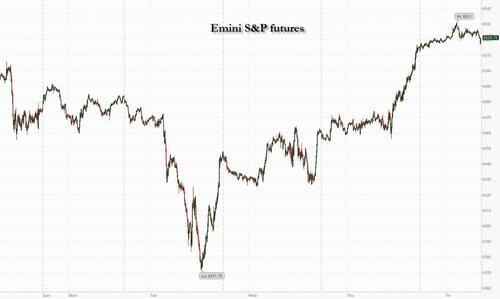

Futures Rise Further Into Record Territory Ahead Of Jobs Report

US equity futures are higher into NFP, rising after strong results from Broadmcom and on optimism that Friday’s jobs report will set the stage for the Fed to resume cutting interest rates this month. At 8:00am, futures for the S&P 500 ticked 0.1% higher – reaching a new record high – but eased off the best levels of the session. Nasdaq contracts advanced 0.5%. In premarket trading, Broadcom rallied more than 9% following its pact with OpenAI to create an artificial-intelligence chip. Tesla rose 2% after the board proposed a potentially $1 trillion pay package for Elon Musk. US Treasuries were little changed, with the two-year yield near the lowest in almost a year. The dollar headed for its weakest showing this week. Commodities are mixed: oil and base metals are lower, while gold and ags are mostly higher.

In premarket trading, Mag 7 stocks are mixed (Tesla +2%, Meta Platforms +0.3%, Microsoft +0.2%, Apple -0.1%, Amazon -0.3%, Alphabet -0.1%, Nvidia -0.8%) as Broadcom (AVGO) soars 11% after the chipmaker is said to be helping OpenAI design and produce an artificial intelligence accelerator from 2026. It also said that its artificial intelligence outlook will improve “significantly” in fiscal 2026.

- Crypto-linked stocks rose with Bitcoin and Ether prices up as broader markets gain on hopes that US jobs data on Friday will increase the chances of a Federal Reserve interest rate cut later this month. Coinbase (COIN) +1.2%, Riot Platforms (RIOT) +1.8%, Bitdeer Technologies (BTDR) +2.7%

- BioNTech ADRs (BNTX) gains 10% after the drugmaker said a late-stage trial of an experimental therapy for breast cancer met its primary endpoint.

- Braze (BRZE) climbs 18% as the cloud software company beat its second-quarter revenue and third-quarter revenue forecast estimates. An analyst at Needham notes that AI is seen to be a growth driver. .

- DocuSign (DOCU) rises 6.6% after the e-signature company reported second-quarter results that beat expectations and raised its full-year forecast.

- Guidewire (GWRE) is up 14% after forecasting revenue for the first quarter above the average analyst estimate.

- Lululemon (LULU) falls 18% after slashing its outlook, disappointing investors for a third straight quarter as the company struggles to meet high expectations and balance tariff expenses in a difficult consumer environment.

- Samsara (IOT) is up 12% as the US hardware-software platform company boosted its adjusted earnings guidance for the full year.

Investors are riding high ahead of today’s nonfarm payrolls report, with hopes it will strike the balance of a softer labor market that clears the way for policy easing without undercutting confidence in the economy. A bigger surprise in either direction could unsettle markets.

August payrolls are projected to rise by roughly 75,000, extending a four-month streak of job growth below 100,000. The unemployment rate is seen climbing to 4.3%, the highest since 2021 (our full preview is here). JPMorgan Market Intel estimates a better than 90% chance that the S&P 500 will advance following the payrolls report. Although the data is unlikely to sway the September decision, a weaker-than-expected print could amplify calls for a 50 basis-point cut, the team led by Andrew Tyler noted earlier this week. While softer numbers may briefly stoke recession fears, the bank notes that the real risk lies in a substantially stronger-than-expected report.

