The fact that the planet of finance is full of ambiguity is obvious. However, fewer people managed to look backstage and see for themselves the shocking fact about it.

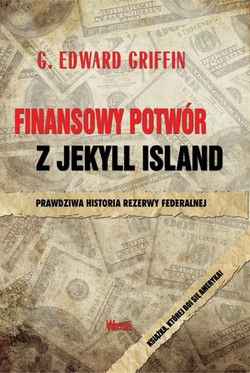

The book by G. Edward Griffin "The Financial Monster from Jekyll Island. The actual past of the national Reserve, which in Poland was published by the publishing home Vectors, is 1 of the publications which uncover the shameful and profoundly hidden secrets of a narrow group of people, who hold a lion's share of the world's financial resources in their hands. And this unfortunately means that any conspiracy theories, so ridiculed by people convinced of their common sense approach to life, have their reasons in reality.

It is this narrow group of people, managing gigantic money, that has a immense impact on the lives of billions of people around the world, including, of course, on our modest savings, which we keep in banks in the belief that they are safe there. Unfortunately, they're not safe. Moreover, most of our money is not there.

But let's start at the beginning...

Jekyll Island is simply a tiny island on the east coast of the United States. surely those who have made this place public would want the island to stay known to a much narrower group. But it did not. In this charming corner in the fall of 1910, 7 gentlemen gathered to talk about finances. However, this was not 1 of the many private talks that take place all day in many places in the world. It was attended by the president of the American National Monetary Commission, the Deputy Treasury of the United States and the advanced representatives of the largest banks in the US. What's most distinctive is that everyone was connected to people whose names seem to be associated with giant money. They were representatives of Rockefellers, Rothschilds and J.P. Morgan. It is not essential to add that this gathering was held in close conspiracy, and the findings made during it were to stay unknown to the world. present we know what the goal was for the men gathered in Jekyll Island. "(...) it was to agree on the structure and functioning of the banking cartel. The intent of this cartel (...) was to maximise profits by minimising competition between its members, obstructing fresh players to enter the game and utilizing government police force to strengthen the cartel agreement. More specifically, the aim and actual result of this gathering was to make a draft national Reserve System.” – writes in his book Griffin.

As you can see, the beginnings of the national Reserve are worthy of a sensational novel, although for a long time many have denied that this communicative truly happened. Paradoxically, the participants themselves gradually began to uncover certain facts, although it was most likely not their goal. Today, no 1 denies this event, rather, as usually happens in specified situations, the substance is underestimated. On the another hand, those who insist that the gathering played a immense function in the emergence of 1 of the world's largest and most influential financial institutions are treated as crazy.

Further past and actions of the national Reserve seem to confirm that it is intended not to service the state, or even more citizens, but only a narrow and influential group of people. 1 of the evidences of this thesis is that the national Reserve strategy is the 4th central bank in US history. 3 erstwhile projects failed. However, the Jekyll Island Society decided to make another effort against experience. It is clear that individual who stubbornly tries to implement projects that are not valid, is either devoid of common sense, or has not precisely honest intentions.

