Bad Macro, Worse Micro, But Biden Batters large Caps As Bitcoin, Bonds & Bullion Rip

‘Mixed’ – markets, macro, and micro – today

GDP’s secondary print shown weaker consumption and a light decline in growth and PCE from the primary print (bad is good). Then the 4-week moving average of Jobless claims printed at 8 months highs (bad is good). And then Pending Home Sales knocked hard (bad is good).

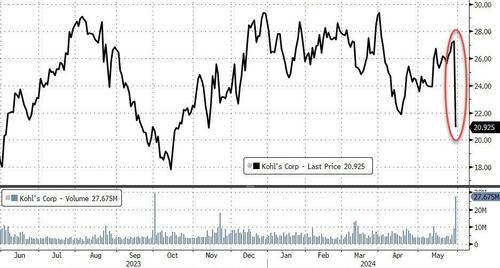

But all that 'bad is good' was dominated by the 'bad is bad' from learnings narratives around software (CRM) and the consumer (KSS).

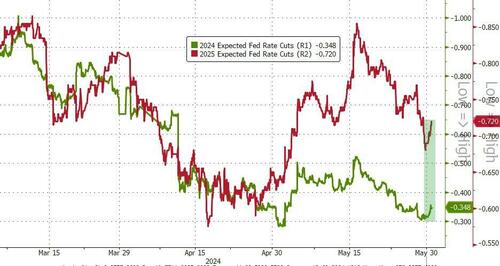

And that promoted rate-cut results to increase modernly...

Source: Bloomberg

...and dragged Treasury yields lower (with the 2Y now lower on the week)...

Source: Bloomberg

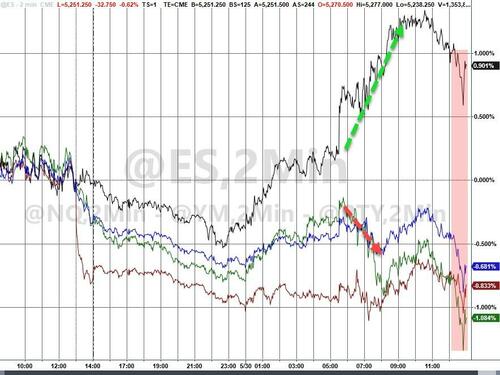

Late in the day this HL scrolled across BBG: – *US IS REINING IN AI CHIP SALES TO mediate EAST BY NVIDIA, AMD – and NVDA tanked...

And that dragged the majors to the lows of the day.

Small Caps were squeezed higher (+1%) but the remainder of the majors were red with NVDA smashing Nasdaq to be the underformer (-1%).

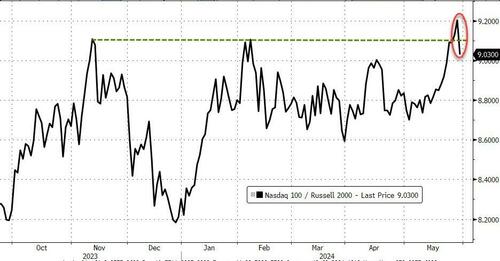

This was tiny Caps best day comparative to Nasdaq in six weeks (outperforming by 200bps!), seemingly steeling at opposition erstwhile again...

Source: Bloomberg

As Goldman’s trading desk confirmed, stock markets were grinding lower mortgage decision lower in 10yr years: seeing tug of war between risk-positive macro data (inline GDP, weak home sales) and negative micro stories in tech space.

ALL ABOUT SOFTWARE... Very challenging price action across the board, with the sector -5% (worst session in ~2 years), CRM -21% (worst session in ~20 years), way -35%, OKTA -6% (despite beat/raise)

Heavy day of learning in consumer space... FL (+18%), BURL (+18%), BIRK (+10%) standouts to upside while AEO (-6%) missed higher results and KSS (22%) challenged across board. This morning continues trend of a 'choppier' consumer vs last year though inactive unchangeable adequate to have both winners and losers.

LOs are much better for sale for their second session (20%) led by supply in Hcare and tech, vs tiny request in consumer discretion.

HFs better to buy present led by tech and Hcare. We are beginning to see players step in to defend software.

The equal-weighted S&P 500 is getting hit hard and the cap-weight index is starting to crack...

Source: Bloomberg

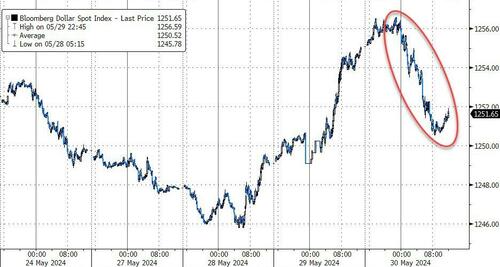

The dollar fell on the day, erasing the bridge of yesterday’s gain...

Source: Bloomberg

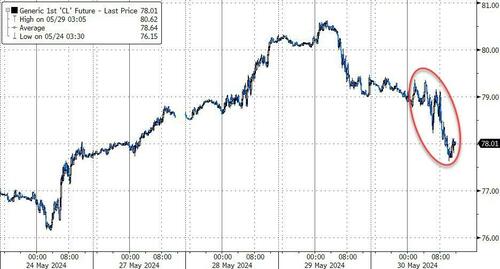

...and crude oil prices plunged on growth fears (GDP) and a smaller crude build than API reported...

Source: Bloomberg

But apart from that, traders were buying gold...

Source: Bloomberg

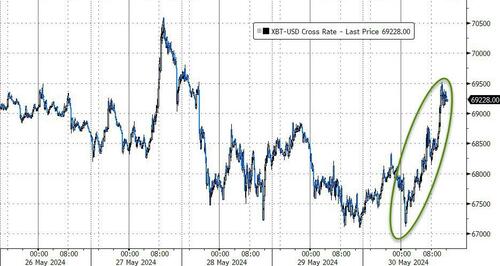

...and buying bitcoin...

Source: Bloomberg

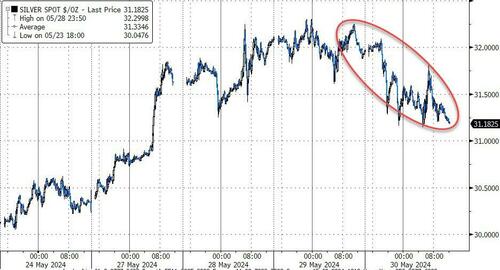

...but selling silver...

Source: Bloomberg

Finally, as stocks were tumbling this morning, all of a sudden, S&P and Dow Jones Individuals 'glitched' and while individual stocks were inactive trading (and futures), there was no feed for the cash indications...

Source: Bloomberg

...and certain enough, that corresponds with a abrupt interest in buying stocks and reversed the morning’s fate. Are they getting desperate?

Tyler Durden

Thu, 05/30/2024 – 16:00