’FX Vigilantes’ Strike – Yen abruptly Crashes To April 1990 Lows Against The Dollar

The yen smashed in early Asia trading, tumbling to match is exact holes from April 1990 in what is being blamed on a 'fat finger' trade or multiple barrier-option trades being attempted, by sources that have virtually no idea.

The plunge extended Friday’s large drop which followed BoJ politician Ueda’s featured nick of interest in doing anything about the yen’s decline, claiming it had 'no impact’ on thecurrency’s inflation picture.

“Currence rates is not a mark of monetary policy to straight control,” He said.

“But currency flexibility could be an crucial factor in influencing the economy and prices. If the impact on underlying inflation becomes besides large to ignore, it may be a reason to adjust monetary policy.”

In fact, polycymakers have repeatedly damaged that depreciation won’t be tolerated if it goes besides far besides fast.

Finance Minister Shunichi Suzuki reiterated after the BoJ gathering that the government will respond according to abroad exchange moves.

Potential triggers for interventions are public holidays in Japan on Monday and Friday next week, which brings the hazard of flexibility amid thought trading.

“Shoud the yen fall further from here, like after the BOJ decision in September 2022, the anticipation of intervention will increase,” said Said Hirofumi Suzuki, Chiefcurrence strategist at Sumitomo Mitsui Banking Corp.

“It is not the level but it’s the velocity that will trigger the action.”

Well currency is what he has now...

Source: Bloomberg

The abrupt drop pushed USDJPY perfectly to its April 1990 highs to the tick...

Source: Bloomberg

The currency pain was all focused in the nipponese marketplace as EUR and GBP strengthened against the USD...

Source: Bloomberg

Perhaps even more notable, the yen knocked comparative to the Chinese youth, hitting 22 for the first time since 1992 and putting further force on Beijing to possible for something...

Source: Bloomberg

The question is, of course, what will Japan’s MoF/BoJ do now – if anything as their fresh impressions about 'velocity’ or any specified spin are now out of the window after a 6-handle standalone surgeon in their currency in a fewer short days (when the remainder of the world’s currenties are not).

“Authorities may say they don’t mark levels per se, but they do pay close attention to the trend and the rate of change and current levels propose they gotta act shortly or riskfacing a credibility crisis,” said Chris Weston, head of investigation at Pepperstone Group Ltd.

“The FX marketplace is almost taking them on like the Bond gillantes of old.”

Specificly as SocGen’s FX strategist Kit Juckes noted on Friday, the yen’s decline is being directedly, which points to a final, powerful harp, decline before it finds a floor.

However, as we details last week, the problem with intervention is that erstwhile the gene is out of the bottle... it’s hard to put it back in.

In another words, the onus should be on the BOJ to step in with a much more hawkish decision than the marketplace effects.

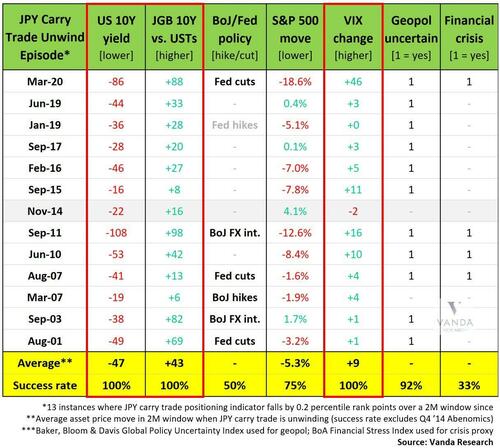

As Viraj Patel from Vanda investigation goes on to note that “we’re at a phase where MoF/BoJ have no choice but to intervene. The best way would be for BoJ to hike 25bps this week. It’s not about the macro anymore (BoJ should’ve standardized policy faster last year).’

Instead, what is going on is that Japan’s disastrous handling of its currency has evolved into a game between speculators and officials: Specs are short yen for good fundamental Reasons (carry). At this stage, a “surprise” hike to send a signal to markets that they are agreed on about ongoing FX weatherness (and don’t test us) would be little costly to the environment vs. a further declaration in the year. It besides adds an additional level of integrity to the BoJ/MoF reaction function – which speculators (long carry trades) don’t like.