“Today’s release is unlikely to show the kind of pronounced weakness that would force the Fed to accelerate its easing plans,” wrote Max McKechnie, global market strategist at JPMorgan Asset Management. “Instead, investors should focus on the unemployment rate and wage growth for a clearer sense of the Fed’s next steps.”

The run-up to today’s payrolls report has brought a raft of data signaling a slowdown in the labor market. Fed Chair Jerome Powell cautiously opened the door to a first rate cut for 2025 in his Jackson Hole speech, citing risks to the jobs backdrop even as inflation concerns persist.

Some investors are approaching the release cautiously after recent revisions showed significantly weaker growth than previously reported. The downward adjustments, published with the July report, also led US President Donald Trump to dismiss the head of the Bureau of Labor Statistics, raising concerns about the integrity of data going forward. Stretched valuations also argue for restraint.

“We’re at a pivotal moment not only on growth and the labor market but also on inflation,” said Patrick Brenner, chief investment officer of multi-asset at Schroders Plc. “The market is priced for perfection and so we’re taking a wait-and-see approach by taking profits on our equity position.”

European stocks rise for a third straight session as investors await key US payrolls data later in the day. The Stoxx 600 rose 0.3% to 551.97 with the FTSE 100 outperforming European peers. The CAC 40 lagged, flat on the day. Miners, industrials and tech led sector moves. Dutch chip equipment maker ASML gains after an upgrade at UBS. Here are some of the biggest movers on Friday:

- ASML shares rise as much as 2.9% after UBS upgraded the firm to buy from neutral, noting that the factors that have seen the Dutch semiconductor equipment maker underperform over the past year are now priced in.

- Hexagon gains as much as 7.7% after the Swedish industrial design and measurement firm announced it would sell its design and engineering (D&E) unit to Cadence Design Systems for €2.7 billion ($3.2 billion).

- Berkeley Group rises as much as 2.5% as the housebuilder reassures that trading has been stable over the first four months of the year. Peers Persimmon, Taylor Wimpey, Bellway, Vistry, Barratt Redrow and Crest Nicholson also rise.

- Sixt gains as much as 6.9% after being initiated with a buy recommendation at UBS, with the bank saying the market underestimates tailwinds from better fleet management as well as US market-share gains.

- Ashmore shares fall as much as 15% after full-year results from the UK asset manager missed analyst estimates.

- Temenos shares drop as much as 14% after the Swiss banking software provider dismissed CEO Jean-Pierre Brulard, naming CFO Takis Spiliopoulos as his successor and interim CEO.

- Orsted falls as much as 2.2% after the wind farm developer cut its Ebitda excluding items forecast for the full year.

- BioArctic shares drop as much as 13% after Nordea analysts cut their recommendation on the Swedish biopharma company to sell from hold, setting their price target at a Street-low.

Earlier in the session, Asian stocks rose, on track for a weekly advance, supported by a rebound in Chinese equities as well as bullish sentiment around a US-Japan trade deal. The MSCI Asia Pacific Index gained as much as 1.2% in Friday’s session, set to finish higher on the week. China’s benchmark CSI 300 Index rose more than 2% after a three-day selloff. Stocks in Hong Kong, Japan, South Korea and Taiwan also advanced. Chinese stocks are bouncing back as investors mull the week’s events, including President Xi Jinping’s strengthening ties with India and North Korea as well as market policy proposals. Regulators are considering measures to curb the speed of the rally in its stock market, which may introduce more stable structural growth. Elsewhere in the region, Thailand got a new prime minister, with parliament electing Anutin Charnvirakul on Friday. Thailand’s stock index gained to its highest since mid-August. Shares in India traded lower, dragged by information technology firms.

