospot

Photo: EurospotTop Busiest Routes of IndiGo

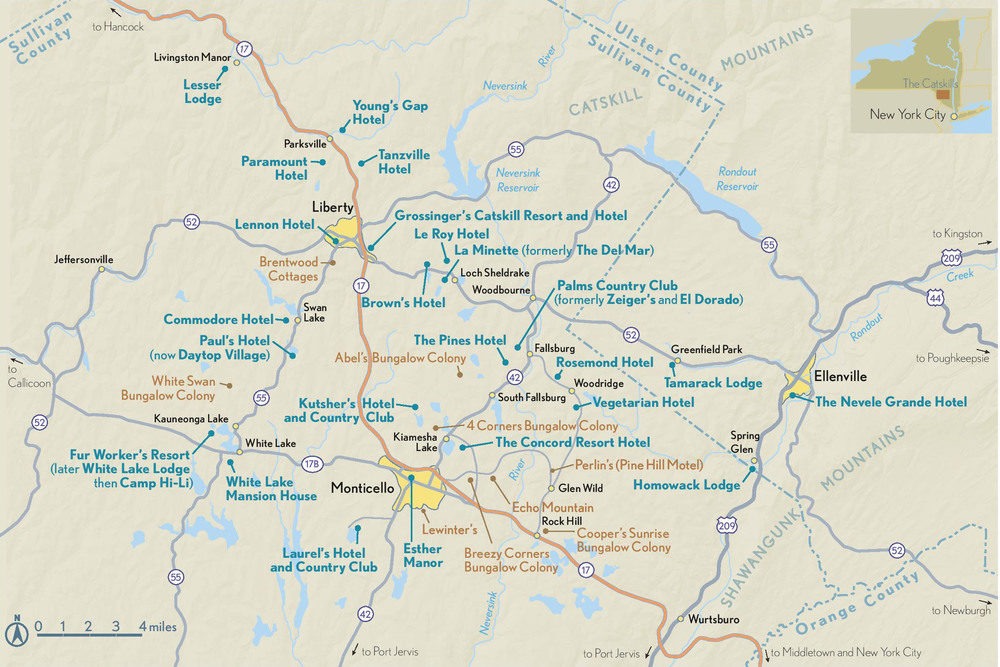

IndiGo Airlines (6E) demonstrates significant market dominance across India’s busiest air routes, with market shares ranging from 42% to 79% on its top 20 routes as of Q3 2024.

AvBench highlights the Mumbai-Delhi corridor emerges as IndiGo’s busiest route with 2.54 million passengers, though it maintains a relatively modest 43% market share.

In contrast, the Hyderabad-Chennai route showcases the airline’s strongest market position with a 79% share, despite lower passenger volumes of 986,000.

The table shows the Top 20 busiest routes of IndiGo Airlines (6E):

| 1 | Mumbai-Delhi | 5,904,651 | 43% | 2,539,000 | 2.3% |

| 2 | Bengaluru-Delhi | 4,082,979 | 47% | 1,919,000 | 3.6% |

| 3 | Bengaluru-Mumbai | 3,751,111 | 45% | 1,688,000 | 6.4% |

| 4 | Kolkata-Delhi | 2,240,678 | 59% | 1,322,000 | 2.7% |

| 5 | Delhi-Hyderabad | 2,564,000 | 50% | 1,282,000 | -3.7% |

| 6 | Mumbai-Chennai | 1,992,063 | 63% | 1,255,000 | 14.7% |

| 7 | Mumbai-Hyderabad | 2,083,051 | 59% | 1,229,000 | -1.5% |

| 8 | Delhi-Chennai | 1,850,000 | 60% | 1,110,000 | 5.5% |

| 9 | Bengaluru-Kolkata | 1,764,407 | 59% | 1,041,000 | -9.8% |

| 10 | Delhi-Poona | 2,416,667 | 42% | 1,015,000 | 4.3% |

| 11 | Hyderabad-Chennai | 1,247,468 | 79% | 986,000 | -12.0% |

| 12 | Bengaluru-Hyderabad | 1,696,429 | 56% | 950,000 | 1.7% |

| 13 | Mumbai-Kolkata | 1,591,525 | 59% | 939,000 | 5.0% |

| 14 | Ahmedabad-Mumbai | 1,701,887 | 53% | 902,000 | 6.8% |

| 15 | Bengaluru-Poona | 1,688,235 | 51% | 861,000 | 5.8% |

| 16 | Delhi-Srinagar | 1,927,273 | 44% | 848,000 | 8.5% |

| 17 | Ahmedabad-Delhi | 1,712,500 | 48% | 822,000 | -1.8% |

| 18 | Delhi-Goa | 1,522,449 | 49% | 746,000 | 7.6% |

| 19 | Kolkata-Hyderabad | 953,947 | 76% | 725,000 | -6.9% |

| 20 | Delhi-Patna | 1,111,667 | 60% | 667,000 | 2.6% |

1. Mumbai (BOM) – Delhi (DEL)

- Passenger Volume: 5,904,651

- Market Share: 43%

- IndiGo Passengers: 2,539,000

- YoY Growth Rate: 2.3%

IndiGo Airlines’ No. 1 busiest domestic route connects the financial capital, Mumbai (BOM), with the national capital, Delhi (DEL).

