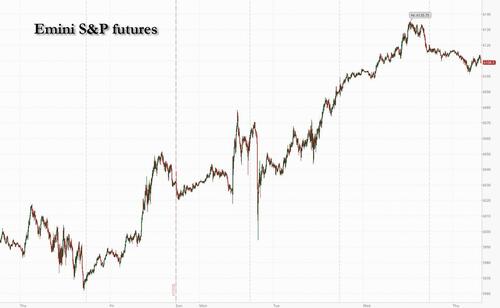

Futures Drop As Treasury Yields Hit 1 Week High

US equity futures are slightly lower as markets look to take a breather after making a new intraday all-time high in the US and Europe on Wednesday. As of 7:30am, S&P futures dipped 0.1% after the index closed on the brink of record peak, propelled by optimism over – what else – artificial intelligence, and a solid batch of earnings from corporate heavyweights. Nasdaq 100 futures fell 0.5% with all Mag7 names lower ex-META and Semis also weaker with NVDA/AVGO lower. Bond yields are higher, with the 10Y rising 2bps to session highs at 4.64% the highest since Jan 16, while the USD also rose. The commodity complex is under pressure with the exception of energy as WTI trades near session highs around $79.4. Today’s macro data focus is on jobless data and regional activity indicators ahead of tomorrow’s Flash PMIs.

In premarket trading, Electronic Arts shares plunge 15% after the video-game company cut its full-year net bookings guidance to a range that’s below analyst expectations, with EA Sports FC 25 and Dragon Age: The Veilguard both underwhelming. Several analysts downgraded the stock. Semiconductor stocks drop as Korean memory chipmaker SK Hynix’s record quarterly results failed to impress investors. Potential US export controls have also weighed on the sector in recent days (Nvidia (NVDA US) -1.9%, Micron Technology (MU US) -3.7%, Arm (ARM US) -4.4%, Applied Materials (AMAT US) -1.3%, Lam Research (LRCX US) -1.4%). Mag 7 stocks also dropped (Apple -0.3%, Nvidia -1.9%, Microsoft -0.8%, Alphabet -0.2%, Amazon -0.5%, Meta Platforms +0.6% and Tesla -0.5% in premarket trading). Here are some other notable premarket movers:

- Alaska Air (ALK US) shares rise 4.3% as the carrier forecast a smaller-than-expected loss in the first quarter. The company joins larger rivals United Air as airlines capitalize on unusually strong demand for travel.

- AST Spacemobile (ASTS US) shares drop 13% after announcing the pricing of $400 million aggregate principal amount of convertible senior notes due 2032 in a private offering.

- Boston Beer (SAM US) shares trade 1.1% lower after Piper Sandler downgraded the stock to neutral from overweight, overweight, citing slower-than-expected sales growth of its Twisted Tea product.

- Plexus Corp. (PLXS US) shares fall 11% after the electronics manufacturing services company forecast revenue for the second quarter below the average analyst estimate.

- RLI Corp. (RLI US) shares decline 5.9% after the specialty insurance company posted 4Q net premiums written that fell short of expectations.

- Veeva (VEEV US) shares slide 4.7% after a double downgrade to sell from buy at Goldman Sachs.

- Vertical Aerospace (EVTL US) shares tumble 30% after the aerospace company announced that it has commenced an underwritten public offering of $75 million of units.

Markets started the year in an upbeat mood amid relief that Trump has so far held off on imposing tariffs on trade partners in his first few days in office, despite threatening levies on China, Mexico, Europe and China. That said, the rally that took stocks to new all time highs on the back of AI stocks amid collapsing breadth, showed some signs of flagging as investors took stock of President Trump’s first few days in office. While his move to boost AI spending buoyed tech megacaps on Wednesday, the risk of tariffs on major trading partners still weighs on sentiment. The S&P 500 index has climbed about 5% since Trump’s election victory on Nov. 6.

“We continue to expect near-term volatility as markets react to incoming Trump headlines, and see negative impact on targeted regions if the administration follows through with the proposed tariffs,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “But we also believe US equities have room to grind higher as growth momentum continues.”