In FX, the Bloomberg Dollar Spot Index edged down 0.3%, trimming its weekly gain. Markets have almost fully priced a Fed rate cut in September, with a follow-up reduction cemented by year-end, according to swaps data compiled by Bloomberg

In rates, Treasuries are steady with yields close to Thursday’s closing levels as investors wait for the August payrolls data and the potential impact on expectations for the September FOMC decision. Treasury yields marginally richer on the day, underpinned by gilts, where a broader bull-flattening move has been seen over the early London session. US 10-year yields trade around 4.15%, with gilts outperforming by 1bp in the sector and bunds trading broadly in line. Ahead of the jobs report, Fed-dated OIS is pricing in around 23bp of easing for the September policy meeting. For nonfarm payrolls change, which was 73k in July, the Bloomberg survey median estimate is 75k, matching the crowd-sourced whisper number. French and UK bonds advanced, while bunds were little changed.

In commodities, WTI held near $63.44 and gold added about $3 to $3,548/oz. Bitcoin gained another 2%.

Today’s US economic data slate includes only the August jobs report at 8:30am. The Fed speaker slate is empty for the session, and external communications blackout ahead of Sept. 17 rate decision begins Saturday

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.1%

- Stoxx Europe 600 +0.2%

- DAX +0.1%

- CAC 40 little changed

- 10-year Treasury yield little changed at 4.16%

- VIX -0.1 points at 15.24

- Bloomberg Dollar Index -0.3% at 1203.5

- euro +0.4% at $1.1692

- WTI crude -0.3% at $63.32/barrel

Top Overnight News

- Trump signed an order implementing the US-Japan trade deal, imposing a 15% tariff on most imports. The pact requires Japan to set up a $550 billion US investment fund or risk higher levies. BBG

- At a White House dinner, Silicon Valley leaders including Mark Zuckerberg pledged to increase AI spending. Trump said he would soon impose tariffs on chip imports but exempt goods from companies such as Apple that are expanding their US investments. BBG

- Lisa Cook argued that Donald Trump’s attempt to fire her is a cover for his real motive — taking control of the Fed. She pointed to a court ruling that Trump’s purported concerns about antisemitism at Harvard were a “smokescreen” to target the university. BBG

- Congressional leaders begin formulating a short-term deal to avoid a gov’t shutdown on 10/1, but the two sides still have a lot to work through in the coming weeks. NYT

- China’s investors borrowed a record $322 billion to buy stocks this year, but sharp corrections this week and heightened regulatory scrutiny to cool overheated markets are now making them jittery about the leveraged bets. While risks for China’s broader financial system have been elevated for months due to deflation in the economy and a persistent property debt crisis, the stock investors’ recent actions could add more pressure. RTRS

- Japan’s nominal wages rose by a more-than-expected 4.1% in July from a year earlier, the fastest clip in seven months. Separately, prefectures nationwide will raise the minimum hourly wage by a record 6.3%. BBG

- U.K. retail sales increased at the start of the third quarter, a boost as the country looks to get some momentum into its sluggish economy. Retail sales came in at +0.5% M/M (vs. the Street +0.3%). WSJ

- German factory orders unexpectedly slumped in July, as weaker foreign orders reflected a fragile export market amid increased trade barriers. Factory orders came in at coming in -2.9% M/M (vs. the Street +0.5%). WSJ

- Trump is to sign an order on Friday to rename the Department of Defense to the Department of War, according to a White House official. However, a CBS News reporter noted regarding President Trump signing an executive order to rename the Department of Defense to the Department of War, that it will be a secondary title as an official name change requires an Act of Congress.

- US House Speaker Johnson has, in an interview with Punchbowl, opened the door somewhat to extending Obamacare subsidies that are scheduled to expire at end-2025.

- Fed’s Goolsbee (2025 voter) said the labor market might be deteriorating and inflation might be picking back up, while he added there is a bit of wait and see because of uncertainty and that rates are better indicators for the labour market than raw job growth. Goolsbee also commented that the impact of tariffs on price increases is dependent on sector and noted the September Fed meeting is a live meeting, but he hasn’t made up his mind.

