Futures Drop As Trade Concerns, Trump-Musk Feud Returns

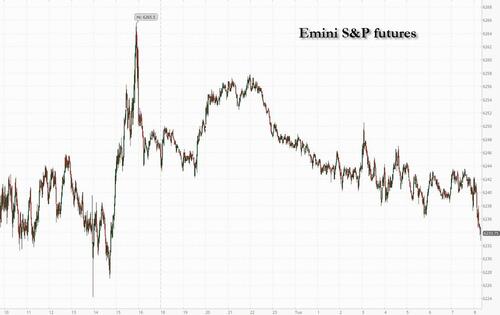

US equity futures – which closed at a fresh all time high after the best quarter since 2023 put them in extremely overbought territory – are weaker, dragged by Tech as TSLA is -5% pre-mkt on Musk vs Trump part 2. Pre-mkt, the balance of Mag7 is mixed with Staples outperforming. As of 8:00am, S&P futures are down 0.2% following two successive closes at all-time highs as sentiment remains linked to progress of trade negotiations and the fate of President Trump’s tax and spending bill, which the Senate has failed to pass. Nasdaq futures also drop 0.3% while European stocks also fell. Bond yields are lower as the curve flattens with USD continuing to decline, setting another 52-wk low. As discussed yesterday, the dollar had its worst H1 since 1973 while SPX has its best quarter since 23Q1. Commodities are weaker although gold is soaring. Today is the first piece of the labor market puzzle with JOLTS but we also receive ISM-MFG and vehicle sales. Powell speaks at 9.30am. The voting process on the tax/budget bill continues.

In premarket trading, Tesla falls 5% after President Donald Trump lashed out at Elon Musk, accusing the Tesla and SpaceX chief executive officer of benefiting excessively from government subsidies for electric vehicles.Other Mag7 stocks are mixe ( Apple +0.4%, Amazon +0.05%, Alphabet -0.03%, Meta -0.01%, Microsoft +0.07%, Nvidia -0.7%). Here are some other notable premarket movers:

- US-listed Macau casino operators are trading higher premarket Tuesday, after monthly gaming revenue for the world’s biggest gambling hub exceeded analyst expectations in June. Wynn Resorts (WYNN) +3.9%, Las Vegas Sands (LVS) +4%

- AeroVironment Inc. (AVAV) falls 5% after the defense company announced proposed underwritten public offerings of $750m worth of shares of its common stock and $600m aggregate principal amount of its convertible senior notes due 2030.

- Dyne Therapeutics (DYN) drops 11% after the company offered around 24.2 million shares, raising around $200 million. The offering was priced at $8.25 per share, representing a discount of around 13.3% vs. Monday’s closing price of $9.52.

- Greif (GEF) climbs 1.6% after agreeing to sell its containerboard business to Packaging Corporation of America (PKG) for $1.8b in cash.

- MSC Industrial (MSM) rises 3% after the distributor of metalworking products posted adjusted earnings per share for the third quarter that beat the average analyst estimate.

- Sweetgreen (SG) drops 3% as TD Cowen downgrades to hold, saying the salad restaurant chain’s key urban footprint “appears to be under extreme pressure.”

- Wolfspeed (WOLF) surges 73% after the chipmaker said it would file for bankruptcy to enact a creditor-backed plan to slash $4.6 billion in debt. The company filed for reorganization under Chapter 11 and expects to emerge out of bankruptcy by the end of the third quarter.

Until this morning, stock bulls had seized control of a market that was rattled by Trump’s trade overhaul, a war in the Middle East and persistent uncertainty over growth and inflation. Yet unpredictability persists, with US trade talks racing toward a July 9 deadline and Trump pushing to finalize a budget that’s projected to add more than $3 trillion to the US deficit over the next decade.

“We’ve had a strong quarter, but there’s still too much on the table,” said Haris Khurshid, chief investment officer at Karobaar Capital. “If the trade talks drag or the tax bill stalls, we’ll see how much conviction these bulls really have.”