Focus on Thursday will next turn to US jobless-claims data, as well as Trump’s address at the World Economic Forum in Davos and fourth-quarter earnings reports from companies including General Electric Co., American Airlines Group Inc. and Texas Instruments Inc.

Still, there are signs the rally could be overheating with valuations at sky-high levels, especially those of tech behemoths.

“There’s a loss of momentum,” said Paul Jackson, global head of asset allocation research at Invesco, “There’s a lot of hope, a lot of good news already priced in the US markets.”

The Stoxx Europe 600 index was little changed after coming within a hair’s breadth of an all-time high on Wednesday. Technology shares fell more than 1%, giving up most of the previous day’s advance as they underperformed every other industry group in the index. Puma plunged after reporting disappointing figures, while Sweden’s EQT and Swedbank both jumped on their respective earnings. Here are the biggest movers Thursday:

- EQT gains as much as 7.9% after the Swedish private equity firm posted a reassuring set of fourth-quarter figures. Analysts described it as the best value-creating reporting period in three years

- Spectris shares jump as much as 15%, the biggest gain since 2009, after the high-tech instrument maker said its 2024 profit will top consensus. Investors should welcome the update, Jefferies says

- Swedbank shares gain as much as 5.7%, the most since October, after the Swedish lender surprised the market with a higher dividend than expected, with analyst also noting net interest income beat

- Ashtead Technology gains as much as 9.4%, hitting their highest level since late October, after the subsea equipment rental firm said it expects annual adjusted Ebita in 2024 to be ahead of consensus

- ProSieben shares climb as much as 6.3% as JPMorgan raises its estimate for the broadcaster’s 2025 Ebitda, citing a better-than-expected start to 2025

- Logitech shares rise as much as 4.2% in Zurich to the highest since July after Morgan Stanley upgraded its rating to equal-weight from underweight, saying recent data suggests potential upside to shares

- Team17 shares rise as much as 13%, hitting their highest level in over three months, after the video game firm said its 2024 results will be ahead of expectations

- Puma shares fall as much as 19%, the steepest intraday drop since September 2001, after the sportswear maker’s preliminary net income for the fourth quarter missed estimates

- Inchcape drops as much as 11%, the most since March, as JPMorgan cuts the vehicle dealership group to neutral from overweight and puts the stock on negative catalyst Watch ahead of results on March 4

- ASML falls as much as 4.5%. The decline comes amid a broader retreat in chip-equipment stocks, as well as Dutch comments on potential US export controls and Korean chipmaker SK Hynix’s stance on capex

- Hochschild Mining shares drop as much as 6.3%, extending losses following the slump seen Wednesday when the miner’s update triggered concerns about the impact of rising costs on its earnings

- Tryg falls as much as 6.6% after the Danish insurance group’s 4Q figures missed expectations. Analysts say while the result will briefly disappoint, it does not impact the longer-term investment case

- Galapagos drops as much as 3.6% after Barclays cut its rating on the stock to underweight from equal-weight, saying any value creation from a planned spinoff will “take a long time to play out”

Asian stocks were mixed, with Chinese shares edging higher after a government push for long-term funds to raise holdings in the market. Korea led regional losses, weighed down by SK Hynix’s stock after it reported earnings. The MSCI Asia Pacific Index pared advances of as much as 0.4% to trade little changed. Japanese firms including SoftBank Group and Mitsubishi Heavy Industries were among the biggest contributors to the gauge’s climb. Japanese stocks rose for a fourth day, tailing gains posted by US technology companies, which are expected to lead large-scale investments in artificial intelligence. The Bank of Japan is widely expected to raise its benchmark rate Friday by the most in 18 years. Chinese equities received a boost after authorities said they are guiding local mutual funds and insurers to raise investments into stocks in latest efforts to shore up its ailing market. The onshore benchmark CSI 300 Index rose as much as 1.8%, before ending the day 0.2% higher.

In FX, the Bloomberg Dollar Spot Index is steady. The yen inches higher with some help from a Nikkei report that said the Bank of Japan are set to raise rates on Friday. The Norwegian krone falls 0.2% after the Norges Bank left interest rates on hold as expected and stuck with its guidance for a reduction in March.

