GURUGRAM- This week, aviation analyst and route expert, Ravreet Singh did a unique comparison of an international network of Air India Express (IX) and IndiGo Airlines (6E).

During comparison he shared many important datasets, destinations, and most crucial: their focus cities.

Photo: avgeekwithlens/ Harsh Tekriwal

Photo: avgeekwithlens/ Harsh TekriwalAir India Express vs IndiGo

Air India Express (IX) operates 471 weekly international flights across 93 routes, connecting 21 Indian cities to 15 international destinations with 87,734 weekly departing seats.

IndiGo’s (6E) broader network encompasses 900 weekly international flights on 113 routes from 20 Indian cities to 33 destinations, providing 174,000 weekly seats.

IndiGo maintains a significant lead in network capacity, operating 48% more flights and offering 50% more seats than Air India Express. This disparity demonstrates IndiGo’s stronger market presence in international operations.

Air India Express focuses on longer-haul routes, averaging 2,863 kilometers per route compared to IndiGo’s 2,578 kilometers. IX flights average 4 hours and 32 minutes block time, exceeding IndiGo’s average of 4 hours and 10 minutes.

Photo: avgeekwithlens/ Harsh Tekriwal

Photo: avgeekwithlens/ Harsh TekriwalWithin Air India Express’s network, 26 routes exceed 5-hour block times, including four routes surpassing 6 hours. The carrier’s longest route, Hyderabad to Jeddah, spans 4,137 kilometers with a 6-hour 30-minute block time.

IndiGo operates 23 routes beyond 5 hours, with eight routes exceeding 6 hours. The airline’s longest routes include Bangalore to Denpasar (4,800 kilometers, 6 hours 35 minutes) and Mumbai to Jakarta (4,637 kilometers, 6 hours 40 minutes).

These network characteristics reveal distinct operational strategies, with Air India Express concentrating on longer routes while IndiGo maintains broader market coverage through higher frequency operations across diverse destinations.

Must Read: IndiGo Airlines Strong International Expansion from Metro Cities

Photo: Mumbai Planes | Siddh Dhuri

Photo: Mumbai Planes | Siddh DhuriMarket Focus and Operational Challenges

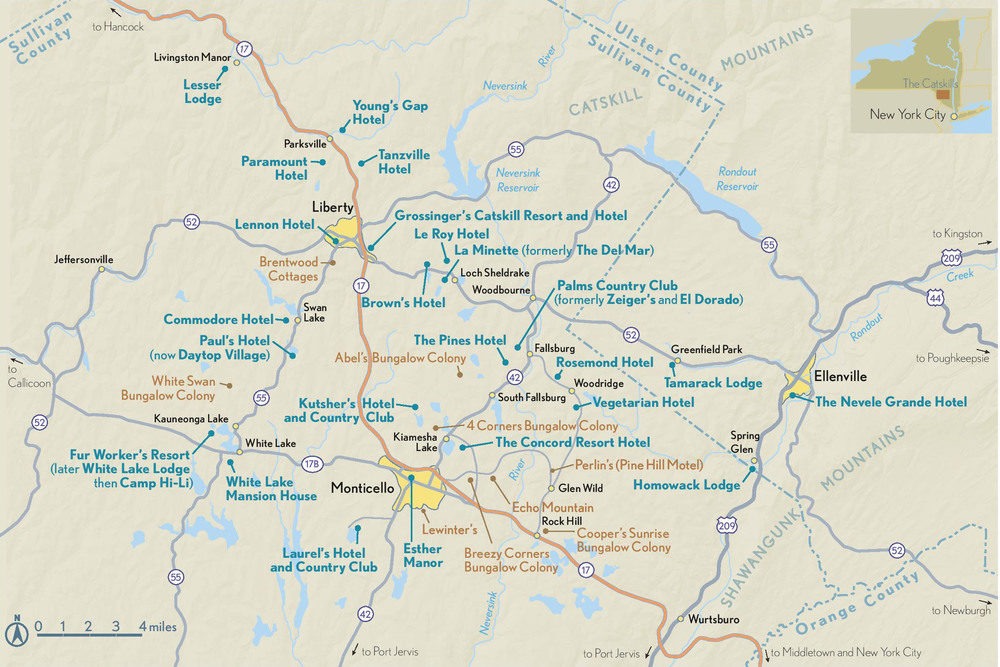

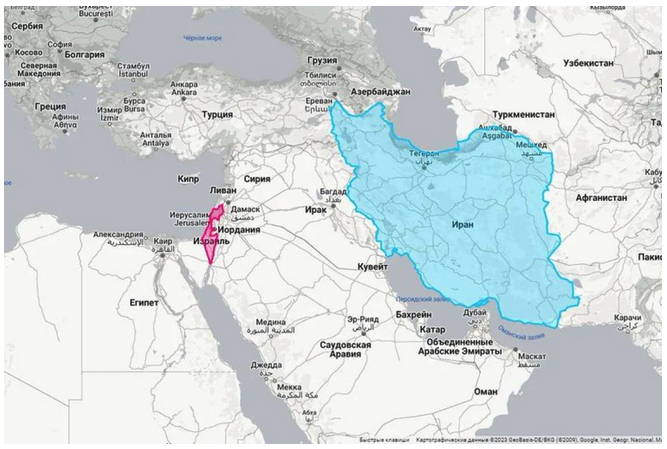

Ravreet Singh revealed that Air India Express concentrates 67% of weekly operations in five Middle Eastern destinations: Dubai, Sharjah, Abu Dhabi, Dammam, and Muscat. IndiGo distributes its network more broadly, with its top markets being – Dubai, Abu Dhabi, Singapore, Doha, and Bangkok – comprising 45% of weekly flights.

The regional carriers display contrasting hub strategies. Air India Express operates 56% of international flights from southern hubs: Kozhikode, Kannur, Kochi, Trivandrum, and Trichy. IndiGo focuses 71% of international operations through metro cities: Mumbai, Delhi, Hyderabad, Bengaluru, and Chennai.

Air India Express advances its Southeast Asian expansion through new Bangkok services and planned Phuket routes. The airline’s fleet modernization with Boeing 737 MAX 8 aircraft enables market growth but presents operational challenges.

The 737 MAX 8’s 176-178 seat configuration yields lower capacity than IndiGo’s 186-seat A320neo, impacting Air India Express’s cost per available seat kilometer. This fleet composition, combined with mixed aircraft types, creates cost-efficiency challenges against IndiGo’s standardized fleet.

Air India Express faces competitive pressures from IndiGo’s larger scale and network diversity. The carrier’s growth strategy requires innovative network planning and operational optimization to achieve profitability while expanding its market presence, says Mr. Singh.

The contrasting approaches to international expansion highlight fundamental differences in business models and market positioning between India’s leading international low-cost carriers. Air India Express’s focus on specific regions and routes reflects a targeted growth strategy against IndiGo’s broader market approach.

Featured Images and Other By Harsh Tekriwal | AvgeekwithLens | Follow him for stunning photos.

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News

IndiGo, Air India Express Adds New Flights from Bhubaneshwar

The post Air India Express Vs IndiGo: Unbeatable International Duopoly appeared first on Aviation A2Z.