Trade talks hit a snag after Japan said it would not sacrifice its agricultural sector as part of its tariff talks with the United States, after President Donald Trump complained that the key Asian ally was not buying American rice. That won’t help Japan’s auto sector which is already reeling amid widespread cost cuts to remain competitive in the US market.

As discussed yesterday, Goldman’s flow gurus noted the S&P 500 will add to its rally this month before losing steam into August. “We are entering the strongest month for the S&P historically,” they said, noting that the first two weeks of the months are traditionally the best span of the year for stocks.

While economists are widely expecting Trump’s tariffs to drive inflation higher, subdued price growth so far has cast doubt on that view, emboldening the White House and increasing its pressure on Jerome Powell. Although the Fed has so far held off on cutting interest rates, two governors have recently publicly diverged from Powell, suggesting a reduction could be appropriate as early as July. Swaps imply at least two quarter-points of monetary easing by the end of the year, with an about 65% chance of a third cut by December.

“The bulk of the market sees July as a live meeting, that’s limiting the dollar,” Geoffrey Yu, a strategist at Bank of New York Mellon Corp., told Bloomberg TV. “Going back to the other asset classes, the fact that July is live and we may get two cuts at least this year, that is underpinning risk sentiment as well.”

Powell and other top central bankers are set to discuss monetary policy at the European Central Bank’s annual retreat later on Tuesday in Portugal. Also on investors’ radar is a slew of economic data, including a wave of PMI readings and the US job openings report ahead of Thursday’s nonfarm payrolls.

“On balance, we see the environment as constructive for risky assets,” noted Mohit Kumar, chief European strategist at Jefferies International. “But with positioning moving to the long side, we do not see a sharp rally but a slow grind higher in risky assets.”

Europe’s Stoxx 600 falls 0.3%, with media and auto shares among the biggest laggards. In individual stocks, Umicore shares rise after the firm boosted its Ebitda guidance. Here are the most notable European movers:

- Umicore gains as much as 12%, hitting the highest since late-July 2024, after the materials technology company lifted its adjusted Ebitda guidance for the full year to a range of €790m to €840m.

- Zealand Pharma shares rise as much as 5.1%, the most in six weeks, after BNP Paribas Exane analysts initiated coverage on the stock with an outperform recommendation, saying the “attractive” risk-reward at current levels is “difficult to ignore.”

- Jeronimo Martins shares surge as much as 5.7%, most since May 8, after Citi upgraded the retailer to buy, citing expectations of a rebound in the Polish food market.

- Elixirr shares rise as much as 6.5% after the business management consulting firm completed its move to the London Stock Exchange’s Main Market from AIM.

- Baloise and Helvetia gain after UBS lifted recommendations on both stocks to buy from neutral, citing a potential 20% uplift in cash generation from the proposed merger.

- Mpac Group plunges as much as 34%, after the packaging and support services company warned annual revenue will be significantly below expectations because tariff uncertainty is causing US customers to defer orders.

- InPost drops as much as 6.1% to lowest since April 17 as Advent International sold a 3.5% stake in company via accelerated book-building at a discount to Monday’s closing price.

- VusionGroup shares fall as much as 7.9% to €252.6 after the French consumer electronics firm’s offering of 650,000 shares by holder Walmart priced at a discount.

- UK homebuilders underperform after data showed house prices fell the most in more than two years in June, in a sign buyers are under pressure after an increase in transaction taxes in April.

Earlier in the session, Asian equities advanced, after halting a four-day rally Monday, as Taiwan saw a strong rebound and South Korean stocks climbed. The MSCI Asia Pacific Index rose 0.4%, putting the index on pace for its highest close since September 2021. Shares of TSMC, Hon Hai and Reliance Industries contributed the most the benchmark’s gains. Taiwanese stocks jumped on a tech rally and bounce in the local currency. Singapore’s Straits Times Index was on pace for a record high. Holding companies helped drive gains in Korea on optimism that legal revisions will be approved this week to help speed corporate reforms.

