Markets Chop As Wall Street Awakes Apple Earnings After Bell, NFP Friday For marketplace Direction

US equities ended their two-day slide as tech companies suggested summertime in the session. The trading day has been chocolate, with Wall Street now turning its attention to Apple’s arrivals after the bell. any analysts anticipate Apple will uncover a major buyback program to offset possibly disappointing listenings amid country reports from investigation companies in fresh months about slumping iPhone sales overseas.

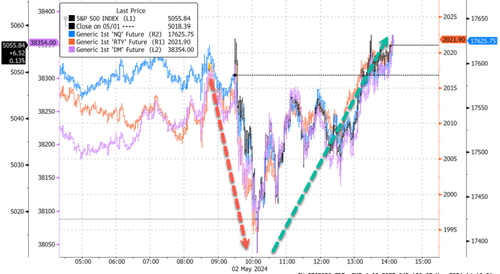

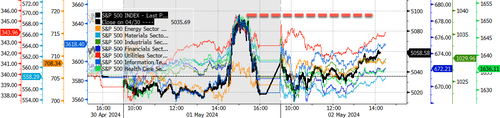

Let’s begin with the chocolate session in main equity index futures. Futs jambled at the start of the cash session and caught a bid about 30 minutes later, or around 1000 ET. Since then, price action has been mostly higher into the summertime afternoon trade.

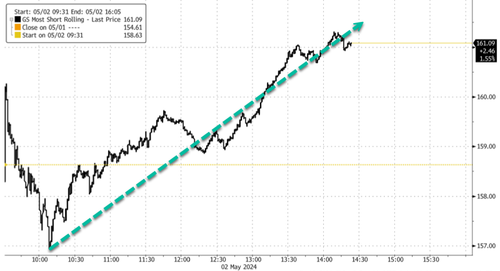

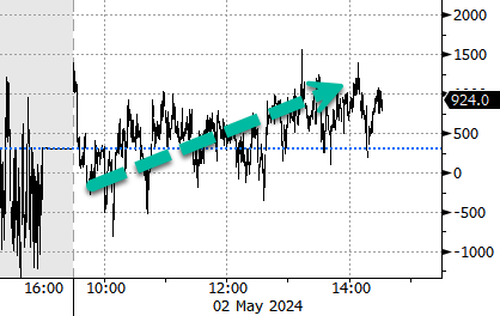

Despite the chop, Goldman’s Most Shorted Index (GSCBMAL) suggested higher, up 4% on the session. Names like Carvana Co. were up 32% later in the session after a better-than-expected first-quarter early-earnings release. The company is dense shorted, with about 27.6% of the float short, contributing to the economy in price.

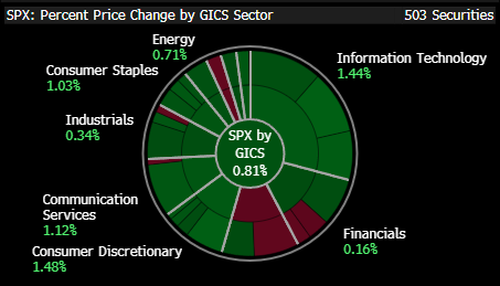

Within the S&P500, consumer discretion and technology stocks were up 1.49% and 1.39%, relatively. Almost green across the board.

Regarding the chop, the S&P500 sectors bridge are inactive below levels after Wednesday's late session pump and dump.

NYSE TICK data shows that most buy programs were out ahead of Apple’s learnings.

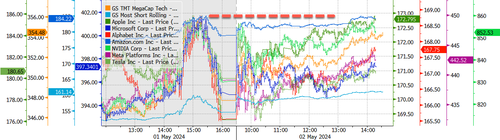

Again, more chop with individual names in the tech sector & Mag7.

Ahead of Apple mornings, here’s Goldman’s preview:

All eyes on AAPL tonight. We have positioning at a 7 out of 10, with a fresh uptick in interest in the name (altho recalls a BM underweight). Focus commentary 1) China trends in March qtr (cons has China revs -11% y/y in March vs the -13% y/y last qtr) .. 2) commentary on AI.. 3) Services visibility (included TAC + App Store)

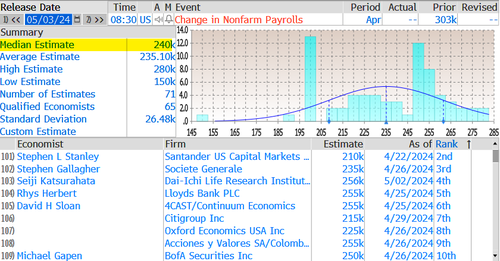

In the macro world, Wall Street traders are preparing for Friday’s announcement of March non-farm payments data. The median estimation tracked by Bloomberg is 240k.