Trade/Tariffs

- US President Trump said he would be placing chip tariffs “very shortly,” which will be “fairly substantial”, but signalled Apple (AAPL) and others will be safe during his dinner with tech CEOs at the White House on Thursday, according to CNBC.

- US President Trump is reportedly preparing to start North American trade deal renegotiations and public consultations on the key US trade deal with Mexico and Canada, which will be the first acts of a likely lengthy and contentious review, according to WSJ.

- White House said US President Trump signed an Executive Order officially implementing the US-Japan trade agreement, while it added that Japan is working towards an expedited implementation of a 75% increase of US rice procurements and the US will apply a baseline 15% tariff on nearly all Japanese imports. It was later reported that Japan and the US issued a memorandum of understanding on the USD 550bln plans with investments to be made up to January 19th, 2029.

- Japanese PM Ishiba reiterated they will work to minimise the impacts on the economy and employment, while he added the US and Japan tariff agreement is very meaningful and it is important to implement the agreement sincerely and promptly.

- Japan’s top trade negotiator Akazawa said Japan agreed to issue joint statements on the US request and they signed an MOU on Japan’s investment package. Akazawa said nothing had changed from the July 22nd agreement with regards to the USD 550bln investment package and the amended executive order does not mention most-favoured-nation treatment for pharma and chips, and will continue to push for the treatment. Furthermore, he said their stance that additional tariffs themselves are regrettable remains unchanged, as well as stated that lower auto tariffs will take effect within up to two weeks.

- Anthropic is to stop selling AI services to majority Chinese-owned groups and is trying to limit the ability of Beijing to use its technology to benefit China’s military and intelligence services, while Anthropic’s policy will also apply to US adversaries including Russia, Iran and North Korea, according to FT.

- Indian oil skips US crude and buys Nigerian and Middle Eastern oil via tender, according to Reuters sources.

- Swiss Economy Minister set to visit the US this weekend, according to EconomieSuisse.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly took their cues from the gains on Wall Street where participants digested soft labour metrics and dovish Fed speak ahead of today’s NFP report. ASX 200 was led higher by outperformance in real estate, tech and consumer discretionary, although gains were capped with the commodity-related sectors, consumer staples and utilities at the other end of the spectrum. Nikkei 225 rallied at the open and briefly returned to above the 43,000 level after US President Trump signed an Executive Order to officially implement the US-Japan trade deal in which the US will apply a baseline 15% tariff on nearly all Japanese imports, although some of the gains were pared amid a firmer yen and an acceleration in Labour Cash Earnings. Hang Seng and Shanghai Comp conformed to the constructive mood following recent tech-related support pledges by Beijing and with DeepSeek targeting an AI agent release by year-end, while reports also noted the PBoC may inject reasonably ample liquidity this month and that cities in China are said to examine new tactics to buy unsold homes.

Top Asian News

- PBoC may inject reasonably ample liquidity into the money markets this month, according to China Securities Journal.

- Japanese PM Ishiba says they are to compile an economic package this autumn.

European bourses (STOXX 600 +0.3%) opened modestly firmer across the board but dipped slightly off best levels in early-morning trade. Currently, still displaying a positive picture in Europe, but are off best levels. European sectors hold a positive bias, and with the breadth of the market to the downside fairly narrow. Basic Resources takes the top spot, buoyed by strength in underlying metals prices. Tech follows closely behind, with the sector boosted by a trifecta of factors; 1) strong Broadcom results, 2) broker upgrade for STMicroelectronics, 3) broker upgrade for ASML. On the latter, ASML was upgraded to Buy from Neutral at UBS and got a 13% boost to its PT. Analysts cite recent underperformance, and note that the „overhang” from China is well understood by investors.

Top European News

- German GDP growth is exp. to grow by 0.2% in 2025 (prev. saw 0.3%); sees growth of 1.7% in 2026 and 1.8% in 2027, via DIW.

