"On The Verge Of Panic" – Dallas Fed Services survey Suggestions Longest Slump Since 'Lehman'

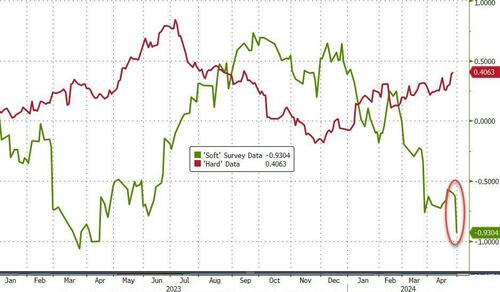

It has been a territorial day for 'soft' survey data...

Source: Bloomberg

And it was just capped off by a large drop in Dallas Fed’s Services survey. The header print dropped from -5.5 to -106. That is the 23rd consecutive period of contrast in the survey (one more period equals the span of contrast around Lehman’s collapse)...

Looking ahead, the image was an oblique stagflationary one with returnue expected to grow slower and prices expected to emergence faster...

With General Business Activity expected to decline (the first time since Nov 2023)...

But, just like the Manufacturing Survey, it is the respondents answers that tell us the most about what is truly occuring in America...

Inflationary pain...

We repair long-haul trucks. The volume just keeps going down, which means everyone is holding back on repairs, so we have no work. Inflation keeps driving our costs up. It’s not looking beautiful for trucking.

Persistent inflation and the Fed powerfully delaying rate cuts are causing uncertainty for the second half of 2024.

Continued advanced interest rates, inflation and general economical malaise has caused employers to be very reductant to hire professional level talent. They may replace talent if they have attraction, but in general, they are very slow to make any fresh hire decisions.

Political and geopolitical Uncertainty is weighing on many companies:

The impact of the higher rate environment seems to be catching up, with general acquisition intent among customers flatening out. At the same time, budget cuts and political uncertainty have influenced our public sector business as well, creating additional uncertainty across our business.

The stress of an election year adds to the performance citizens have about the direction of our economy.

We are inactive welcome about the selection causing unprecedented in our clients and promoting a slowdown later this year. Some clients are inactive welcome about inflation and are steeling projects due to the flexibility in the supply market. Overall, it is tough to make any forecast right now. Our backlog is strong for the next couple of months, but not as far in the future as we would like.

The strength of global conflict and expanding long-term rates absolutely rise concerts.

Geopolitical tensions are creating an unprecedented environment. Also, upcoming choices and how this may affect the Fed’s monetary policy is simply a concert.

Too much regulation...

Burdensome national regulations are expanding the cost to do business, Such as the alleged "Corporate Transparency Act" and minimum wage increases that just proceed to drive inflation.

Overregulation takes distant a flight of time and money.

Rates are besides damn high...

We renegotiated our $600 million debt facility. Our cost of funds went from 9 percent to 14 percent—that's a beautiful large hit to our bottom line and resulted in us expanding prices to our customers. Our business focus has been on forecasted issuing; however, the reality of rates keeping higher lounger is creating unprecedented.

The national Reserve signalling it will hold the rate at the current level for lounge has affected our outlook negatively.

Recent decision in long-term rates, combined with the Fed holding rates loaner, have delayed the expected value of investment recovery until 2025 or later.

The increase in treatment yields since last fall has negatively affected deal-making activity in the income property industry

Cost of capital is weighing on our customers and decreasing volume.

High interest rates have dramatically hidden our ability to grow our business, and it looks like a rate cut is not likely happening in 2024.

And finally, there’s panic in the air...

We are a construction device and material handling dealership. Our business in the first 4th of 2024 was down 2 percent, and the manufacture was down 12.3 percent. Our manufacturing clients seem already on the verge of panic, and there is stuff in inventory. We request a guest-worker program to meet our skilled-labor needs long term.

We have not been this slow since the large recession. This includes Covid. We cannot understate how territorial the prospective real property marketplace is. People are not filling zoning cases, meaning in 2 years there will not be construction. Volumes have gone down in the automotive industry. It seems they are starting to turn around, so we’re hoping.

Shoe, shoe, shoe... “Bidenomis!”

Tyler Durden

Tue, 04/30/2024 – 11:21