“Is This China Rally For Real?” – Goldman’s Flows Guru Says 'Yes’

He John 24th, We posted a advice on our Premium-Subscriber twitter feed, suggesting subscriptions: ‘Get Long FXI here...’

Like many of the reccs on this exclusive feed, it has done alternatively well...

(Subscribe to Premium ZeroHedge here)

The question is, after gaining 30%, to we stay with the trade – or as Goldman Sachs flow of funds guru asks (and Answers) today: “Is This China Rally for Real?”

His answer is simple:

"Yes. TCT (The China Trade) is back."

We have seen our bridge China activity on the board this week in 2024 via a mix of investors types. We think is more than just short covering as there are green shots developing. We have had notable Long Only demand, this is new. I will be spending time on this over the weekend, so sharing the trade thesis more broadcastly.

The Chinese equity marketplace is breaking out on advanced volume, including erstwhile southbound connect is on holiday. Why? Catalysts in the coming weeks/months include the long-delayed 3rd Plenum and more circumstantial policies related to the overall guidance of the 9 measures.

Full Checklist of catalysts, flows, and macro ideas below for TCT:

I. GS investigation presents respective possible catalysts that could possibly turn the entered negative consequence and sentiment around.

1. a comprehensive and forceful easing package

2. Demand-side-focused stimulus

3. assurance booming policy targeting the private economy

4. government backstop in the housing and stock markets

5. improvements and predictability in US-China relations

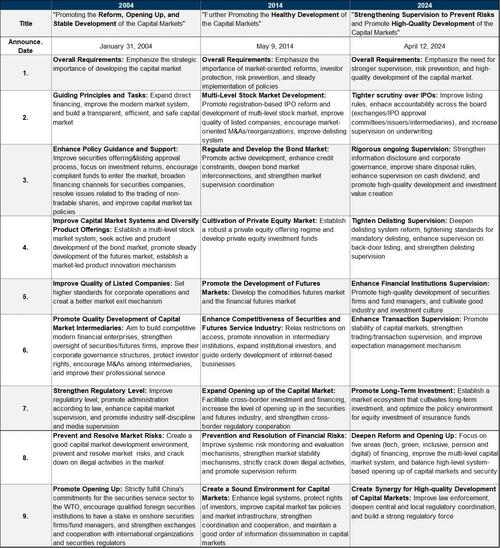

II. The fresh “Nine Measures”

a. GS investigation triangulates the possible policy-driven upside through the lens of shareholder returns, corporate governance standards, and organization investor ownership.

b. GS investigation analysis suggests that A-shares could emergence ~20% if they could run the gaps with global stories along these distinctions, and could re-rate as much as 40% if they catch up with global leaders in our blue-sky script.

III. Positioning is presently short and underweight and FOMO is on the rise.

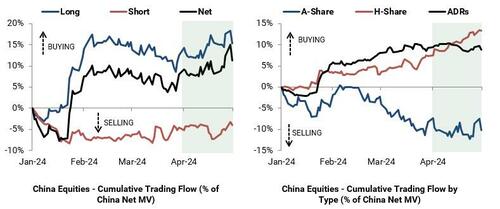

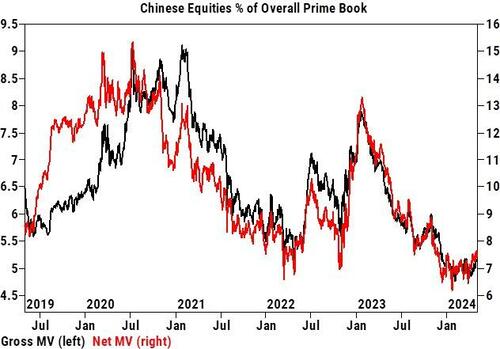

1. Hedge Fund Positioning:

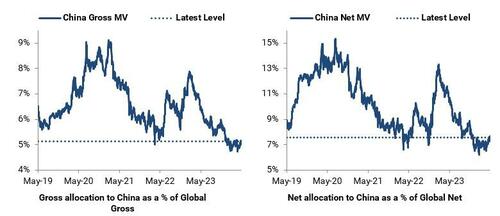

a. Both Gross and Net allocations to China increased in April, but proceed to stay close to 5-year lows. Gross allocation to China increased to 5.1% (7th percentile five-year), while Net allocation increased to 7.5% (10th percentile five-year).

b. The 5 year low of gross vulnerability was 4.7% on March 27th and low net vulnerability in January of 6.2%. (for context the 5 year advanced gross was 9.1% in Jan 2021 and net of 15.3% in July 2020).