22V investigation polled investors and found that 30% of respondents believe Friday’s jobs study will be “risk-on,” 27% anticipate a “risk-off” reaction, and 43% say “mixed/negligible.”

Meanwhile, the S&P500 is wedged between the 100-day Simple Moving Average (4979) and the 50-day Simple Moving Average (5129). A combination of Apple mornings (after the bell) and jobs data (Friday) could find the next direction in price action.

One day after the national Reserve kept the mark scope for the benchmark rate at 5.25% is 5.5%—after seriousus performance that the US is headed for stagflation—bond years across the curve left lower summertime in the session.

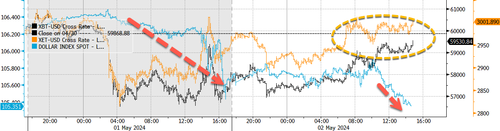

In FX, the greenback is on pace for its biggest drop this year as years continues sliding. Cryptos, specified as Bitcoin and Ethereum, trade mainly in chop. BTC/USD is trying to recover the $60k handle summertime in the cash session.

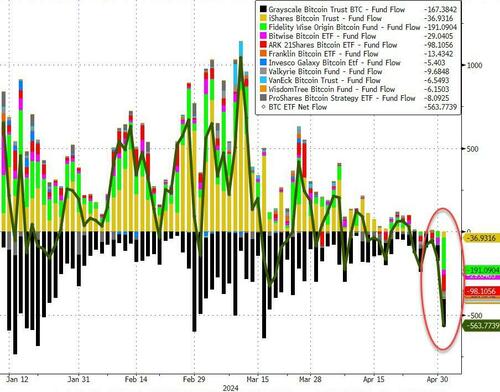

We noted early that BlackRock’s ETF Saw around $37 million in outflows for the first time, while the remaining place Bitcoin ETFs collectively noted over $526.8 million in outflows.

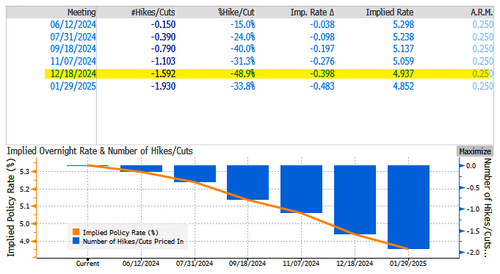

Rate traders have priced in about 1.6 cuts this year—up from 1.15 years—but down from close 7 years this year. There has been a dramatic repracticing in Fed cuts due to sticky inflation.

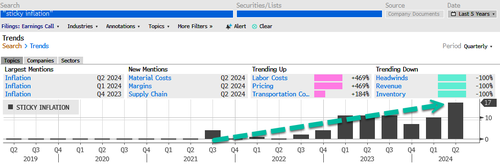

On inflation, utilizing Bloomberg data, the number of thoughts in learning calls for "sticky inflation" suggested to evidence heights in this learning season. respective mega-corporations like Starbucks and McDonald’s have valued about strugdling working mediocre consumers.

Here’s the copy of any of today’s top corporate news:

Peloton Interactive Inc. said Chief Executive Officer Barry McCarthy is stepping down as the company undergoes a major restructuring that will reduce its global workforce by 15% in an effort to slash costs.

MGM Resorts global reported first-quarter sales and learnings that beat analysts’ projections, benefitting from the post-pandemic recovery in Macau and a fresh partnership with Marriott global Inc. that helped fill hotel rooms.

Carvana Co. reported Stronger learnings with revene topping expectations as the company digs into its restructuring plan and regains sales moment.

DoorDash Inc., the largest food transportation service in the US, offered a disappointing profit forecast for the current 4th as the company invests in expanding its list of non-restaurant partners and improvising efficiency.

Moderna Inc. reported a narrower first-quarter failure than Wall Street had expected, as the biotech giant’s cost-cutting helped offset a bargain decline in its Covid business.

Apollo Global Management Inc. reported higher first-quarter profit as the companies cancered in more management fees and originally a evidence $40 billion of private credit, a key area of growth.

By the way, Boeing shares continued to surge even after another Boeing Whistleblower died.

no Whistleblowers left. buy buy buy pic.twitter.com/BMOFzsvOi8

— BuccoCapital Blocke (@buccocapital) May 2, 2024

A copy of this morning’s macro data:

Thursday Humor: Jobless Claims

Unit labour Costs Soar In Q1 As 'AI Productivity Boom' Fails To Show Up

US mill Orders emergence In March... But February Saw Yet Another Downward Revision

.... and it’s an election year – remember that... We citted a note from Goldman’s Adam Crook that points out the Fed and US Treasury are in 'full-blow stock support mode'... Powell can’t let Biden’s stock marketplace crash... Pro subs read here.

Anyways, all eyes are on Apple after the bell.

Tyler Durden

Thu, 05/02/2024 – 16:00