Despite moderate market share, IndiGo maintains la eadership position with over 2.5 million passengers annually. The route shows steady growth despite intense competition from other carriers.

2. Bengaluru (BLR) – Delhi (DEL)

- Passenger Volume: 4,082,979

- Market Share: 47%

- IndiGo Passengers: 1,919,000

- YoY Growth Rate: 3.6%

This tech corridor route connects India’s Silicon Valley with the capital region. IndiGo demonstrates strong performance with nearly 2 million passengers annually.

The route’s growth reflects increasing business travel between these major economic centers.

3. Bengaluru (BLR) – Mumbai (BOM)

- Passenger Volume: 3,751,111

- Market Share: 45%

- IndiGo Passengers: 1,688,000

- YoY Growth Rate: 6.4%

Connecting two major business hubs, this route shows robust growth at 6.4%. IndiGo maintains a strong presence despite competitive pressure, carrying 1.68 million passengers annually on this crucial business corridor.

4. Kolkata (CCU) – Delhi (DEL)

- Passenger Volume: 2,240,678

- Market Share: 59%

- IndiGo Passengers: 1,322,000

- YoY Growth Rate: 2.7%

This route links eastern India with the national capital. IndiGo dominates with a 59% market share, showing steady growth.

The route’s importance stems from Kolkata’s position as the major gateway to northeastern India.

5. Delhi (DEL) – Hyderabad (HYD)

- Passenger Volume: 2,564,000

- Market Share: 50%

- IndiGo Passengers: 1,282,000

- YoY Growth Rate: -3.7%

Despite negative growth, IndiGo maintains half the market share on this important route connecting the capital with the emerging tech hub. The decline might reflect increased competition or temporary market adjustments.

6. Mumbai (BOM) – Chennai (MAA)

- Passenger Volume: 1,992,063

- Market Share: 63%

- IndiGo Passengers: 1,255,000

- YoY Growth Rate: 14.7%

This route shows exceptional growth, with IndiGo commanding a strong 63% market share. The impressive 14.7% growth indicates increasing connectivity demand between western and southern India’s major metros.

7. Mumbai (BOM) – Hyderabad (HYD)

- Passenger Volume: 2,083,051

- Market Share: 59%

- IndiGo Passengers: 1,229,000

- YoY Growth Rate: -1.5%

Despite a slight decline, IndiGo maintains a significant market presence on this business-heavy route. The connection between financial and tech hubs remains crucial for business travelers.

8. Delhi (DEL) – Chennai (MAA)

- Passenger Volume: 1,850,000

- Market Share: 60%

- IndiGo Passengers: 1,110,000

- YoY Growth Rate: 5.5%

Strong growth and market dominance characterize this north-south corridor route. IndiGo’s 60% market share demonstrates its strength in connecting major metropolitan cities.

9. Bengaluru (BLR) – Kolkata (CCU)

- Passenger Volume: 1,764,407

- Market Share: 59%

- IndiGo Passengers: 1,041,000

- YoY Growth Rate: -9.8%

Despite significant market share, this route faces challenges with a notable decline. The connection between the tech hub and the eastern gateway shows potential for recovery and growth.

10. Delhi (DEL) – Pune (PNQ)

- Passenger Volume: 2,416,667

- Market Share: 42%

- IndiGo Passengers: 1,015,000

- YoY Growth Rate: 4.3%

Moderate growth and market share reflect the increasing importance of Pune as a tech and industrial hub. IndiGo maintains steady performance despite competitive pressure.

11. Hyderabad (HYD) – Chennai (MAA)

- Passenger Volume: 1,247,468

- Market Share: 79%

- IndiGo Passengers: 986,000

- YoY Growth Rate: -12.0%

Highest market share across all routes at 79%, though showing a significant decline. The route connects two major South Indian business centers with IndiGo as the dominant carrier.

12. Bengaluru (BLR) – Hyderabad (HYD)

- Passenger Volume: 1,696,429

- Market Share: 56%

- IndiGo Passengers: 950,000

- YoY Growth Rate: 1.7%

Moderate growth in this tech corridor route reflects stable demand. IndiGo maintains the majority of market share in connecting these neighboring tech hubs.

13. Mumbai (BOM) – Kolkata (CCU)

- Passenger Volume: 1,591,525

- Market Share: 59%

- IndiGo Passengers: 939,000

- YoY Growth Rate: 5.0%

Healthy growth and strong market share characterize this east-west corridor route. IndiGo’s performance indicates a growing demand for cross-country connectivity.

