Soft 20Y Auction Tails As Foreign Buyers Shrink

In a day seeing another push higher in yields, moments ago the Treasury concluded the week’s lone coupon auction and it could have been better.

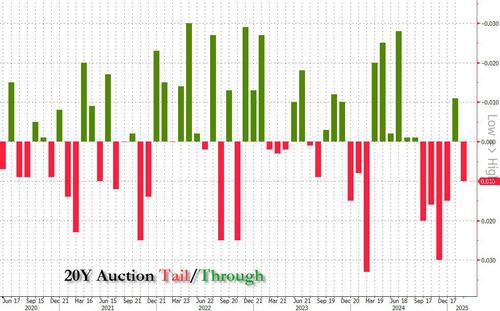

Pricing at a high yield of 4.830%, this was a 7bps drop from last month’s 4.90%, but while January’s auction stopped through the When Issued by 1.1bps, today we saw a 1.0bps tail to the 4.82% When Issued, the 5th tail in the last 6 auctions.

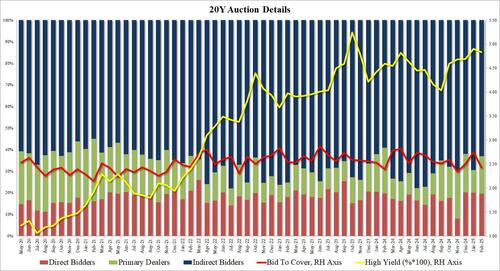

The bid to cover dropped from 2.75 to 2.43, the lowest since November and below the recent average of 2.54.

The internals were also disappointing with Indirect bidders taking down 63.0%, down from 69.5% in January and below the 67.5% recent average usually awarded to foreign buyers. And with Directs awarded 19.5%, Dealers were left holding 17.5%, above the recent average of 15.6%.

Overall, this was a soft and slightly disappointing auction, if nothing too dramatic, and despite the tail and soft internals, there was barely a move in the secondary market where yields continue to trade near session highs.

Tyler Durden

Wed, 02/19/2025 – 13:28

![Wielka bójka imigrantów z Kolumbii na ulicach Słupska [WIDEO]](https://dzienniknarodowy.pl/wp-content/uploads/2025/02/Fotoram.io-1.jpg?v=1738720216)