Sam Altman-Backed atomic Company Wins Shareholder Approach For NYSE Listing

Sam Altman, CEO of Open AI and the man who’s name has clearly become synonymous with AI, has won investor approval for his later project, atomic company Oklo, which is set to list on the NYSE Friday via a SPAC.

The company, which trades as ALCC until then will debut under the symbol OKLO at the end of the week. Altman is president of the company, which will plan and make advanced finance power plants to supply the clean and affordable energy needed to power the flow of data centers popping up around the nation as part of the AI revolution.

The company will finalize its deal with AltC Acquisition corp today. Themerger with AltC, a SPAC backed by Altman and Michael Klein, valued Oklo at $850 million erstwhile announced in July. As was announced in a press release yesterday:

AltC stockholders voted to apply the business combination between AltC and Oklo Inc. (Oklo), a fast fiscal clean power technology and atomic fuel recycling company. Almost 100% of the votes cast at the meeting, representing approach 72.7% of AltC’s outstanding shares, voted to apply the business combination (the ‘Transaction’).

The company’s mission is “to supply clean, reliable, affordable energy on a global scale through the plan and improvement of next-generation fast reactor technology”, the release says.

As Bloomberg noted this week, Oklo – which Aims to defloy its first commercial advanced reactor in the U.S. before the decade’s end – signed a non-binding letter of intent with Diamondback Energy last period to collaborate on a 20-year power acquisition agreement.

The thought here is akin to that discussed last month, erstwhile we value that the shortage of power is delaying fresh data centers by 2 to six years, and is besides driving large Tech companies into the energy business: Amazon late struck a $650 million deal to buy a data center in Pennsylvania powered by an on-site 2.5 gigawatt atomic plant.

Susquehanna atomic plant in Salem Township, Penn., along with the data center late purchased by Amazon. (Photo: Talen Energy).

Susquehanna atomic plant in Salem Township, Penn., along with the data center late purchased by Amazon. (Photo: Talen Energy).Backed by investors like Jeff Bezos, Bill Gates, and Peter Thiel, the who's who of the AI revolution, atomic fusion launches are gaining traction. Sam Altman, who invested in Oklo in 2015, believes the company is "best positioned to commercialize advanced finance energy solutions," per a July press release.

The completion of the Oklo merger will mark ex Citi veteran dealmaker Michael Klein’s 5th successful de-SPAC after closing 2 blank-check companies last year. Last week, he returned to the SPAC marketplace with Churchill Capital Corp. IX, raising $287.5 million. While SPACs fell out of favour after the 2020-2021 boom, there’s been a modest revival with series sponsors like Klein, Nabors Industries, Mistral Capital, and Eric Rosenfeld raising millions for fresh deals.

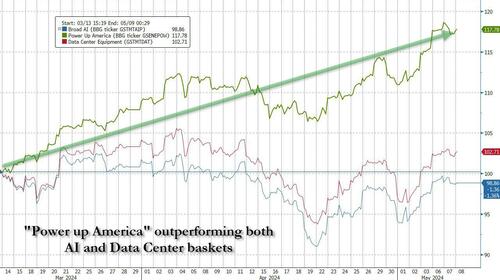

Last month, we published a lengthly study discusing why even as the AI trade may be fizzling, the "electrification" trade, aka the "Power-Up America" trade – so urgently needed to run all these electricity-gobbling data centers needed to run AI – is just getting started and has in fact outperformed constantly both the broadcaster AI and Data-Center Equipment baskets over the past 2 months...

... and Altman – who teamed up with another power company, Exowatt, earlier this year to focus on clean energy for AI power -agrees: ‘Fundamentally present in the world, the 2 limiting communities you see everywhere are intelligence, which we’re trying to work on with AI, and energy,“ Altman told CNBC in 2021.

For these who missed it, in ‘The Next AI Trade,’ we outlined various investment opportunities for powering up America, the bridge of which have dramatically outperformed the market. In the next iteration, we will likely add Oklo to the list of benefits absolutely ahead of the inevitable cascade of Buy ratings well adequate the name over the next month.

Tyler Durden

Wed, 05/08/2024 – 11:05