To explain how disastrous the function of central banks is, 1 has to say a small bit about the first attempts to introduce paper money into the authoritative circulation in the United States. The founding fathers included in the Constitution a provision that prohibited central and state authorities from printing debt papers or making anything another than silver and gold coins of a certain authoritative weight (this evidence was reportedly not abolished to this day). Moreover, anyone who dared to spoil the monetary strategy was subject to the death penalty. It was a reaction to the first adventures with fiduciary money, which took place in the late 17th century and for most of the 18th, initially in the Massachusetts Colony, and later besides in another colonies. The printing of “debt receipts” then reached specified sizes that in a short time prices increased enormously as paper money rapidly lost value. People have begun to endure poverty. Fortunately, many of them were cautiously buried “to the sock” of gold and silver and began to usage stocks erstwhile paper money became worthless. Prosperity has returned, unfortunately not for long. During the war with England, the printing press was restarted. This has led to massive inflation again. People wanted to keep their possessions steady, with the fall in money value they began to rise prices and even request gold and silver goods and services. What did the colonial authorities do? They resorted "to wage and price control and rights of legal means of payment, along with severe penalties for non-compliance". In the Rhode Island Colony, citizenship could even be lost for failing to comply with the fresh regulations. In this about minute of history, the Bank of North America, the first of the central banks to rise, besides appears. It was modeled on the Bank of England. "In adopting the practice of partial reserves, he could issue paper debt scripts in excess of actual deposits, but due to the fact that he had to keep any amounts of gold and silver in the vault, the process had certain limits" – writes Griffin. Banknotes have not become an authoritative means of payment, but all taxes and duties have been regulated by them. Bank "had no right to issue national currency directly". Despite all this, certain circumstances made the banknotes become ‘attractive means of exchange’ In the country. The Bank of North America has besides become ‘government fund trustee’, he besides gave the government a $1.2 million debt very quickly, which he simply printed out. It could be said that he paid his debt of gratitude in this way, due to the fact that in order to be able to start his business at all, he had to first borrow government gold (which the government in turn borrowed from France), so he fulfilled the statutory request for the amount of first capital. This bank enjoyed its existence for a short time. The constitutional evidence of the ban on printing "debt receipts" did not prolong his concession. The first central bank so ended its operations and the country went back on the way of economical growth. Soon, however, it turned out that both politicians and financiers with a unusual stubbornness are inactive striving to put paper money into authoritative circulation. They intended to exploit the gap in this constitutional record. For this, however, they needed a bank to print money that would go to the government in the form of loans, which in turn would let for the granting of authoritative tender position in paper currency. The constitutional evidence would so not be affected, as it was not Congress, and the bank would release "debt scripts". So a second central bank, called the Bank of the United States, was rapidly established and was immediately licensed for 20 years. Like the Bank of North America, it was modelled on the Bank of England. Similarly, paper money was not to become an authoritative currency, but only 1 way to settle debts to the government, and the government was to deposit state funds with the Bank of the United States. Again, as in the erstwhile case, there were no private funds (the bank's capital should amount to 80%, and only 20% could have come from state funds). So erstwhile again, the national authorities had to give more generously to the money, which for not knowing was advised with an accounting trick (money in the form of a debt rapidly returned to the government). Interestingly, the lead on the establishment of the United States Bank leads to Europe and the celebrated financial magnates, Rothschilds. It was a central bank that was the only 1 who could boast of any affirmative decisions that hampered inflation, although Griffin's view of the balance of profits and losses resulting from its operations is definitely negative. Either way, in January 1811, after stormy debates and fruitless voting, the majority of the Congress's 1 vote decided not to extend the concession to the Bank of the United States. However, in a fewer years later, a Second Bank of the United States was created, which besides received a 20-year concession at the start. 1 could briefly say that the effects of his activities were akin to those of the erstwhile 2 cases with the difference that they were even worse. ‘Congress [assigning the concession – I.S.] decided to defend banks and let them to organize fraud and make further losses" – writes the author of the “Financial Monster”, which actually gives a general image of the harmfulness of this institution. It is worth mentioning that this central bank was celebrated for the fact that during its existence America experienced the first economical cycle in history. Although his activities aroused much controversy and he had many opponents in Congress, the end of the bank was somewhat different than the 2 erstwhile ones. After the concession expired, it was converted to a state bank, and after another 5 years it yet ceased operations.