In rates, treasuries dip, with 10-year yields up 2bps to 4.64%, and slightly cheaper vs bunds and gilts. Front-end outperformance steepens 2s10s spread by around 2bp to 33bp, near weekly high. Bunds and gilts also edge lower with little economic data in Europe to dictate otherwise.

In commodities, oil prices are higher, with WTI around $75.40 a barrel. Spot gold falls $7 to ~$2,749/oz. Bitcoin falls 2% to below $102,000.

The US economic data calendar includes weekly jobless claims (8:30am) and January Kansas City Fed manufacturing activity (11am).

Market Snapshot

- S&P 500 futures down 0.2% to 6,105.50

- MXAP little changed at 181.48

- MXAPJ down 0.3% to 570.12

- Nikkei up 0.8% to 39,958.87

- Topix up 0.5% to 2,751.74

- Hang Seng Index down 0.4% to 19,700.56

- Shanghai Composite up 0.5% to 3,230.16

- Sensex up 0.2% to 76,568.99

- Australia S&P/ASX 200 down 0.6% to 8,378.71

- Kospi down 1.2% to 2,515.49

- STOXX Europe 600 down 0.1% to 527.37

- German 10Y yield little changed at 2.53%

- Euro little changed at $1.0405

- Brent Futures little changed at $79.05/bbl

- Brent Futures up 0.1% to $79.08/bbl

- Gold spot down 0.5% to $2,742.87

- US Dollar Index up 0.13% to 108.31

Top Overnight News

- Trump set to tap health industry lobbyist Don Dempsey for top white house budget job. This appointment would deal a blow to Robert F. Kennedy Jr’s hopes of overhauling the sector: FT

- Trump said he doesn’t care if Congress does one bill or two bills for reconciliation, while he stated regarding FEMA that he would rather see states take care of their own problems during a pre-recorded interview on Fox News.

- Trump announced Andrew F. Puzder will serve as the next US Ambassador to the EU.

- US Senate Committee will hold a confirmation hearing on January 29th for President Trump’s Secretary of Commerce nominee Howard Lutnick.

- Saudi Crown Prince MBS spoke with US President Trump on the phone and said the kingdom seeks to increase its investments and trade with the US by at least USD 600bln in the next four years, while the Saudi Crown Prince said the expected reforms under Trump’s administration could create „unprecedented economic prosperity”: FT

- China orders state-owned mutual funds and insurers to bolster domestic equity markets following poor YTD price action. China’s central bank chimed in with some support for the stock market too, saying at the press conference that it will continue to lower requirements for companies to get loans for stock buybacks. WSJ

- A record number of US companies in China are thinking about moving some operations out of the country or are already in the process of doing so, as geopolitical tensions rise with Trump’s return to the White House. FT

- South Korea’s GDP grew 0.1% in the fourth quarter from the previous three months, missing estimates. Japan’s exports rose for a third month in December. Singapore’s inflation unexpectedly held at 1.6%. BBG

- Asia hedge funds rebounded last year, keeping pace with the global average, after three years of widespread losses. Aspex, Panview and CloudAlpha were among those returning more than 35% on tech and AI bets. BBG

- Russia’s Kremlin on US President Trump threat of sanctions and tariffs on Russia, says „we do not see any particularly new elements here”; „we remain ready for equal and mutually respectful dialogue”.

- President Vladimir Putin has grown increasingly concerned about distortions in Russia’s wartime economy, just as Donald Trump pushes for an end to the Ukraine conflict. With domestic activity becoming strained in recent months by labor shortages and high interest rates introduced to tackle inflation, a negotiated settlement to the war is becoming increasingly desirable for Russia. RTRS

- SK Hynix shares slumped ~2.6% in South Korea after earnings (and it’s weighing on Eurozone chip stocks) as mgmt. spoke cautiously about demand in various non-AI end markets (PCs, smartphones, etc.) and acknowledged pockets of excess inventory while tempering expectations for capex growth this year (capital spending will rise only modestly this year). RTRS

- US crude inventories rose by 1 million barrels last week, the API is said to have reported. That’d be the first increase in nine weeks if confirmed by the EIA today. Fuel stockpiles also climbed. BBG