FX

- After a resilient showing in the wake of soft labour metrics yesterday, DXY is on the backfoot in the run up to the August payrolls report. For today’s release, expectations are for a modest uptick in payrolls to 75k from 73k and for the unemployment rate to rise to 4.3% from 4.2%. DXY has slipped below yesterday’s trough @ 98.08 and is sat around its 50DMA at 98.05.

- EUR is currently taking advantage of the broadly weaker USD. Newsflow surrounding the Eurozone is light during today’s trade and therefore the dollar is likely to be in the driving seat for EUR/USD. Traders are mindful of French political risk at the start of next week with PM Bayrou set to face a confidence vote on Monday. Betting markets are overwhelmingly expecting him to suffer a defeat. Desks have touted a move towards 90bps (2024 peak) in the event Bayour is defeated with the risk of a venture to 100bps if fresh elections are called. The follow-through into the EUR may be limited by the looming ECB rate decision and accompanying macro projections. EUR/USD has moved back above its 50DMA at 1.1664 with clean air until the 1.17 mark.

- USD/JPY has trickled closer towards the 148.00 level to the downside after mixed data including the hotter-than-expected Labour Cash Earnings which showed the fastest pace of increase in seven months, while Real Cash Earnings unexpectedly grew for the first time in seven months. On the trade front, the White House said US President Trump signed an Executive Order officially implementing the US-Japan trade agreement. On the trade front, the White House said US President Trump signed an Executive Order officially implementing the US-Japan trade agreement. Subsequently, Japanese PM Ishiba reiterated they will work to minimise the impacts on the economy. For USD/JPY, a soft NFP print could see the pair lose its footing on a 148 handle and head towards Thursday’s low at 147.78.

- GBP is firmer vs. the USD but not showing much in the way of outperformance relative to peers despite a better-than-expected outturn for UK retail sales. Commenting on the release, Pantheon Macroeconomics observes that the ONS made major revisions to retail sales today by correcting seasonal factors. As such, H1 retail sales were actually softer than initially assumed. For the BoE, following the data and the MPC’s appearance before the TSC earlier in the week, Investec now expects that the Bank rate will remain on hold over the remainder of the year at 4.00%. Cable has eclipsed Thursday’s best at 1.3460 and is now eyeing the 50DMA at 1.3477.

- Antipodeans are both are firmer vs. the USD and towards the top of the G10 leaderboard in what has been a choppy/directionless week for AUD/USD and NZD/USD. Fresh macro drivers from Australia and New Zealand are lacking and as such, both pairs’ fates are likely to be determined by events stateside and broader risk dynamics.

- CAD is marginally stronger vs. the USD in the run up to Canadian and US labour market reports, both due at 13:30BST. It is likely that the latter will deliver the greatest source of traction for the pair.

Fixed Income

- USTs are contained into NFP. Holding in a very thin 112-28 to 113-00 band, but at a WTD high and comfortably above the week’s 112-15+ opening mark. NFP is expected to inch higher to 75k (prev. 73k) in August, though revisions to the series will undoubtedly draw attention, particularly as Trump has replaced the BLS head since the last report.

- OATs are firmer counting down to Monday’s confidence vote. The base case remains that PM Bayrou will lose. Thereafter, President Macron is likely to try and appoint a new PM in an attempt to bring the centrist bloc and the Left closer; current Finance Minister Lombard is a potential candidate. The bias for OAT-Bund 10yr spread is likely some further widening, though the fall of Bayrou itself is likely already priced at this stage.

- Bunds are trading in-line with USTs. Specifics for the EZ light, aside from more updates (downgrades) to the German growth outlook from domestic bodies. Elsewhere, China has announced preliminary anti-dumping measures on the EZ, though this has had no discernible effect. Currently at the upper end of a 128.52-74 band, at a fresh WTD high and looking to 128.81 and 128.87 from last week.

