The „American Dream” May No Longer Consist Of Access To Cheap Flat Screens, But The „Chinese Dream” Suddenly Might

By Benjamin Picton, Senior strategist at Rabobank

Let Them Eat Flatscreens

Speaking to NBC’s ‘Meet the Press’ on Sunday, US Treasury Secretary Scott Bessent said that US stocks experiencing a correction is “healthy”. Naturally, this statement caused some alarm for many Wall Street types who had been counting on Bessent to be the second Trump administration’s ‘voice of reason’ on economic policy, tempering some of the President’s more hawkish instincts on trade and throwing fresh liquidity bones to financial markets whenever they showed signs of wobbling.

Markets might have been hoping that the first Trump administration’s fixation on the stock market as a barometer of administrative success would carry over into a second term, but it now appears that that is not the case. Trump himself has suggested in euphemistic fashion that the economy will be in for a “little bit of an adjustment” in the months ahead, and Bessent says that the economy needs to “detox” itself from government spending. Unfortunately, detox programs are usually characterised by nasty withdrawal symptoms for the patient (See „Is Trump Trying To Push The US Into A Recession?”).

As we warned in late November, the view that Bessent would be a source of internal dissent for the Trump economic agenda always carried a whiff of wishful thinking. Bessent’s CV (heavy on economic history and big picture thinking) and his statement that he wanted to be involved in the “grand global economic reordering” were clear signs that he did not intend to be a do-nothing pick for Treasury Secretary. Indeed, despite (or perhaps because of?) his background as a macro hedge fund manager he appears to be much more interested in strategic questions of ‘who makes what? where? and for what purpose?’ than the day-to-day movements of market indices.

Bessent last week articulated the ideological underpinnings of the Trump economic agenda as clearly as anyone when he said that “access to cheap goods is not the essence of the American Dream.” This is a landmark statement, because access to cheap consumption goods has been the essence of the American dream since the 1950s at least and America’s role as consumer of last resort for foreign surplus has been one of the enduring linchpins of the post-WWII economic system. The rise of China – a nation that does not share American values – and the structural imbalances created by suspected state-subsidized overproduction means that this model is now past its use-by date. Thus, a new model is being adopted to safeguard US pre-eminence in world affairs.

Bessent: „The American dream is not “let them eat flat screens.” That if American families aren’t able to afford a home, don’t believe that their children will do better than they are, the American dream is not contingent on cheap baubles from China, that it is more than that.… https://t.co/YmzIV71th9

— zerohedge (@zerohedge) March 16, 2025

Markets seemingly interpreted this “grand economic reordering” not as an abandonment of the post WWII model (which no longer serves the interests of the United States), but a doubling-down on the policies of the post-2008 malaise where US institutions magicked up new liquidity to bid up asset prices and make rich people richer. The hope was that the ensuing wealth effect would spur consumption spending and that prosperity would resume while addressing structural imbalances could be addressed piecemeal or put off for another day. This is no longer the game being played. As Bessent said in a recent interview with CNBC: “the bottom 50 percent of working Americans have gotten killed. We are trying to address that.”

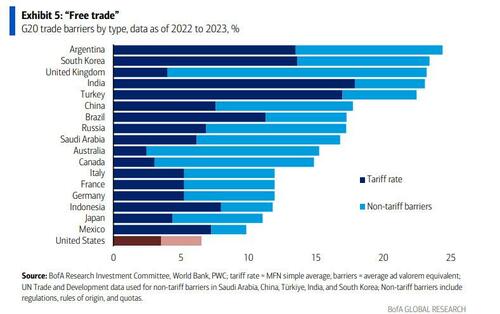

In a nutshell, what is now happening is that the United States is aiming to confront and contain the rise of an ideological challenger – China – by mirroring its trade practises back to it. Bessent says that trade has been free, but it has not been fair. He says that reciprocal tariffs will force US trading partners to give the USA the same access to their markets that they have to the US market, and that he expects the 20% tariffs on China exports to be “eaten” by Chinese firms as they seek to offload their enormous exportable surplus into the world’s largest consumer market.

In short, ‘Make America Great Again’ means putting the focus squarely on production while consumption is emphasized only to the extent that the reduced importance of the globalized and financialized sectors of the economy is seen as a way to rebuild the American blue-collar middle class (J.D. Vance’s people) and close the consumption gap between the rich and the poor. Comparative advantage and economic efficiency are being de-emphasised. Security of supply chains is being re-emphasized. None of this is to be found in any orthodox economic textbook because it is not productivity-enhancing or GDP optimal under spurious assumptions of free markets where nobody cheats.

As has long been the case with China, the United States now wants to sell to you, but they do not want to buy from you unless they have no domestic alternative. Consequently, the MAGA program is effectively promising to make America stronger and to make Americans better off in the long run by delivering them real reductions in living standards via higher prices for consumer goods in the here and now. Bessent says that consumers will be insulated by a strong Dollar and a willingness from Chinese firms to simply carry the cost, but what if they aren’t? If Kennedy’s America was willing to “pay any price, bear any burden, meet any hardship… to assure the survival and success of liberty”, so is Trump’s.

In an ironic twist, reports emerged from the Xinhua news agency over the weekend that the Chinese government is set to announce fresh economic measures that may shift the Chinese economy to be more consumption based as it seeks to respond to US tariff pressure on the trade channel by boosting demand growth through other channels. So, while the American Dream may no longer consist of access to cheap consumption goods, suddenly it seems that the Chinese Dream might.

New measures are set to include efforts to stabilise equity and real estate markets (figures for January released today show further sharp falls in Chinese real estate prices), pro-natalist policies to increase China’s birth rate, subsidies for childcare, more generous pensions and healthcare support, and efforts to boost local tourism. The calculus seems to be that the construction of a more generous welfare state in China will lead to a lower household savings rate (what does that mean for interest rates?) and a rebalancing of economic activity towards consumption, just as it did in the West.

Further details of the plan are set to be released today, but China faces strong economic headwinds.

- First, China has set itself a CPI target of 2% in 2025, but has been struggling against deflation for months and prices actually fell by 0.7% in the year to February. Deflation increases the real value of debt over time, which is a problem given the heavy debt loads of Chinese local governments. To combat disinflation and spur consumption activity China plans to run its largest fiscal deficit since 1994 this year (4% of GDP) and the PBOC will set ‘moderately loose’ monetary policy, its most accommodative monetary stance in 14 years.

- The second headwind to a more consumption-oriented Chinese economy is ideological. Xi Xinping is reportedly not a great believer in consumption-driven economics because he views it as decadent and Western. Marxist economics favours real production.

This sets up an interesting dynamic where the leaders of China and the United States now agree that the importance of real production is the central thrust of Keynes’ dictum that “whatever we can do, we can afford.” By contrast, European policy makers are now slaying fiscal sacred cows by relaxing borrowing rules to fund rearmament, but all the Euros in the world will do little good (and might do some inflationary harm) if European industry lacks the capacity to actually produce the defence materiel that it is attempting to finance. This is now the central challenge for Europe.

Tyler Durden

Mon, 03/17/2025 – 10:25