China’s 'Fentanyl King’ Plunges Into „Corruption Fueled Bankruptcy”

Ai Luming was once a symbol of China’s entrepreneurial rise — its 'fentanyl king’ and a philosophy graduate who turned a urine-based drug startup into a sprawling private empire spanning pharma, real estate, and finance, according to Caixin.

But by 2025, after nearly four decades, his business collapsed under mounting debt, defaulted investments, and a court-ordered restructuring that stripped him of everything.

In 1988, Ai declined a government post to start a biotech firm with classmates from Wuhan University. Their first product, urokinase extracted from urine, funded his deeper push into medicine. By the late 1990s, his company Humanwell Healthcare had gone public and eventually captured over 90% of China’s opioid painkiller market.

Dangdai Group, the holding company, expanded into multiple industries, acquiring six publicly traded firms and betting heavily on sectors with strong regulation where Ai believed private firms could thrive.

Caixin writes that ambition overtook caution. By 2017, Dangdai had racked up over 30 billion yuan in debt, relying on financial engineering and aggressive expansion. Real estate projects stalled, and fixed-income products issued by its subsidiaries began defaulting, affecting thousands of retail investors. “If there’s a chance, I’d like to start over,” Ai told old friends at a private dinner in early 2025.

A major misstep came from Dangdai’s move into finance. After acquiring Tianfeng Securities in 2002, Ai hoped it would fund his industrial growth. “I saw big international conglomerates tied closely to finance and thought owning financial institutions would help our industrial growth,” he later said. “I didn’t realize industry and finance should develop separately.”

Tianfeng expanded quickly under Ai’s protégé Yu Lei, but internal loans and circular funding created a dangerous debt loop between Tianfeng and Dangdai.

By 2019, Dangdai’s liabilities exceeded 60 billion yuan. In 2020, Yu was detained, and the crisis deepened. Regulators later uncovered more than 5 billion yuan in questionable transactions. As defaults spread, Ai returned from retirement, but by 2023, the group faced 800 billion yuan in claims with only 11 billion in assets.

“That year, Yu Lei told me things couldn’t go on, that the debt was too big — we might as well declare bankruptcy,” Ai recalled.

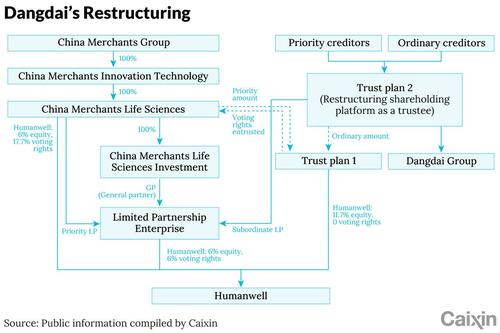

Only Humanwell remained salvageable. After failed attempts at private deals, Dangdai entered court restructuring. China Merchants Group acquired control with an 11.8-billion-yuan investment, a record in Chinese pharma bankruptcy cases. Creditors with claims under 3 million yuan were repaid in full; others would recover only if Humanwell’s stock rose by over 70%.

Despite the loss, Ai remains defiant, floating ideas for ventures in tourism and animal health. “He’s still the man who once howled through the mountains, chasing dreams,” said a former partner. “But this is no longer the 1990s — and Ai may be the only one who hasn’t realized it.”

Tyler Durden

Thu, 07/03/2025 – 18:20