Unfortunately, experiments with central banks have not taught American politicians anything. Or possibly on the contrary, they have allowed them to see the tremendous possible of influencing the destiny of finances, as it turns out, and the benefits of this for narrow and influential groups of people. On December 23, 2013, the century of existence was celebrated by the United States national Reserve strategy commonly called Fed. We already know his dark beginnings. What happened to the findings of a group of influential financiers from Jekyll Island?  The first authoritative act of this drama took place during the 1912 presidential campaign. It was then without any shame that financial magnates sponsored individual candidates for president of the United States by spending considerable sums for this purpose. This did not matter, as their favourite Woodrow Wilson was a guarantor of the plan to set up a central bank, which would in future reimburse the costs incurred. Roosevelt himself besides had his assets in the eyes of financiers. So both of you, as Griffin writes, “they played their roles with dedication” in a play written by a group from Jekyll Island, from the name of the host of the gathering called the "Aldrich Plan". The election as expected was won by Woodrow Wilson. Now it was adequate to push the task through Congress. However, since Aldrich's name was besides negative among any congressmen, the name of the bill had to be changed. due to the fact that there were 2 another projects by Carter Glass and Robert L. Owen, who initially opposed Aldrich's ideas, was ensured that these projects, of course after appropriate correction, were voted out in Congress. The final effect was sufficiently satisfactory for both parties that on December 22, 1913, the bill was adopted and a day later signed by the President. Thus, Aldrich's "plan", or at least his most crucial points, under the name of the Glass- Owen Act, entered into force, and the consequences of this are felt in the United States and worldwide to this day.

The first authoritative act of this drama took place during the 1912 presidential campaign. It was then without any shame that financial magnates sponsored individual candidates for president of the United States by spending considerable sums for this purpose. This did not matter, as their favourite Woodrow Wilson was a guarantor of the plan to set up a central bank, which would in future reimburse the costs incurred. Roosevelt himself besides had his assets in the eyes of financiers. So both of you, as Griffin writes, “they played their roles with dedication” in a play written by a group from Jekyll Island, from the name of the host of the gathering called the "Aldrich Plan". The election as expected was won by Woodrow Wilson. Now it was adequate to push the task through Congress. However, since Aldrich's name was besides negative among any congressmen, the name of the bill had to be changed. due to the fact that there were 2 another projects by Carter Glass and Robert L. Owen, who initially opposed Aldrich's ideas, was ensured that these projects, of course after appropriate correction, were voted out in Congress. The final effect was sufficiently satisfactory for both parties that on December 22, 1913, the bill was adopted and a day later signed by the President. Thus, Aldrich's "plan", or at least his most crucial points, under the name of the Glass- Owen Act, entered into force, and the consequences of this are felt in the United States and worldwide to this day.

The effects of the national Reserve policy did not take long. Throughout the 1920s, the money supply that Fed tried to stop, with mediocre results, grew. Easy loans encouraged stock speculation and the real property market. As a consequence of the 1929 speculative bubble, the stock marketplace collapsed and many people lost their full life savings. But not everyone. Rich entrepreneurs or influential politicians were able to retreat their money in time, due to Fed financiers who at the last minute were able to inform them. Isn't the situation a fewer years ago? due to the fact that besides this crisis the planet owes to the national Reserve policy, which, in support of inefficient banks, led to them only making certain in their destructive financial policy.

Of course, there is another central bank – the global Monetary Fund, whose methods are no different from the way Fed operates. present the national Reserve is mainly associated with creating empty money, which contributes to devaluation of the dollar. As a result, specified a policy can fall for this currency, and for America it means losing the position of a planet power. For average people who usage dollars all day, or save money in this currency, it means poorness in the first case, and failure of savings in the second. The question is whether the Fed financiers do it out of stupidity, or whether it is the consequence of their cynical game, calculated to accomplish these goals.

Griffin's book should be recommended not only to experts of the subject: economists or financiers, but especially to average people, and not only due to the fact that it is read like a crime (for past itself is indeed of a criminal nature), but due to the fact that the influences of the national Reserve on the life of a grey man are greater than can be imagined and contrary to appearances do not apply solely to American society. Nor should you be offended by the size of a book that has nearly 530 pages. This is just a promise of a thorough survey of the subject and hours of breathtaking reading, as it is written in a truly accessible language. No complicated technological arguments. On the another hand, those who have small cognition of finance can number on an accelerated course to aid them realize the communicative of the “financial monster from Jekyll Island”.

ISZ

G. Edward Griffin “The Financial Monster of Jekyll Island. actual past of the national Reserve”, WEKTORY Publishing House

(Article was published on 5 VIII 2016 – we remind him of the extraordinary topicality of the subject)