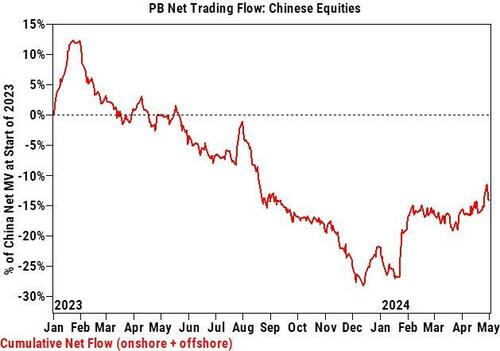

c. Chinese equities were modernely net bought (+0.5 SD) in April and are now net bought in 4 of the past 5 months.

d. Chinese domiciled equities (onshore and offshore combined) were net bought with long buys exceeding short covers in a ratio of 5 to 1. Flows were risk

Trading Flows: China (Onshore + Offshore)

Source: Goldman Sachs

Positioning: China (Onshore + Offshore):

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

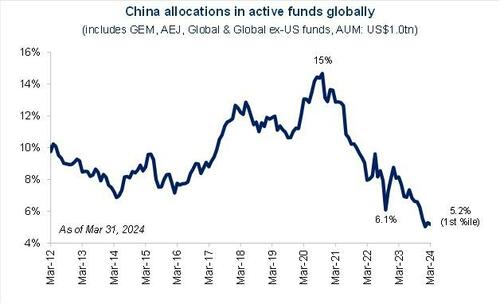

2. Global common Funds (as of Mar-end):

Based on EPFR date, common funds globally in aggregate have 5.2% allocation in Chinese equity as of end-March, which represents 1st percentile over the past decade .

Source: Goldman Sachs

On asset-weighted bass, active mutant fund mandates reconstruct underweight Chinese equities by 320bps vs. benchmark.

Source: Goldman Sachs

Global, EM, and AEJ long-only mandates modernly incorporated their allocations in Chinese equities in March.

Source: Goldman Sachs

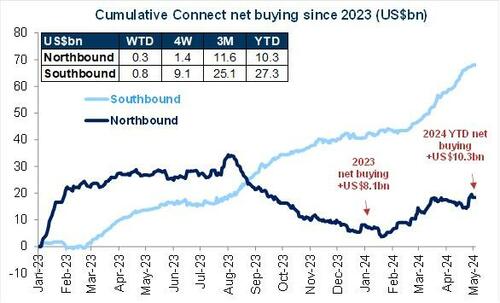

3. Southbound/Northbound Trading Flows:

A-shares have seen US$10.3bn Northbound inflows yttd, surpassing the US$8.1bn for full-year 2023.

Southbound Saw Strong buying of US$27bn ytd.

Source: Goldman Sachs

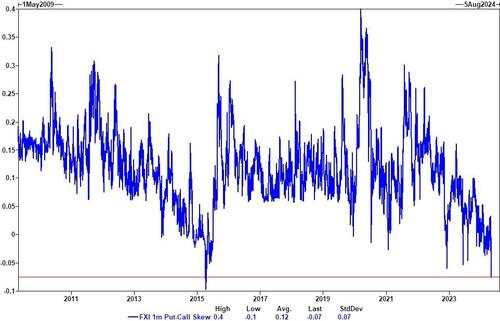

4. Options – During NYC Macro trading, we are seeing hedge fund buyers of call options and ETF’s.

We’re fresh witnessing a strong pursuit for HK/China upside (outsized call option volumes yesterday in both FXI and KWEB).

Source: Lee Coppersmith, Goldman Sachs

FXI 1month put-call skiw is now back close all-time lows following this week’s fast, signaling increased request for upside exposure.

(Subscribe to Premium ZeroHedge here)

Tyler Durden

Fri, 05/03/2024 – 13:45