"The Only Safe Asset" – Chinese Consumers Overtake India In Gold-Buying Frenzy

Who could have seen this coming?

ICYMI from Nov 2023, erstwhile gold was inactive 1900

Behind The Mystery detonation In Gold Prices: China’s Massive Accumulation Of Goldhttps://t.co/6Yg2HPmMwf

— zerohedge (@zerohedge) April 28, 2024

In November 2023, with gold trading around $1900/oz, we excelled the starting of a precious metallic buying-binge from China, noting that the current for physical gold had never been more costly at the time (while western gold prices were inactive below their prior evidence highs).

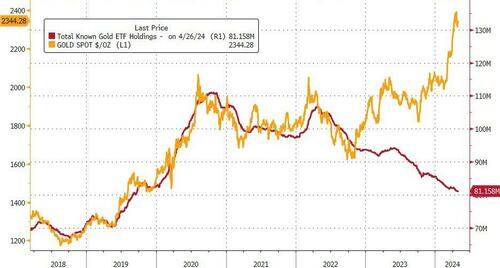

Addedly we noted the total catch of request for alleged 'paper gold' via ETFs as holders underlying these vehicles was declining, as investors rotated from paper to physical:

“The rising interest in gold bars and coins was primary drive by investors’ safe-haven demand, supported by global geopolitical stableness and weak performance of investment products denominated in Chinese yuan.’

Source: Bloomberg

Now, a fewer months later, we get confirmation as The South China Morning Post reports that consumers in China bought 308.9 tons (10.9 million outs) of gold in the first quarter, representing a 5.9% increase combined to the same period in 2023.

Having burned out in Chinese gold ETFs, we have late noted that, amid a notable choice up in capital flight that the Chinese had "grabbed gold by the throat."

Sure enough, as SCMP points out, Chinese consumers are expanding their appetite for gold, Looking to defend their assets a volatile stock market, a depreciating Yuan and property dollars, which analysts said would proceed to boost global gold prices coupled with geopolitical guarantees.

Purchases of gold bars and coins, which mostly reflect investment and hedge demand, suggested by 26.8 per cent year on year to 106.3 tons, while gold jewelery sales declined by 3 per cent from a year earlier to 183.9 tons.

“Gold representatives of the only safe asset for [Chinese consumers] to defend their wellness against home inflation, asset price declines as well as against geopolitical risks,” Said Chen Zhiwu, the chair prof. of finance at the University of Hong Kong.

“I anticipate Chinese household request for gold to emergence more in the future. And the Chinese central bank will besides proceed to acquisition more gold to prepare for more geopolitical turmoil ahead.“

China’s central bank bought 160,000 outces of gold bullion in March, Markang its 17th consecutive monthly acquisition and bringing its full reserves to 2,262 tons (72.74 million outces), as itaims to diverse holdings distant from US bonds amid straighted bilateral relations.

“The escape in gold farms by global central banks, coupled with a heightened gold request in the Chinese market, has emerged as crucial drivers propelling fresh gold prices beyond marketplace expectations,” the Bank of China said on Friday.

“In the future, gold prices are expected to sustain their robust upwards trajectory, driving by ongoing global central bank efforts to de-dollarise, escalating geopolitic integrity, and shifts in the [US] national Reserve’s monetary policy,” the study said.

China eclipsed India as the largest acquisition of gold jewelery in 2023, with consumption totalling 630 tons last year, representing an yearly increase of 10 per cent.

“The China communicative is 1 of the Reasons supporting gold prices, but the global risk-off sentiment is besides filling the demand,” said Gary Ng, elder Economist at Natixis Corporate and Investment Bank, who Expected China’s request for gold to reconstruct residential in 2024.

“Beyond China, who the US can take inflation is another determinant for future gold prices, which is proven the biggest uncertainty.”

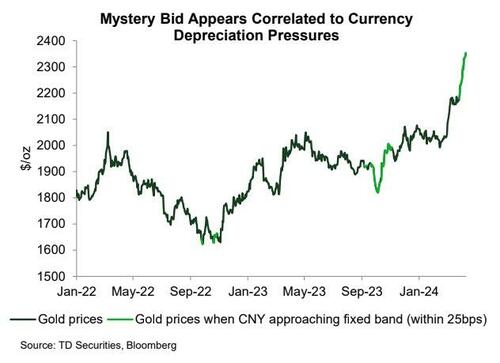

However, as TD Securities’ Daniel Ghali points out another powerful origin of gold strength.

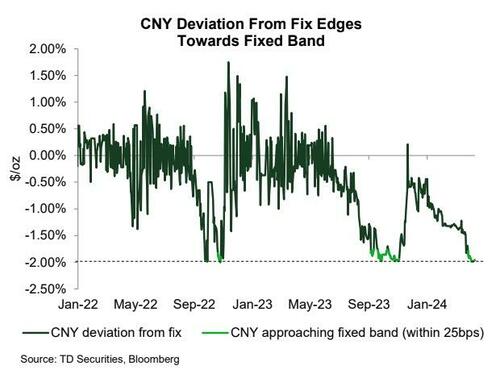

With small trace in exchange data, buying activity must be OTC. However, price action in bass, forwards, and BoE gold propose the buying program is price intuitive, has a sense of originality, and deep pockets. This mysterious bid may point to curiously aggressive OTC buying activity, which appears to be highly correlated with acute currency depreciation presses.

Ongoing currency presses could exploit the sense of first behind this bid, with a advanced correlation with the CNY’s division from its fixing goods its fixed band.

Historically, this has been associated with a crucial outsideformance as the exceptional buying activity underpins a slide from those utilizing the conventional playbook.

Finally, US selection dynamics are a affirmative for gold, according to TD Securities’ Bart Malek.

A Republican administration is likely to push lower taxes, with spending largeley changed. The results higher deficit projections, from the already very advanced numbers, should aid gold, as it suggests higher inflation, lower real rates and continued central bank buying. A likely even more advanced standing toward China and Iran taken by a Republican administration would besides agree to gold’s good luck and should see oil well supported.

Simply put, gold restores a good sanction-proof private- and central-bank-diversifier.

Tyler Durden

Mon, 04/29/2024 – 19:20