14. Ahmedabad (AMD) – Mumbai (BOM)

- Passenger Volume: 1,701,887

- Market Share: 53%

- IndiGo Passengers: 902,000

- YoY Growth Rate: 6.8%

Strong growth reflects increasing business ties between Gujarat and Maharashtra. IndiGo maintains the majority of market share with positive momentum.

15. Bengaluru (BLR) – Pune (PNQ)

- Passenger Volume: 1,688,235

- Market Share: 51%

- IndiGo Passengers: 861,000

- YoY Growth Rate: 5.8%

Connecting two major tech hubs shows steady growth. IndiGo’s majority market share reflects its strong presence in business-heavy routes.

16. Delhi (DEL) – Srinagar (SXR)

- Passenger Volume: 1,927,273

- Market Share: 44%

- IndiGo Passengers: 848,000

- YoY Growth Rate: 8.5%

Strong growth in this tourism-heavy route demonstrates increasing leisure travel demand. IndiGo’s performance reflects the successful penetration of leisure markets.

17. Ahmedabad (AMD) – Delhi (DEL)

- Passenger Volume: 1,712,500

- Market Share: 48%

- IndiGo Passengers: 822,000

- YoY Growth Rate: -1.8%

Slight decline but maintaining nearly half market share. This route connects the western industrial hub with the capital region.

18. Delhi (DEL) – Goa (GOI)

- Passenger Volume: 1,522,449

- Market Share: 49%

- IndiGo Passengers: 746,000

- YoY Growth Rate: 7.6%

Strong growth in this leisure route indicates robust tourism recovery. IndiGo captures half the market in this popular tourist corridor.

19. Kolkata (CCU) – Hyderabad (HYD)

- Passenger Volume: 953,947

- Market Share: 76%

- IndiGo Passengers: 725,000

- YoY Growth Rate: -6.9%

Despite its decline, IndiGo maintains a dominant market position. This route connects eastern India with the emerging tech hub of Hyderabad.

20. Delhi (DEL) – Patna (PAT)

- Passenger Volume: 1,111,667

- Market Share: 60%

- IndiGo Passengers: 667,000

- YoY Growth Rate: 2.6%

Steady growth and strong market share in this tier-II route. IndiGo’s performance demonstrates successful penetration of emerging markets.

Photo: Dirk Grothe

Photo: Dirk GrotheIndiGo Market Trends

IndiGo’s network strategy has yielded substantial dominance on critical routes. The Mumbai-Delhi corridor remains the busiest, handling over 2.5 million passengers annually with a 43% market share.

This route has seen consistent growth, recording a 6.4% gain over the last three years and 2.3% in the previous 12 months. Bengaluru-Delhi and Bengaluru (BLR)-Mumbai (BOM) follow closely, with passenger volumes of 1.9 million and 1.6 million, respectively.

Certain routes reflect IndiGo’s competitive strength, like Hyderabad-Chennai, where the airline boasts a remarkable 79% market share, despite a 12% dip in the past year. Similarly, Mumbai-Chennai has shown the highest 12-month gain of 14.7%, driven by strategic focus and demand growth.

However, challenges persist on other key routes, such as Bengaluru-Kolkata (-9.8%) and Kolkata-Hyderabad (-6.9%), where market share losses suggest increased competition or capacity adjustments.

Routes like Delhi-Goa and Delhi-Srinagar display robust growth patterns, with market share gains of 7.6% and 8.5%, respectively, reflecting IndiGo’s ability to capture leisure travel markets.

Additionally, less saturated routes, such as Kolkata-Delhi, show consistent growth (8.3% over three years), cementing IndiGo’s dominance on metro connections.

Despite challenges, IndiGo’s focus on capacity optimization and passenger retention suggests resilience. Strategic adjustments on underperforming routes and targeted marketing could bolster its overall network performance.

Photo: Utkarsh Thakkar (Vimanspotter)

Photo: Utkarsh Thakkar (Vimanspotter)Revenue Vs Volume Growth

IndiGo’s prioritization of profitability over sheer passenger numbers is evident in its selective route adjustments.

For instance, while Delhi-Hyderabad and Mumbai-Hyderabad show market share declines in recent years, the airline may be optimizing yields instead of focusing solely on passenger volume.

Mumbai-Chennai and Ahmedabad-Mumbai highlight revenue-driven route optimization, with strong year-on-year gains of 14.7% and 6.8%, respectively. These shifts indicate a deliberate approach to leverage high-demand routes while mitigating challenges elsewhere.

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News

IndiGo Adds New Flights from Bengaluru, Future Destinations and More

The post Top 20 Busiest Routes of IndiGo, No. 10 Will Surprise You! appeared first on Aviation A2Z.