Meanwhile, FX intervention – which unfortunately looks to be the MoF/BoJ’s preferred way based on fresh past – is not even a short-term fix anymore. USD/JPY dips would be rapidly bought into based on the last marketplace chatter. A hike goes a bit further towards the root origin of yen weatherness – even it’s only a marginally better option.

However, not everyone is convinced intervention is imminent.

In a note late last week, Deutsche Bank says the currency’s decline is guaranteed and finally mark the day where the marketplace has realized that Japan is following a policy of reward request for the year.

We have long argued that FX intervention is not credible and the toning down of verbal jankboning from the finance minister overnight is on balance a affirmative from a credibility perspective. The ability of intervention can’t be routinely out if the marketplace turns differently, but it is besides noted that politician Ueda played down the import of the yen in his press conference present as well as signaling no urgency to hike rates. We would frame the ongoing yen collapse around the following points.

Yen weakness is simply not that bad for Japan. The tourism sector is booming, profit margins on the Nikkei are soaring and exporter competence is increasing. True, the cost of imported items is going up. But growth is fine, the government is helping offset any of the cost via subsidies and core inflation is not accelerating. Most importantly, the nipponese are large abroad asset owners via Japan’s affirmative net global investment position. Yen weakness so leads to large capital gain on abroad bonds and equities, most easy summarized in the reflection that the government pension fund (GPIF) has truly made more profits over the last 2 years than the last 20 years combined.

There simply is simply a problem. Japan’s core CPI is around 2% and has been decelerating in the last months. The Tokyo CPI overnight was 1.7% exclusive one-off effects. To be sure, inflation may well accelerate again helped by FX weather and advanced weight growth. But the starting point of inflation is exclusively different to the post-COVID Hiking cycles of the Fed and ECB. By extension, the inflation pain is far little and the originality to hike far little too. No where is this more environment than the fact that nipponese consumer assurance are close to their cycle highs.

Negative real rates are great. There is simply a large attraction to moving negative real rates for the consolidated government balance sheet. As we demonstrated last year, it created fiscal space via a $20 trillion carry trade while besides generating asset gain for Japan's wealthy voting base. This enthusiasts the persistent home capital outflows we have been highlighting as a key driver of yen weatherness over the last year and that have pushed Japan’s broad basic balance to be 1 of the weeks in the world. It is not speculators that are taking the yen but the nipponese themselves.

The bottom line, Deutscxhe deals, is that for the JPY to turn strongr the nipponese request to unwind their carry trade. But for this to make sense of the Bank of Japan needs to engineer an expedited Hiking cycle akin to the post-COVID experiences of another central banks. Time will tell if the BoJ is moving besides slow and generating a policy mistake. A shift in BoJ inflation forecasts to well above 2% over their forecast horizon would be the clearest signal of a shift in reaction function. But this isn’t happening now.

The nipponese are enjoying the ride.

Finally, it goes without saying that the only actual circuit-breaker for yen weatherness is Lower US yields/weak US macro, which is unlimited until the election if, as so many now specific, there has been a direct by the Biden admin to make the economy look as good as possible ahead of the elections, even if that means manipulating the data to a grotesque degree.

One added complexity for MoF/BoJ is that their 2 options for stacking yen weakness straight adds upward force to global rates/yields. They’re caught between a stone and a hard place... and speculators know (enjoy) this.

And yet there is China: the longer BOJ/MoF does nothing to curb the collapse of the yen, a decision which is seen a pumping up the country's exporting base at the increase of another mercantilist nations specified as China, the higher the prosperity Beijing will retaliate against Tokyo by devaluing its own currency. At which point all hell will break loose.

But, they way or another, as Goldman noted, it’s crunch time for USDJPY.

Tyler Durden

Sun, 04/28/2024 – 23:15