ASML Shares Plunge As Uncertainty Casts Shadow Over 2026 Outlook

Shares of ASML Holding NV plunged in Europe on Wednesday after CEO Christophe Fouquet warned he could no longer guarantee the company’s 2026 sales forecast due to an increasingly complex macroeconomic backdrop.

What’s critical to understand is that ASML’s largest customers—Taiwan Semiconductor Manufacturing Co. and Samsung Electronics—are widely seen as bellwethers for both the semiconductor sector and the broader global tech cycle. Signs of caution from ASML about next year may be an early warning light flashing for the AI-driven tech bubble…

„Looking at 2026, we see that our AI customers’ fundamentals remain strong. At the same time, we continue to see increasing uncertainty driven by macro-economic and geopolitical developments. Therefore, while we still prepare for growth in 2026, we cannot confirm it at this stage,” Fouquet stated in an earnings release.

ASML shares in Amsterdam tumbled 8% to 649 euros on Wednesday— the largest daily decline since October 15, 2024.

The stock is down approximately 4% year-to-date, having failed to sustain a breakout above 700 euros. Shares remain well below the 1,000 euro peak reached in mid-2024.

ASML guided 3Q net sales between 7.4 billion euros and 7.9 billion euros—below the 8.2 billion euros consensus estimate tracked by Bloomberg. The company still expects full-year revenue to grow 15%. CFO Roger Dassen said customers of its ultraviolet lithography machines, which produce the advanced chips that power artificial intelligence data centers, smartphones, EVs, robots, and drones, are holding off on orders amid rising macroeconomic headwinds and export controls.

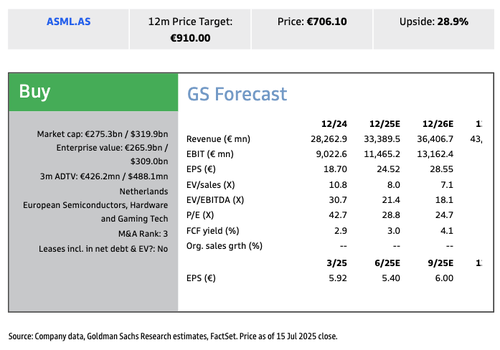

The first take on ASML’s earnings and growth outlook comes from a team of Goldman analysts led by Alexander Duval:

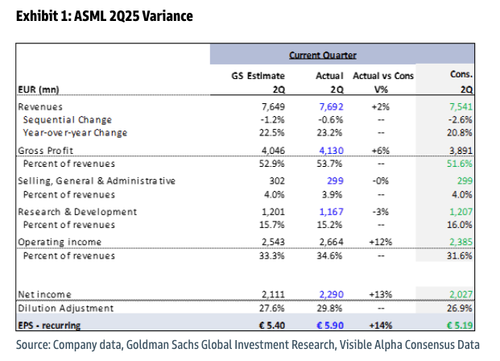

ASML’s 2Q25 revenue was above Visible Alpha Consensus Data and EBIT of €2.7bn was 12% ahead of consensus, driven by higher gross margins which benefited from a higher share of upgrades as part of the IBM business, lower-than-expected tariff effect and some one-off cost benefits. The company’s bookings figure in 2Q was €5.5bn, (up qoq from a weak 1Q25 order intake of €3.9bn and above Visible Alpha Consensus Data of c.€4.4bn), including €2.3bn of EUV orders (above consensus estimate of €2.0bn). As such, we note that the 2Q25 order intake of €5.5bn is above the top-end of the order run-rate needed (c.€4-5bn) to hit the 2026 consensus estimate. Importantly, the company shipped its first 5200B High NA system this quarter which will be used for high volume manufacturing and could be taken positively by investors. The company highlighted that AI related demand will continue to be strong in 2026 and the company is still preparing for growth, but cannot confirm it at this stage as the uncertainty around macro has increased. The company introduced its 3Q25 net sales guidance of around €7.4-7.9bn and expects 3Q25 gross margins to be around 50-52% implying revenue/gross profit/EBIT that is 6%/7%/11% below consensus. Further, ASML stated that it expects 2025 sales to grow 15% yoy (vs €30-35bn prior), with gross margins of 52% (vs 51-53% prior). As such, we note that the new guide for FY25 implies revenue/gross profit/EBIT in line with Visble Alpha Consensus Data. Additionally, the company highlighted it expects 2H to be bigger than 1H and revenues in 2H will be more 4Q concentrated. Finally, we note that ASML sees its lower GMs in 2H driven by a decline in upgrade activity for the 3800E (a high-margin segment within the Installed Base business), some one-off cost effects and dilution from the ramp of High NA tools.

In terms of end market trends, ASML expects continued strength in advanced Logic, with customers adding capacity in most advanced nodes, strong Memory as customers invest in their latest HBM and DDR5 products, and Installed Base growth supported by an expanding fleet of EUV systems transitioning from warranty to full-service contracts. The company sees increased EUV adoption among DRAM customers, while across the broader customer base, total capacity expansion plans suggest around 30% additional capacity. Finally, the company reiterated its LT 2030 revenue and GM guidance and remains positive on the trajectory of Lithography intensity. More broadly, we expect investors to seek more colour on the tariffs related dynamics, latest expectations for order intake from Foundry/leading-edge customers in coming quarters, demand in the trailing-edge end markets. Reiterate Buy.

Analysis

We expect an initial positive reaction in the shares, in light of a beat on the current quarter KPIs versus consensus, quarterly order intake above consensus and the 5Y median and positive view on Litho intensity, partly offset by a below cons 3Q guide and slightly more cautious view on 2026 growth opportunities due to an uncertain macro. We note that ASML has performed in-line vs EU Tech in the last 3 months, and is up 4% abs YTD.

. . .

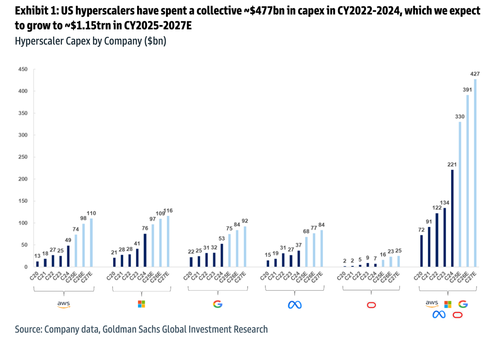

Despite ASML’s downgraded outlook and growing macroeconomic uncertainty, SoftBank Group founder Masayoshi Son and OpenAI CEO Sam Altman both stated earlier, via a teleconference at SoftBank World, that there is no end in sight to AI demand and scaling.

„As we drive the cost of AI down, more people want to use it,” Altman told Son after a question about diminishing returns from further scaling of data centers. „So if we make the cost of AI 10 times cheaper, people wanna use it 30 times as much or whatever. And the demand for intelligence in the world just seems to be huge.”

As we noted on X earlier…

ASML crashes 9% after lowering Q3 revenue and margin outlook, does not confirm 2026 growth target.

But… but… but… AI AI AI

— zerohedge (@zerohedge) July 16, 2025

But… but… but… AI AI AI.

And Capex!

ASML, TSMC, and Samsung are considered bellwethers for the semiconductor industry and broader global tech trends.

Tyler Durden

Wed, 07/16/2025 – 09:55