- Gilts are outperforming, higher by just over 40 ticks at most in 90.65-87 parameters. Despite the stronger-than-expected UK retail metrics for July, the ONS’ revision YTD data has trimmed the H1 monthly average by 10bps. Revisions which have seemingly provided some bullish impetus for Gilts. Though, ultimately, the revision is unlikely to change the BoE’s trajectory and the strength may just be more a case of Gilts continuing the move seen in the last few days and paring some of the recent pressure spurred by fiscal jitters.

Commodities

- Crude futures were lower but now flat after recent declines and reports that OPEC-8 are mulling another production hike at the meeting on Sunday, while demand was also not helped by the surprise build in the weekly EIA headline crude stockpiles. In geopolitics, Russia’s Kremlin says the next round of Russian President Putin and US President Trump talks are possible in the near future, via Ria. This follows on from Trump saying he will speak to Putin to get the war in Ukraine settled. WTI currently resides in a 63.04-63.42/bbl range while Brent sits in a USD 66.59-66.97/bbl range.

- Spot gold is kept afloat in rangebound trade after yesterday’s sideways price action and with the NFP report on the horizon. Spot gold resides in a USD 3,540.01-3,561.28/oz range at the time of writing, yesterday’s range between USD 3,511.75-3,564.15/oz, and with the all-time-high set on Wednesday at USD 3,578.66/oz.

- Copper futures steadily gain alongside the mostly positive risk appetite in the Asia-Pac region and then Europe. 3M LME copper remains under USD 10k after recently topping the level. The contract currently trades in a USD 9,895.30-9,991.45/t range awaiting the US jobs report.

- Russian Deputy PM Novak said OPEC-8 are not discussing production increase now and no agenda has been set for the upcoming OPEC+ meeting yet, while he added that current market conditions and forecasts are to be considered. Novak also said the OPEC+ deal shows its effectiveness and the level of implementation of OPEC+ deal is 102% in January-August.

- Aluminium producers seek USD 98-103/t in Oct-Dec premiums in talks with Japan, down 5-9% from current quarter levels, via Reuters citing sources.

Geopolitics: Ukraine

- Russia’s Kremlin says the next round of Russian President Putin and US President Trump talks are possible in the near future, via Ria

- US President Trump said he will speak to Russian President Putin in the near future and they are going to get the war in Ukraine settled.

- Kremlin’s Peskov said security guarantees for Ukraine cannot be provided by foreign military contingents, while the Kremlin said the level of the Russian negotiating team with Ukraine is already quite high and a huge amount of work needs to be done before there could be a meeting between Russia and Ukraine at a higher or the highest level, according to RIA.

- Russian President Putin says „we have open dialogue with US President Trump”; have not yet spoken to Trump. Russia assumes military contingents in Ukraine will be legal targets for strikes and sees no sense in their deployment if there is a peace deal. Adds, „we are ready for a summit with Ukraine, please come to Russia, we will provide security”; says the best place for a summit is Moscow.

- Iranian delegation will be in Vienna for IAEA talks today, via WSJ’s Norman.

- EU Energy Commissioner says if there is a Russia-Ukraine peace deal, „we should still not return to Russian energy”, adding this is not a temporary sanction; US supports that EU stops Russian energy imports. Will meet US Energy Secretary next week to discuss the trade deal.

- Ukrainian President Zelensky says he has spoken with NATO’s Rutte, security guarantee work needs to be accelerated.

Geopolitics: Other

- South Korea, Japan and US militaries will conduct a joint aerial, naval and cyber defence exercise from September 15th.

- North Korean leader Kim returned to North Korea following a summit with Chinese President Xi, while Kim told Xi about strengthening strategic cooperation and protecting common interests in international and regional issues. Furthermore, the leaders exchanged candid opinions on strengthening high-ranking strategic communication and Kim said that North Korea will continue to support China to protect its sovereignty, territory and development interests, according to KCNA.

