Caterpillar Shares Fall On Recalibration To „Slightly Lower” Revenue Outlook

Caterpillar reported adjusted fourth-quarter earnings per share that exceeded the Bloomberg Consensus. However, the Texas-based company warned that 2025 revenue is forecasted to be „slightly lower” as demand concerns for heavy equipment weighed on shares in premarket trading. There are also destock headwinds and elevated inventories impacting dealers.

Here’s a snapshot of the fourth quarter results (courtesy of Bloomberg):

Adjusted EPS $5.14 vs. $5.23 y/y, estimate $5.05 (Bloomberg Consensus)

- EPS $5.78 vs. $5.28 y/y

Revenue $16.22 billion, -5% y/y, estimate $16.72 billion

- Financial segment revenue $883 million, +6% y/y, estimate $858.3 million

- Machinery, Energy & Transportation segment revenue $15.33 billion, -5.6% y/y, estimate $15.76 billion

- Adjusted operating income $2.96 billion, estimate $3.15 billion

- Machinery, Energy & Transportation segment operating income $2.94 billion, -5.4% y/y, estimate $3.11 billion

- Financial Products segment operating income $137 million, -27% y/y, estimate $199 million

R&D expenses $519 million, -6.3% y/y, estimate $538.1 million

Investor focus was not necessarily on fourth-quarter earnings. Instead, Caterpillar’s 2025 outlook, disclosed in a presentation, comes at a time when China’s recovery remains fragile, and President Donald Trump is potentially escalating tariff wars with top trading partners.

Goldman’s Jerry Revich, Clay Williams, and others told clients, „The key debate on CAT this morning is whether the 2025 margin outlook marks a cycle trough following CAT 4Q results that revealed positives from (i) sharply higher destocking ($700 mn) and (ii) orders (1.08x book-to-bill), but (iii) 2025E margin targets that are ~200 bps below FactSet consensus and (iv) 4Q EBIT miss (though we view this as less material within the context of destocking progress).”

„We expect the stock to be down on the recalibration to 2025 estimates, but with destock headwinds peaking, strong bookings, and solid cost control amid production cuts, we see potential for multiple expansion post earnings,” the analysts continued.

Here are their key takeaways from the quarter:

-

4Q EBIT was 6% below our and consensus estimates due to a 5% sales shortfall amid sharply higher destock. 4.5% of the sales shortfall was driven by dealer inventory destocking.

-

We believe management outlook comments imply 2025E EPS of ~$19. CAT guided to margins at the high end of its framework, which assuming a 2% sales decline would imply a margin target of ~19% vs. GSe and consensus of 20-21% and 2024 margins of 21.6%.

-

Dealer inventories of machines were destocked by an additional $700 mn vs. guidance. Total dealer inventories destocked by -$1,300 mn compared to our estimate of a -$780 mn decrease and a normal seasonal decrease of -$225 mn. (iv) Orders of $16.6 bn were up 6% yoy, 8% ahead of our estimate, and represented a book-to-bill of 1.08x.

-

Retail sales were +8% above our estimates in Construction. Construction Industries were -3% yoy vs. GSe -11%. Resources retail sales were down -3% yoy vs. GSe of -12%. Energy & Transportation retail sales were up +2% vs. GSe of +9%.

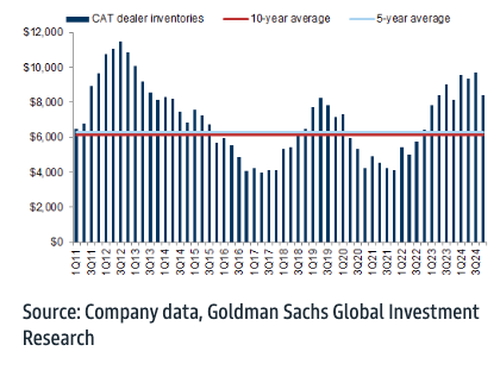

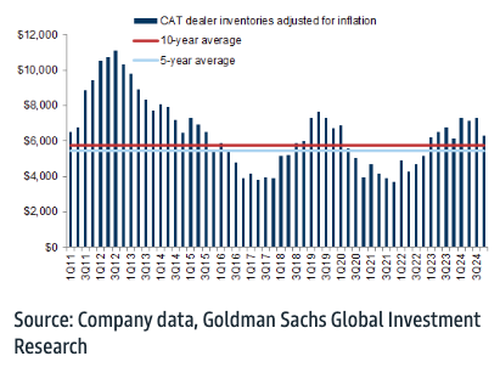

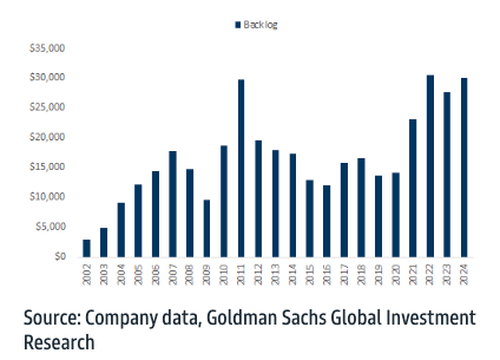

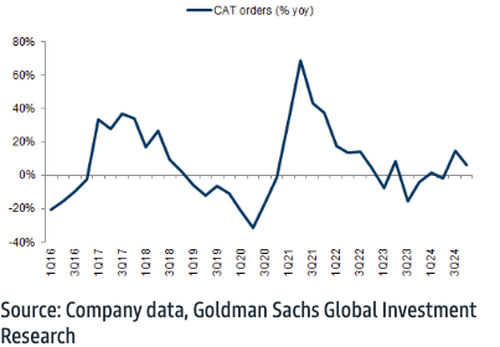

The analysts provided additional insight into inventories, backlog, and order growth via a chart pack:

CAT dealer inventories

CAT dealer inventories (inflation-adjusted)

CAT backlog

CAT consolidated orders (% chg yoy)

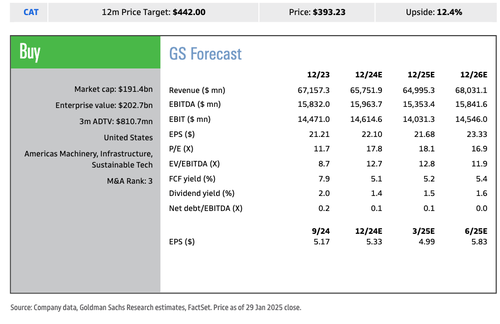

The analysts maintained their „Buy” rating and a 12-month price target of $442, based on their 26x mid-cycle EPS estimate of $17.00.

CAT shares are 5% lower in premarket trading in New York. Resistance has been building along the $ 400 handle, which has been rejected numerous times since October.

Caterpillar is considered a bellwether for global economic growth because it supplies articulated trucks, backhoe loaders, dozers, engines, excavators, motor graders, skid steer loaders, and wheel loaders to the construction, mining, and energy industries worldwide. The economic headwinds across China and Europe have led to elevated inventories at dealers.

Tyler Durden

Thu, 01/30/2025 – 09:35