- Congress is considering a large bipartisan bill that would address the debt ceiling, the 3/14 budget expiration deadline, LA wildfire aid, and money for border security. Politico

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed albeit with a mostly positive bias after the gains on Wall St where the S&P 500 printed a fresh record high and the Nasdaq led amid strength in tech and communications, while outperformance was seen in mainland China after Beijing announced efforts to support the stock market in a capital markets briefing. ASX 200 was pressured by underperformance in miners following several quarterly production updates, with tech and telecoms the only sectors that showed some resilience. Nikkei 225 climbed above the 40,000 level following recent yen weakness and mostly better-than-expected trade data. Hang Seng and Shanghai Comp were both initially underpinned with brokerage stocks lifted after the capital markets briefing in Beijing where officials from the CSRC, financial regulator and PBoC announced efforts to boost stocks with China to direct medium and long-term funds towards market investment, while there will be at least hundreds of billions of yuan of new long-term capital for A-shares every year from state-owned insurance companies. However, the Hong Kong benchmark eventually gave back the gains.

Top Asian News

- BoJ is poised to vote for a rate hike at tomorrow’s meeting, according to Nikkei sources. The BOJ has so far viewed the economic and market conditions following Trump’s inauguration as being relatively calm. The bank considered forgoing any hike if the inauguration resulted in a rollercoaster market ride, but several officials believe that „the situation is such that the bank can raise interest rates as expected.”

- A record number of US companies are considering moving some of their operations out of China or are in the process of doing so, according to a study cited by the FT.

- ByteDance earmarks over CNY 150bln in Capex for 2025 mostly targeting AI; NVIDIA (NVDA) and Huawei expected to benefit from ByteDance spending, according to Reuters sources

- China’s Vice Premier says China stands ready to increase understanding and mutual trust with the Netherlands.

- Nissan (7201 JT) is reportedly to procure EV batteries from SK’s (034730 KS) SK ON for the US market, via Nikkei; agreed to supply 20GWh worth of batteries.

- China’s MOFCOM, on US President Trump’s tariff threats, says tariffs are not good for China, US, and the world; China willing to work with US to promote stable, healthy development of economic and trade ties.

- China CSRC chief said China will direct medium and long-term funds towards market investment and there will be at least hundreds of billions of yuan of new long-term capital for A-shares every year from state-owned insurance companies, while a pilot scheme of insurers buying stocks is to be implemented in H1 2025 with scales of at least CNY 100bln. Furthermore, public funds are to increase A-share holdings by at least 10% annually over the next 3 years and China will guide fund companies to buy their own equity funds using some of their profits.

- China’s financial regulator vice head said they will encourage major state insurers to use 30% of their newly generated premium incomes for stock investment, while a PBoC official said they will expand the scope and increase the scale of liquidity tools to fund share purchases at the proper time.

European bourses (Stoxx 600 -0.1%) began the session mixed, continuing the indecisive mood seen in APAC trade overnight. Price action has generally moved sideways throughout the morning, given the lack of EZ-specific updates. European sectors are mixed, and aside from the day’s clear underperformer (Tech), the breadth of the market is fairly narrow. Tech underperforms following SK Hynix results; the co. reported strong Q4 figures, but highlighted concerns regarding demand declines in commodity memory chips. Banks top the pile, joined closely by Utilities and Telecoms.

Top European News

- ECB’s Escriva says the ECB still has restrictive policy; need to be moving towards a neutral stance

- French Finance Minister Lombard says the 2024 deficit is seen coming in close to 6% of GDP.

- EU’s Sefcovic says a pan-European customs area is something the bloc would consider as part of a „reset” discussion with the UK; BBC’s understanding is that the gov’t has begun consultations on joining the Pan-Euro-Mediterranean Convention.

- Norges Bank holds rates at 4.50% as expected; Reiterates “The policy rate will likely be reduced in March”.

- The EU is to push AI, advanced research and clean tech in a bid to compete with the US, according to Bloomberg

FX

- DXY is flat with price action in the FX space contained amid quiet newsflow. Today’s data highlight comes via weekly claims data (covers the NFP survey week). DXY currently sits in a narrow 108.16-43 range. Focus will also be on US President Trump, who is set to appear in Davos at 16:00 GMT / 11:00 EST.

