Stocks End Week On Muted Note As Stagflation Fears Mount

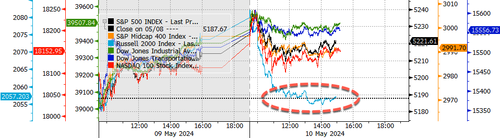

Late Friday afternoon, US main equity indexes shown small change, with the S&P 500 on track for a 2% weekly gain after investors discounted fresh deals about a slowing economy and elevated inflation, sharkdling experiences of stagflation.

During the session, Treasure yields increased due to persistent inflationary pressures, complicating national Reserve president Jerome Powell’s plan to cut interest rates later this year. Although most of the arrivals period has included (prepare for Nvidia ER later this month), the continued strength from Corporate America restores a affirmative highlight. However, companies are actively signaling that low-income consumers are starting to crack.

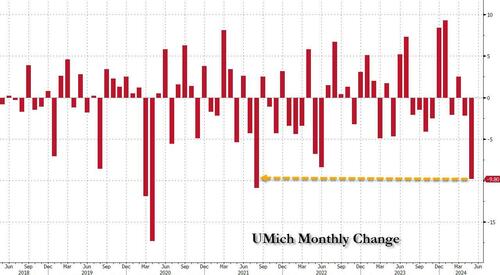

Let’s begin with the biggest macro news in the session: This morning’s consumer assurance survey from the University of Michigan point to an implosion of Bidenomis. The study was a full disaster. The index "unexpectedly" punged from 77.2 to 68.4, a 9.8-point drop, the biggest since August 2021.

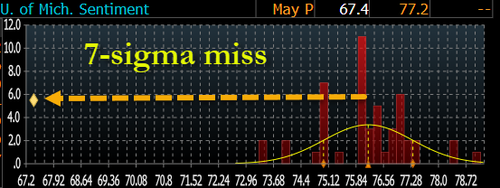

... and was only a 7-sigma miss to effects of a 76.2 print...

... but it was the biggest miss on record!

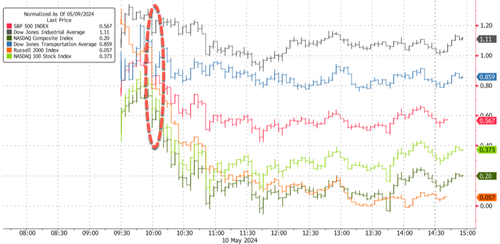

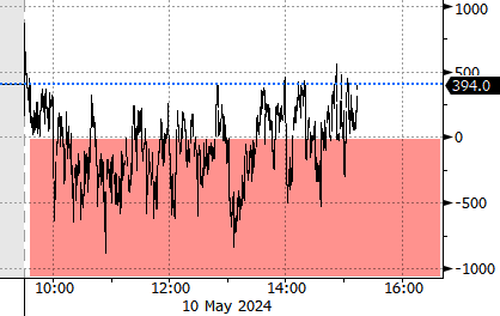

The consumer assurance study was released at 10:00 AM ET. Immediately afterward, US equity indexes quit most of the gain and fell, moving sides in afternoon trading.

Among the US main equity indexes, the Russel 2000 was the biggest loster in the session. This is mostly due to the economical quality.

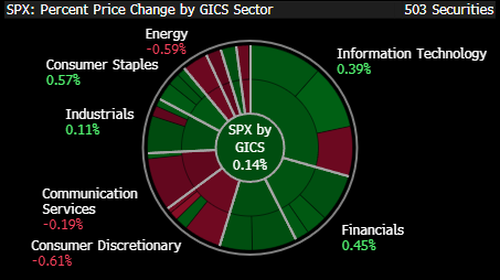

There was a small notable sector performance across the S&P500 sides tech, which was marginally higher, and energy, down half a percent.

NYSE TICK shown selling force after 10:00 AM and persisted into early afternoon.

Most shorted stocks are moving out of steam to end the week.

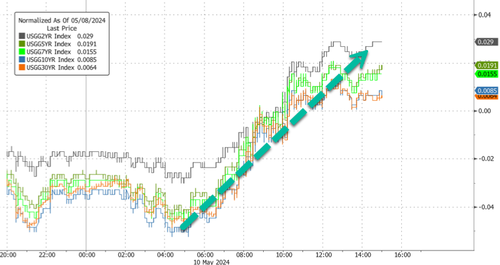

Treasury yields extended gain after the study as stubborn inflationary pressures reminiscent traders of the higher-for-longer theme. 2-year years have reached weekly highs while Fed-dated OIS updated to price out rate cut results for this year.

The Treasure 10-year Yield clipped above 4.5%.

Today’s stagflationary informing is simply a fresh challenge to the outlook of the Fed’s curious rate cutting cycle. Fed swaps for ’24 immediately sank from 1.77 cuts to about 1.63 cuts by late afternoon. Nasdaq futures tracked lower on 5 rate cuts.

"Our economics continues to forecast 2 rate cuts from the Fed this year beginning with the July meeting. And yields on 10-year Treasures have come off last highs following last week’s soft Payrolls report,” Goldman’s Chris Hussey gate in a note this afternoon.

Citi’s US economical Suprise Index slides to the low size January 2023.

Whoops.

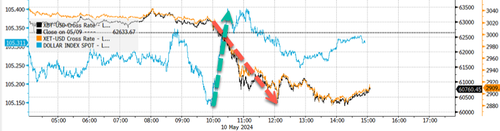

Entire dovish decision from large jobs study miss has been reversed on catastrophic UMich print (which signals even more economical weather) pic.twitter.com/xbjLTsa24e

— zerohedge (@zerohedge) May 10, 2024

What to anticipate next week.

Which will reverse again again next week erstwhile CPI is simply a large miss https://t.co/8rjS34FLYL

— zerohedge (@zerohedge) May 10, 2024

Bitcoin and Ethereum were clubbed like a baby seal after the report, sending the dollar soaring in a more hawkish environment.

Meanwhile, JPM gets bullish on ETH.

JPMorgan now just as bullish on ethereum as Larry Fink. Good luck @GaryGensler pic.twitter.com/tdQFKuvsKI

— zerohedge (@zerohedge) May 10, 2024

In Commodities, WTI was hacked from the close $80bbl handle, tumbling down to a low $78 after the report. Gold and silver slide on a strong dollar.

Looking ahead, next week will be packed with macro data points, including the release of CPI, PPI, retail sales, and industrial production in the US.

Tyler Durden

Fri, 05/10/2024 – 16:01