- US Secretary of State Rubio announced a new US visa restriction policy and will restrict US visas for Central American nationals who act on behalf of China.

- US and Taiwanese defence officials held secret talks in Alaska, according to FT.

- US Defense Department said two Venezuelan military aircraft flew near a US Navy vessel in international waters.

US Event Calendar

- 8:30 am: Aug Change in Nonfarm Payrolls, est. 75k, prior 73k

- 8:30 am: Aug Change in Private Payrolls, est. 75k, prior 83k

- 8:30 am: Aug Change in Manufact. Payrolls, est. -5k, prior -11k

- 8:30 am: Aug Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

- 8:30 am: Aug Average Hourly Earnings YoY, est. 3.8%, prior 3.9%

- 8:30 am: Aug Unemployment Rate, est. 4.3%, prior 4.2%

DB’s Jim Reid concludes the overnight wrap

Today see’s the first of the three massive days for markets in the next nine business days. US Payrolls today, US CPI next Thursday and then the FOMC decision the following Wednesday. Ahead of today’s start to this run, markets have put in a strong performance over the past 24 hours, after soft data meant investors became increasingly convinced that the Fed would cut rates this month. Those prints pointed to growing weakness in the US labour market, which is top of mind given that last month’s jobs report was unexpectedly bad. So bonds saw a broad rally on both sides of the Atlantic, and the 2yr Treasury yield (-2.9bps) even closed at an 11-month low of 3.59%. In turn, the prospect of imminent rate cuts lifted equities, with the S&P 500 (+0.83%) closing at a new record high.

In terms of that jobs report, our US economists expect nonfarm payrolls to come in at +100k in August, picking up from the +73k reading back in July, with the unemployment rate staying at 4.2%. However the revisions will be of massive importance after last month saw the biggest downward revisions in over 5 years to the prior two months. As you will no doubt remember this contributed to BLS chief Erika McEntaref losing her job hours after the release. The presumptive nominee E.J. Antoni hasn’t yet been confirmed by the Senate with hearings expected this month. After last month’s report, the entire picture of labour market resilience after Liberation Day was suddenly undercut, and the current data shows payrolls up by just +19k in May and +14k in June. So as it stands, both the 3-month and 6-month average of payrolls are at their weakest levels of this economic cycle, at +35k and +81k respectively. However such numbers might still reflect a tight labour market as our economists believe that due to the crackdown on immigration and the increase in deportations, the breakeven level of payrolls that keeps the unemployment rate steady could now be as low as 50k per month.

Ahead of the big print, labour market jitters got more traction yesterday, as the ADP’s report of private payrolls was a bit weaker than expected in August, at +54k (vs. +68k expected). Then 15 minutes later, we found out that the weekly initial jobless claims hit a 10-week high of 237k in the week ending August 30 (vs. 230k expected). To be fair, there was a bounceback in the ISM services index, which rose to a 6-month high of 52.0 (vs. 51.0 expected). But even there, the employment component was still in contractionary territory at 46.5. So when it came to the labour market, it was hard to generate much of a positive narrative from yesterday’s releases.

All that helped to fuel the bond rally, with investors dialling up their expectations for Fed rate cuts over the months ahead. For instance, the amount of cuts priced by the June 2026 meeting rose +3.8bps by the close to 113bps. And in turn, that helped to push Treasury yields lower across the curve, with the 2yr yield (-2.9bps) at an 11-month low of 3.59%, whilst the 10yr yield (-5.6bps) hit a 5-month low of 4.16%. Over the last couple of days, the market has been less worried about inflation but the prices paid component of the ISM services remained at a very high 69.2 yesterday even if it was three tenths less than expected and seven tenths below last month. See my CoTD from yesterday here for why that’s still a potential worrying sign for future CPI even if the prices paid number is more volatile.