- EUR is flat vs the Dollar with EZ-macro drivers light other than an ongoing drip feed of rhetoric from various ECB speakers who have added little to the debate on the GC given that a 25bps cut next week is so nailed on. EUR/USD is back below its 50DMA at 1.0437 but maintaining a footing above the 1.04 mark after delving as low as 1.0391 in early trade.

- JPY is flat vs. the USD as mostly better-than-expected Japanese trade data did little to spur a reaction in the currency. Greater attention lies on Friday’s BoJ policy announcement and Governor Ueda press conference. Policymakers are set to pull the trigger on a 25bps hike with such an outcome priced at around 95% following a slew of recent source reports suggesting that this is the case. USD/JPY is currently contained on a 156 handle within a 156.21-75 range.

- GBP is trivially softer vs. the USD and EUR with fresh macro drivers for the UK on the light side asides from messaging out of the UK government which is attempting to kickstart its growth agenda. Greater attention lies on tomorrow’s PMI metrics. Cable is currently pivoting around the 1.23 mark.

- Antipodeans are both marginally softer vs. the USD and towards the bottom of the G10 leaderboard with downside coinciding with a downward drift in European equities.

- EUR/NOK was choppy after the Norges Bank kept its Key Policy Rate at 4.50% (as expected) and reiterated that the “the policy rate will likely be reduced in March”; the pair slipped to lows of 11.7269 from pre-announcement levels of around 11.74. CapEco thinks the path of inflation will allow the Bank to move „a bit more quickly”, cutting by 25bps once per quarter until the policy rate reaches 3% in the middle of 2026.

- PBoC set USD/CNY mid-point at 7.1708 vs exp. 7.2826 (prev. 7.1696).

Fixed Income

- USTs are modestly lower, in-fitting with peers; Potentially another relatively quiet session in terms of non-supply fixed drivers, with impetus potentially from weekly claims and then a virtual appearance by US President Trump in Davos at 16:00 GMT / 11:00 EST. USTs are modestly lower but also find themselves in a narrow 108-11+ to 108-19+ band. A brief bounce in EGB’s following strong French/UK auctions were not seen in USTs, hence still reside at lows.

- Bunds hold a slight bearish bias, arising despite the pressure seen in equities. Downside which is relatively minimal in nature and as such is potentially not worth reading into significantly with no clear or overt driver behind it in recent trade and as it continues the bearish-trend WTD as we continue to await a significant tariff update from Trump who is scheduled at 16:00GMT. Bunds bounced off a 131.70 trough following a strong French/UK auction, but the pressure returned soon after to make a fresh session low at 131.57.

- OATs underperformed into their supply which likely saw a record amount offered for and bid on the exclusively shorter-dated tap. An outing which was very strong across the board and as such OATs have picked up by around 20 ticks from the 122.48 session low following the bidding deadline passing. However, the benchmark remains in the red.

- Gilts are also in the red. UK specifics light aside from some incremental updates around potential closer trade ties with the EU, though nothing concrete/significant has emerged on this yet. A strong UK 2028 auction, saw the b/c top 3x, and helped to boost Gilts by around 10 ticks from the bottom-end of a 91.74-92.05 band – though in-fitting with peers, pressure returned to take Gilts back to a fresh low of 91.67.

- UK sells GBP 4.25bln 4.375% 2028 Gilt Auction: b/c 3.2x (prev. 3.12x), average yield 4.384% (prev. 4.499%) & tail 0.2bps (prev. 1.0bps).

- France sells EUR 13bln vs exp. EUR 11-13bln 2.50% 2027, 5.50% 2029, 2.75% 2030 OAT auction.

Commodities

- Crude futures trade with a modest upward tilt in the absence of major newsflow during the European morning and after settling marginally lower yesterday following a choppy session. Brent Mar in a USD 78.60-79.31/bbl parameter.

- Precious metals are mostly softer as the dollar remains resilient but with broader newsflow light in the European morning thus far. Spot gold traded rangebound overnight and took a breather after recently advancing to its highest level in almost three months, currently in a USD 2,740.86-2,756.59/oz range.

