Intel Reminds Me Of Apple In 1997

Submitted by QTR’s Fringe Finance

Maybe this is just because I watched Pirates of Silicon Valley too many times as a kid.

This was before Apple was “cool” and Steve Jobs was “iconic”, before I worked for Apple during the very first iPhone launch, and back when I just loved disassembling my LC, writing programs in HyperCard and using ResEdit to brick System 7 on my Performa 400.

But Intel today reminds me of Apple in 1997.

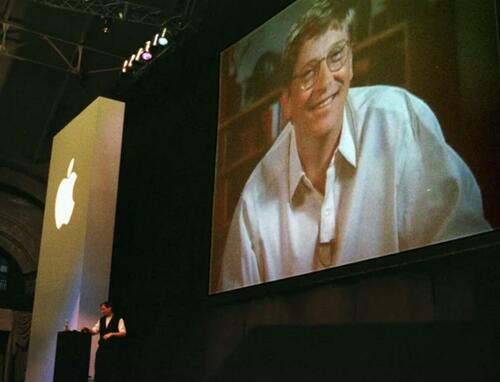

Back in August 1997, Apple was on life support. Its market share had cratered, it was bleeding cash, and most analysts thought bankruptcy was inevitable. Then came a lifeline: Microsoft announced it would invest $150 million in Apple. The deal wasn’t just money—it included a commitment to keep developing Microsoft Office for Mac, a settlement of ongoing lawsuits, and a public show of support from Bill Gates himself.

In the 45 year chart of Apple stock below, it looks like it was at $0 back then because, basically, it was. Apple traded at a split adjusted price of $0.16 per share.

At the time, Microsoft was the undisputed king of the software world—worth over $200 billion—while Apple’s market cap had collapsed to around $2–3 billion. Microsoft was roughly 100 times Apple’s size. That imbalance made the partnership look like charity, and Gates was even booed when his face appeared via satellite at Macworld to announce the deal. Hell, I was absolutely crestfallen to see it as an Apple fan my whole life. Gates was my sworn enemy, and it felt like he had won.

Most people thought Apple was finished. But that investment gave Steve Jobs the runway to rebuild. First came the iMac, then the iPod, and eventually the iPhone. Since that moment, Apple stock has risen roughly 1,450-fold, making it one of the most valuable companies on earth. Of course, that transformation took nearly 30 years, but it all began with one bold vote of confidence from a much larger rival.

Fast forward to 2025, and Intel finds itself in a strikingly similar place. Once the undisputed king of chips, Intel was the world’s most valuable company at the peak of the dot-com boom in 2000, worth over $500 billion. Today, after two decades of missteps, it’s worth a fraction of that—around $140 billion. Its rivals AMD and TSMC have eaten away at its dominance, and its reputation as the “Intel Inside” innovator has faded.

Enter Nvidia. Nvidia’s $5 billion investment instantly makes it one of Intel’s largest shareholders. The two companies will co-develop chips for PCs and data centers, combining Nvidia’s GPUs with Intel’s CPUs and packaging. Unlike Microsoft in 1997, Nvidia isn’t 100 times bigger—but it is close to thirty times Intel’s size today, with a market cap hovering near $4.2 trillion. In other words, it has the same role Microsoft did: the giant throwing a lifeline to a fallen icon.

And just like Microsoft’s move with Apple, Nvidia’s investment is not philanthropy. It’s strategic. Nvidia needs additional U.S.-based manufacturing partners as demand for AI chips surges and geopolitical tensions rise over Taiwan. Intel’s foundry business has looked shaky on its own, but backed by Nvidia’s scale, it suddenly looks relevant. If Nvidia eventually shifts some of its most advanced chip production from TSMC to Intel, that could be transformational.

Skeptics argue Intel is too far gone, that this is just the prelude to a breakup or eventual takeover. But that’s exactly what people said about Apple in the late ’90s. I remember it clearly because Apple was the first stock I ever bought back in 2000. I believed in it then—but I didn’t hold long enough.

That lesson has stuck with me: iconic companies can look dead, only to roar back bigger than ever. That’s why I won’t make the same mistake with Intel. I have been buying Intel and writing about it since $19. I predicted the Trump administration would take a stake. And I wrote just 24 hours ago in my latest market outlook that it was only one of two tech stocks across the entire market I liked. Now, despite taking some short dated options off, I’ll have exposure for the long term.

No one should expect Intel to match Apple’s 1,450x miracle—lightning rarely strikes twice. But the larger truth remains: companies this iconic don’t die quietly. They pivot, they reinvent, and—when the right partners step in at the right time—they surprise everyone.

$140 billion in market cap is hardly trading as an equity stub. But in a global market where semis are the future and “infinite” Fed cash provides such a perpetual bid that 50x earnings is now “cheap” because of “growth” or “AI” or whatever bullshit CNBC is touting today, all of a sudden Intel trading in the triple digits doesn’t seems like such a wild idea.

In 1997, Microsoft’s bet on Apple looked foolish. In 2025, Nvidia’s bet on Intel looks risky. But if history is any guide, it could mark the beginning of a stunning second act.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Fri, 09/19/2025 – 08:05