AUTHOR: TYLER DURDEN

The French markets were relieved after the first circular of fresh elections, the shares recovered a bit and the yields of the bonds fell after reaching highest level in 12 years.

But no substance which side wins in France, market fearsthat the common denominator may be growth Non-sustainable expenditure.

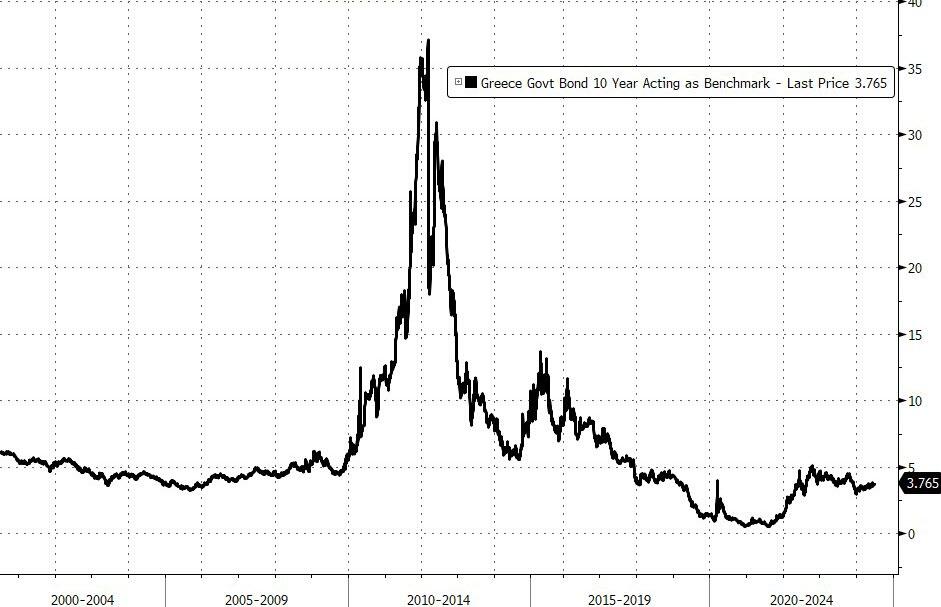

Greek debt crisis After global implosion in 2008, it was characterised by an excessively advanced debt-to-GDP ratio, a budget deficit, low economical growth and excessive dependence on tourism revenue. Now there are rumors in the euro area that a akin crisis may happen in France.

With its entry into the euro area, the Greek central bank lost much of its ability to print money.

The profitability of long- and short-term bonds increased sharply as the value of Greek debt declined sharply and investors in bonds fled to greener pastures. In 2015, the Council adopted Decision (CFSP) 2015/849. Greece failed EUR 1.6 billion of commitments to the IMF.

Source: Bloomberg

France's debt to GDP increased rapidly during the COVID-19 pandemic, and after the decline now tends to grow and is expected to exceed COVID levels in a fewer years.

The French economy is not certain how to react to the political promises of the left and The right, so the whispers about the possible debt crisis continued simply due to the fact that unstable French markets are experiencing temporary relief.

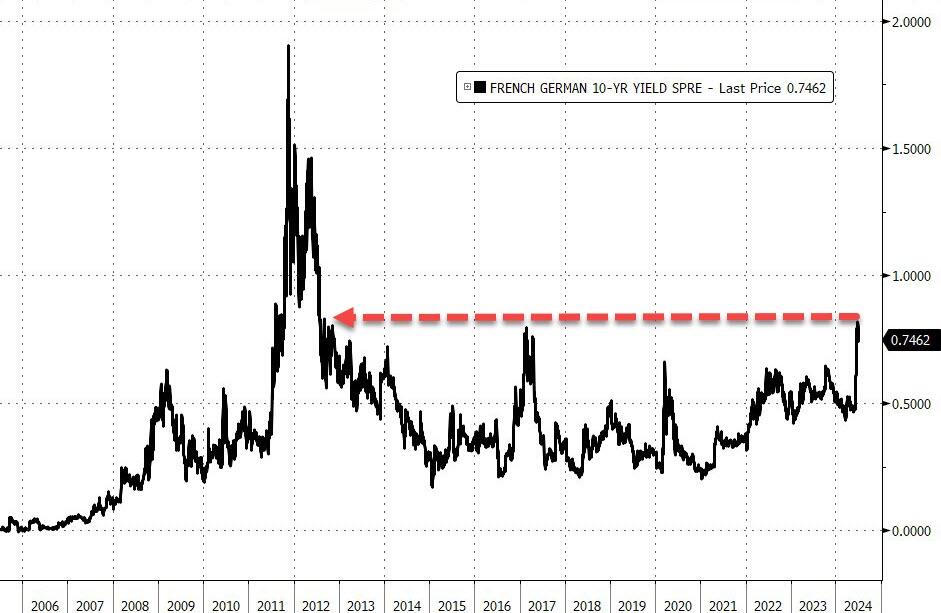

The spread of profitability between France and Germany was noted.

Source: Bloomberg

Profitability of "safe havens" German bonds have become a benchmark for the euro area, so The difference between German and another profitability has become an indicator of comparative tolerance to hazard to investors in European government debt.

Both France and Belgium were erstwhile considered low-risk countries in European economies, but now this communicative changes, since the problem of excessive spending is seen in countries that were erstwhile considered economically stable.

Meanwhile, the United States faces many akin problems – raging deficits, low growth, a increasing debt-to-GDP ratio and advanced inflation. The United States besides has more tricks to make kick the can downbut fewer options to truly solve the problem.

In 2010, the IMF defined the "unbalanced" debt-to-GDP ratio of the developed economy as About 180%. Officially, the current debt-to-US GDP ratio is "only" about 125%. But with Fed alone, global lenders, specified as the IMF, begin to express Concern over budget deficits getting out of control in the main economies.

GDP itself doesn't say everything. A large part of the United States' full GDP is based on the housing marketplace and the over-indebted real property market, an economical paper tiger that is completely dependent on low interest rates and printing money through central banks. Given that properties account for between 12 and 18% or more of the GDP cake, depending on who you ask, the image is not so reassuring. In Greece, the tourism manufacture was besides dominant to cope with the economical shock. In the United States these are properties.

There is besides an uncomfortable fact that advanced inflation can make nominal GDP appear higher due to the fact that the "market value" of goods in the economy is higher on paper. erstwhile it costs more, it can pump GDP data, even if the marketplace value itself has nothing to do with whether the economy is healthy or unhealthy. Of course. Keynesists insistthat it may be equivalent to "real" growth, and economists are inactive debatingwhether advanced GDP drives advanced inflation or vice versa.

Politicians love spending another people's money due to the fact that it makes them look good in the short run – and all that matters is winning Next elections. But whether it's Greece, France, Japan or the United States, the country can only take so much debt before it enters in a black hole. And central banks can hold the inevitable only for so long.

Translated by Google Translator

source:https://www.zerohedge.com/