Those inflationary concerns were echoed by Cleveland Fed President Hammack, one of the hawks on the FOMC, who said that “inflation is still too high, and we’re trending in the wrong direction” and reiterated that she did not see the case for a September rate cut. By contrast, NY Fed President Williams said that concerns on the labour market have ticked up relative to ones on inflation and that it will „become appropriate” to cut interest rates „over time”, though he did not comment on exact timing.

Yesterday also saw the Senate confirmation hearing for Stephen Miran to join the Fed’s Board of Governors, which is an important one given investor concerns about the Fed’s independence. In his testimony, Miran said that “If I’m confirmed to this role, I will act independently, as the Federal Reserve always does”. Miran was also questioned on his intention to take a leave of absence from, but keep his current CEA Chair role as he fills the rest of the Governor term expiring in January, though he said would resign from his CEA post if nominated for a longer term role at the Fed. Separately, we heard that the US Justice Department opened a criminal investigation into whether Fed Governor Lisa Cook committed mortgage fraud. That comes as we await to hear whether Cook will succeed in getting a temporary court order blocking her dismissal.

Thrown altogether, this provided a strong backdrop for equities, as investors became increasingly confident that the Fed would cut rates in a couple of weeks’ time. So that helped drive both the S&P 500 (+0.83%) and the Magnificent 7 (+1.31%) to new all-time highs. All of the Mag-7 were higher on the day, led by Amazon which jumped +4.29% after Business Insider reported that it is testing a new AI-powered workspace software. Overnight the FT reports that Open AI are teaming up with Broadcom to produce a new AI chip to rival Nvidia. So it’ll be interesting to see if that creates any competition to Nvidia over the medium term. Broadcom itself issued a rosy revenue outlook overnight and was up +4.6% in extended trading. Nasdaq futures are up +0.35% overnight with the S&P equivalent up around half that.

Switching continents, and attention is increasingly turning back to France, as the confidence vote is being held on Monday in the National Assembly. We should hear the results after 5pm local time. The announcement of the vote several days ago led to considerable market concerns, as investors feared a prolonged bout of instability that would make fiscal tightening even more difficult. But since then, French assets have stabilised over recent days, as a defeat is now widely expected given the positions of the various parties, meaning that the prospect of a defeat in itself isn’t driving market moves anymore. Indeed, French OATs outperformed yesterday, with their 10yr yield down -5.0bps to 3.49%, which was bigger than the decline for bunds (-2.1bps) and BTPs (-4.4bps). So that brought down the 10yr Franco-German spread to 77bps, which is its lowest in the last week and a half. The STOXX 600 rose +0.61%.

In Asia, Chinese equities have recovered some of yesterday’s losses which came from fears of a regulatory clampdown, with the CSI (+0.92%), the Hang Seng (+0.62%), and the Shanghai Comp (+0.35%) all higher. Elsewhere, the Nikkei (+0.64%) is also trading higher following President Trump’s signing of an executive order that enacts the trade agreement with Japan, under which the US will impose a maximum 15% tariff on most of its products. Elsewhere, the S&P/ASX 200 (+0.41%) is building on its previous session gains with the KOSPI (+0.08%) struggling for momentum after seeing decent gains in the previous three sessions.

Coming back to Japan, nominal wages increased by +4.1% year-on-year (compared to +3.0% anticipated), representing the fastest growth in seven months during July, and an acceleration from a revised +3.1% rise in June. Real wages unexpectedly increased for the first time this year, rising by +0.5% year-on-year in July (against an expected -0.6%), contrasting with a revised -0.8% decline the previous month, thereby strengthening the case for the BOJ to consider a rate hike in the forthcoming months. Additionally, household spending rose by +1.4% year-on-year in July (versus +2.3% expected), compared to a +1.3% increase the prior month.

Looking ahead, the main highlight today will be the US jobs report for August. Meanwhile in Europe, data releases include German factory orders and UK retail sales for July.

Tyler Durden

Fri, 09/05/2025 – 08:23