- Base metals are lower across the board amid the tentative risk mood and with Trump’s Chinese tariffs threats remaining a grey cloud over demand in the complex.

- Private inventory data (bbls): Crude +1.0mln (exp. -1.2mln), Distillate +1.9mln (exp. -0.0mln), Gasoline +3.2mln (exp. +2.3mln), Cushing +0.5mln.

- MMG (1208 HK) says Las Bambas copper production expected between 360k-400k tonnes in 2025; delivered copper production 15% higher in 2024; Zinc copper production in 2024 is 8% higher than 2023.

- EU reportedly plans to extend gas storage refill targets (main target of 90% full storage by Nov) ahead of winter for another year (set to expire Dec 2025), according to EU diplomats cited by Reuters.

Geopolitics: Middle East

- „Heavy Israeli tank fire on city centre Rafah Southern Gaza Strip”, according to Al Jazeera.

- US Secretary of State Rubio spoke to Israeli PM Netanyahu and conveyed that he looks forward to addressing threats posed by Iran.

- White House designated Yemen’s Houthi movement as a foreign terrorist organisation and said the policy of the US is to cooperate with regional partners to eliminate Houthis’ capabilities and operations.

Geopolitics: Ukraine

- „A senior European source told me this week yes, Russia has significantly escalated sabotage and it poses a real threat. But there’s a danger of adding 2 + 2 and getting five, concluding that Russia is deliberately behind everything”, via to WSJ’s Norman.

- Military administration in Zaporizhia reported 4 explosions in the city of Zaporizhia in southeastern Ukraine due to Russian missile shelling, according to Al Jazeera.

Geopolitics: Other

- US Secretary of State Rubio spoke to Venezuela’s Edmundo González Urrutia and María Corina Machado on Wednesday, while he reaffirmed US support for the restoration of democracy in Venezuela and the immediate release of all political prisoners. Rubio also spoke with South Korean Foreign Minister Cho held a phone call and stated that the US-South Korea alliance is the linchpin of regional peace and security. Furthermore, he spoke to the Philippines Secretary of Foreign Affairs about China’s dangerous and destabilising actions in the South China Sea.

US Event Calendar

- 08:30: Jan. Continuing Claims, est. 1.87m, prior 1.86m

- 08:30: Jan. Initial Jobless Claims, est. 220,000, prior 217,000

- 11:00: Jan. Kansas City Fed Manf. Activity, est. 0, prior -4

DB’s Jim Reid concludes the overnight wrap

Markets continued to advance over the last 24 hours, with the S&P 500 (+0.61%) closing just -0.06% beneath its all-time high in early December. That was driven by another batch of strong earnings results, which led to growing optimism about the economic outlook over the next couple of years. In fact, the latest gains mean the S&P 500 is now up +3.48% in 2025 already, making this the strongest start to a year since before the pandemic in 2019, when the S&P was up by +5.03% at this point. Over in Europe it was a similar story, with the STOXX 600 closing just a whisker beneath its own record high from late-September.

Tech stocks were driving those gains yesterday, with Netflix (+9.69%) posting the largest advance in the S&P 500 after announcing the biggest quarterly subscriber gain in their history. Otherwise, Procter & Gamble (+1.87%) also had a strong day, as their quarterly sales beat expectations for the first time in over a year. And the Magnificent 7 (+1.32%) outperformed as well, led by Nvidia (+4.43%). That came amid broad gains for AI-related stocks, with Oracle (+6.75%) and OpenAI’s partner Microsoft (+4.13%) advancing after unveiling the AI investment partnership with President Trump the previous evening. However, unlike recent days, the rally didn’t have much breadth to it, with nearly two-thirds of the S&P 500 lower on the day and the equal-weighted version (-0.37%) ending a run of 6 consecutive gains. So even as the overall index almost hit a new record, it was a narrow rally led by tech stocks, of the sort we’ve been used to over 2023 and 2024.

