The Gauntlet Of Fed Chair Powell

Authored by Tuomas Malinen via Substack,

Chairman of the Federal Reserve Jerome Powell signaled a September rate cut in his speech in Jackson Hole on Friday. During the past decade or so, the annual meeting of the most powerful central bankers in Jackson Hole has turned from something we (macro)economists looked forward to into a ‘snake pit’ of central bank policy.

Back in the day, we looked for signals considering monetary policy, but in recent years we have started to worry about messages on world domination.

This year, it is likely that Central Bank Digital Currencies (CBDCs) and the independence of central banks, particularly the Fed, have been prominent topics of discussion, and they can only be described as tools for financial enslavement. The former is nothing more than a plan to take over the global financial system, while the latter is whether the central banks are in government control or not. The implications of the combination of these topics could not be more worrying for us regular citizens.

My friend, who works in a high position at the Bank of Finland, told me in the spring that there’s almost zero understanding towards the Central Bank Digital Currency, or CBDC, pushed by the leadership of the European Central Bank, ECB, among the economists at the BoF. The central bankers within the euro area I’ve spoken with in recent years tend to agree.

My friend summarized all this by noting that “Why on earth should a central bank start to compete with commercial banks?”

This does not make any sense, unless you add a conspiracy into it by noting that the attitude of central bankers towards CBDCs tends to change only at the very top (the leadership of the ECB).

I detailed the likely dark aims of CBDCs in my first entry into the Apocalypse Scenario. It was actually rather worrying, and intriguing, how squarely CBDCs fit into my (absolute) worst-case scenario for the world. It was like they were created for the domination of the financial world, and they probably are, summarized by this part of my piece:

They [commercial banks] would lose most of their freedoms as independent actors. While central bankers would not, at least in the very beginning, enact tough guidelines towards their newly acquired ‘commercial branches’ this would almost certainly change, when the economy falls into recession or if there was some major crisis. In such a case, the central bank would most likely issue strict guidelines on all transactions of banks, dictating what you could buy and from where (consider for example the sanctions against Russia). Moreover, in such situations, central bank and government policies would, most likely, also be strictly enforced on all lending activities.

This means that lending to both corporations and consumers would be monitored, and only those projects and investments would get financed, which would follow the agenda and policies of the government (and the ‘elite’).

Think, for example, of the enforcement of the ‘European Green Deal’ in all investment activities.

The striking fact is that there’s even academic research providing a very conspiratorial conclusion on the role of CBDCs in the financial system. Jesús Fernández-Villaverde, Daniel Sanches, Linda Schilling, and Harald Uhlig note in their 2021 paper, published in the Review of Economic Dynamics, that a central bank could be forced to use its profits and its ability to divert lending towards politically desirable ends, such as green initiatives, social, gender, or racial equality, universal basic income, or even towards supporters of politically acceptable political parties, if the independence of the central bank were to be broken. Such outspoken criticism against central banks and speculation on massive political corruption of central banks are utterly unheard of in a respected macroeconomic journal.

In the worst-case scenario, central bank digital currencies could be used to control what you can buy and what investments get financed. For example the European Central Bank (ECB) is already controlling the latter with loans to “dirty” industries (like coal) treated in the balance sheets of banks in such a way that banks get punished for issuing them. This is being done, I hear, despite the major energy issues faced by Europe, which naturally raises questions about the motives and aims of our leaders.

Now let’s move back to the standard signals. Chair Powell noted on Friday that, “With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” This central bank jargon implies that the Federal Reserve (the Federal Open Market Committee) is getting ready to lower rates. This is happening despite the increasing inflation pressures and the U.S. Producer Price Index, or PPI, reaching its highest monthly growth in July since March 2022. Illogical, yes, but our quest for the probable solution doesn’t require extensive exploration.

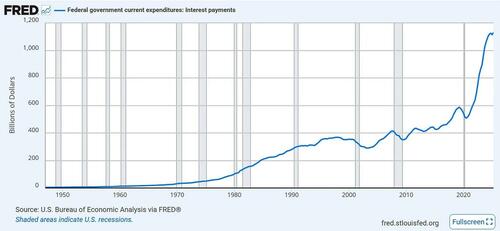

Federal government current expenditures: Interest payments in billions of U.S. dollars. Source: St. Louis Fed, U.S. Bureau of Economic Analysis.

The administration of President Trump has gone on a mad spending spree, a possibility we at GnS Economics warned about in January. In just July alone, the U.S. federal government posted a $291 billion deficit, the 2nd largest July deficit on record. President Trump wants to bring down the interest rates so that it would bring some relief for massive interest rate costs (remember that the U.S. 2024 federal budget was $6.8 trillion), and he has been putting a lot of heat on Chairman Powell and FOMC to accomplish this. Yet, are (semi-high) interest rates really the root of the problem? They are not.

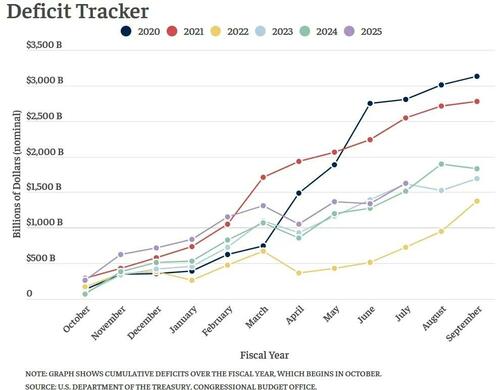

From the Bipartisan Policy Center.

Cutting interest rates would solve nothing, because this is a spending and not an interest cost issue, but it would bring temporary relief with a (massive) downside. Per the Kobeissi letter (and Wolf Street):

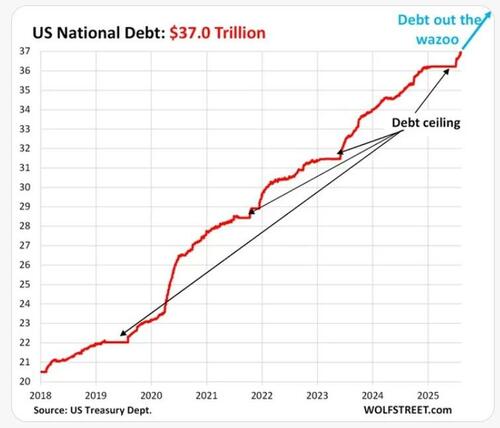

President Trump is pushing the Federal Reserve to cut interest rates into a darkening inflation picture just so that he would be able to finance an unsustainable borrowing spree from an unsustainable starting point. President Trump has always been good at playing with debt, but now he is likely to be over his head, like we saw in April.

In our (consensus) forecast for 2025 we noted that

The economic policy of President Trump will be first concentrated on helping the economy with tax cuts and shielding U.S. interests with tariffs. However, the deteriorating economic picture in the U.S., and globally, and growing issues in the bond markets will eventually force him to enact drastic spending cuts, which will cause a recession.

-

President Trump will float the idea of U.S. defaulting on its federal debt at some point, but will eventually walk back from it, when the implications of such a move to the U.S. and global banking sectors is made clear to him.

Therefore, my dear President, do play freely with the bond market, but please remember that it delivers a nasty bite. And, to Fed Chair J. Powell, I leave this immortal quote by the (great) Paul Volcker:

It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less.

[I]f the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with 'free banking.’

The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.

Tyler Durden

Tue, 08/26/2025 – 08:05