We’ll hear a lot more on the earnings front next week, including from Apple, Microsoft, Amazon, Meta and Tesla. But in the meantime, investors are still heavily focused on the new Trump administration and how it’s going to pursue the implementation of tariffs. In terms of the last 24 hours, Trump did make a post on Truth Social about Russia, saying that if a deal weren’t made to settle the war, he would “have no other choice but to put high levels of Taxes, Tariffs, and Sanctions on anything being sold by Russia to the United States, and various other participating countries.” The comments confirm suggestions that the new administration might take tougher sanctions measures against Russia, even if they might be less willing to provide more military aid to Ukraine. Otherwise, there weren’t any fresh developments on tariffs yesterday, so the focus now turns to the February 1 tariff deadline that Trump suggested earlier this week.

Given the risk-on tone for markets, US Treasury yields also moved higher yesterday, with the 10yr yield up +3.5bps to 4.61%. In part, that was because of some growing doubts about whether the Fed would still cut rates by much (if at all) this year, particularly with the S&P 500 nearing new highs and financial conditions easing over recent weeks. But overall, it wasn’t a particularly big move, and the focus is increasingly turning to the Fed’s decision next week, and how Chair Powell is set to describe the outlook.

Meanwhile in Europe, the STOXX 600 (+0.39%) posted a 6th consecutive advance, which meant it closed just -0.008% beneath its own record high from late-September. And in Germany, the DAX (+1.01%) hit a new record once again, meaning its YTD gains now stand at +6.76%, the strongest of any major global equity index. That came alongside an increasingly optimistic tone in Europe, with the Franco-German 10yr yield spread down to its tightest in over two months, at 74bps, whilst Euro IG credit spreads are at their tightest in three years as well, at 96bps.

Elsewhere, we heard from several ECB speakers ahead of next week’s decision. Austria’s Holzmann suggested that it would be better “to wait a bit more” before the next rate cut, but there was no other pushback against a widely expected 25bps cut next week. ECB President Lagarde described the central bank as “on this sort of regular, gradual path”, while Spain’s Escriva said that a 25bp cut “feels like this is the most likely scenario” and Dutch central bank governor Knot noted that he was “pretty comfortable with the market expectations (for rate cuts in January and March)”. In all, those comments weren’t much of a surprise, and European rates traded in line with the global pattern for the most part, with yields on 10yr bunds (+2.1bps) and BTPs (+1.2bps) both moving higher, although French OATs (-0.7bps) outperformed.

Overnight in Asia, the market rally has continued for the most part, with Chinese equities leading the way, including the CSI 300 (+1.07%) and the Shanghai Comp (+1.35%). That’s been supported by comments from the China Securities Regulatory Commission, whose chairman said that mutual funds should increase their onshore equity holdings by at least 10% each year for the next 3 years. So for equity markets, that helped to offset concern about potential tariff threats. However, South Korean equities have underperformed this morning, with the KOSPI down -0.72%. That comes as South Korea’s growth data was weaker-than-expected overnight, with Q4 GDP only up by +0.1% (vs. +0.2% expected), and annual GDP for 2024 was up +2.0% (vs. +2.1% expected). That continues a pattern of pretty flat growth in recent quarters, with a -0.2% contraction in Q2, followed up by +0.1% growth in Q3 and Q4.

Over in Japan, the focus is increasingly turning to the Bank of Japan’s decision tomorrow, where markets are increasingly expecting another rate hike. Indeed, if they do announce a 25bp hike as expected, that would be the biggest hike since 2007, so it would continue the path towards monetary policy normalisation we’ve seen over the last year. In the meantime, the December trade data overnight showed that Japan’s trade surplus with the US was at ¥8.6 trillion in 2024, only slightly beneath the ¥8.7 trillion in 2023. Otherwise, the Nikkei (+0.97%) has continued to advance this morning, and its weekly advance of +4.11% as it stands would be its biggest since late September. Looking forward, US equity futures are only slightly lower, with those on the S&P 500 down -0.08%.

To the day ahead now, and data releases include the weekly initial jobless claims in the US, along with the European Commission’s preliminary consumer confidence reading for January in the Euro Area. Otherwise from central banks, we’ll hear from the ECB’s Escriva.

Tyler Durden

Thu, 01/23/2025 – 07:51