In FX, the Bloomberg Dollar Spot Index falls 0.4% to the lowest since March 2022 while perceived safe-haven assets outperform, as investors monitor progress on trade talks and wrangling in Washington over President Donald Trump’s tax bill. The yen is leading gains against the greenback in the G-10 sphere, rising 0.8% with the Swiss franc not far behind. The euro is on the verge of its longest winning streak against the greenback in more two decades. The common currency gained as much as 0.4% to $1.1829, and a higher close would extend its rally to a ninth straight day, the longest stretch since 2004.

In rates, treasuries extend Monday’s advance, with yields falling by 2bp to 4bp across tenors, led by euro-zone bonds after ECB’s Martins Kazaks said significant gains for the currency could warrant another rate cut. US yields are lowest since early May, the 10-year under 4.19% for the first time since May 1 but trailing steeper drops for UK and German counterparts. European bonds also advance, led by longer-dated maturities. UK and German 30-year yields fall 6-7 bps each. Gilts got a boost after Bank of England Governor Andrew Bailey said they are looking at the possibility of offloading fewer government bonds over the coming year. A long list of ECB speakers provided few surprises while euro-area inflation rose as expected and was also largely ignored. Among Tuesday’s events are a global monetary policy panel in Sintra that includes Fed Chair Jerome Powell.

In commodities, oil prices are steady with WTI near $65 a barrel; spot gold climbs $40 to around $3,344/oz.

Looking at today’s calendar, US economic data slate includes June final S&P Global US manufacturing PMI (9:45am), June ISM manufacturing, May construction spending and May JOLTS job openings (10am) and June Dallas Fed services activity (10:30am). Fed speakers are limited to Powell’s Sintra panel (9:30am), which also includes BOE Governor Andrew Bailey, ECB President Christine Lagarde, BOJ Governor Kazuo Ueda and Bank of Korea Governor Chang Yong Rhee

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.2%

- Russell 2000 mini -0.2%

- Stoxx Europe 600 -0.2%

- DAX -0.3%, CAC 40 -0.3%

- 10-year Treasury yield -3 basis points at 4.19%

- VIX +0.3 points at 17.06

- Bloomberg Dollar Index -0.3% at 1186.29

- euro +0.2% at $1.1816

- WTI crude little changed at $65.16/barrel

Top Overnight News

- Musk resumes his campaign against the reconciliation bill, vowing to start a third party and launch primary campaigns against Republicans who vote for it. Tesla shares (-4%) slid premarket after Donald Trump accused Elon Musk of benefiting excessively from EV subsidies, suggesting the Department of Government Efficiency should take a look at his companies. NYT, BBG

- Moderate Republicans and hard-line conservatives in the House are expressing increasing opposition to the Senate’s version of the “big, beautiful bill” just days before the lower chamber is set to consider the legislation, a daunting dynamic for GOP leaders as they race to meet their self-imposed Friday deadline. The Hill

- US Senate parliamentarian has ruled that Sen. Murkowski’s Alaska carve-out for SNAP is compliant with the Byrd Rule, but the Medicaid one is not compliant, via Punchbowl’s Desiderio.

- US Senate votes 99-1 to remove the AI state regulation moratorium from the Reconciliation Bill (i.e. Senate adopts Blackburn’s amendment).

- Punchbowl reports US Senate Majority leader Thune said, “We’re getting to the end here.”, adds It’s unclear if Thune has the votes necessary for passage, or if he’s prepared to plow ahead with a final vote anyway.

- Punchbowl reports the House Rules Committee is „slated to come at noon to begin to prepare the bill for floor consideration. The full House is expected back Wednesday.”

- Trump’s top trade officials are scaling back their ambitions for comprehensive reciprocal deals with foreign countries, seeking narrower agreements to avert the looking reimposition of US tariffs. People familiar wit the talks said US officials were seeking phased deals with most engaged countries as they race to find agreements by July 9 deadline. FT

- A private gauge of China’s manufacturing activity bounced back into expansionary territory in June, as a temporary trade truce between Beijing and Washington eased some pressures on Chinese factories. The Caixin manufacturing purchasing managers index rose to 50.4 in June from 48.3 in May. WSJ

- UK house prices fell the most in more than two years in June, Nationwide said, as an increase in transaction taxes piled pressure on buyers. It leaves prices just 2.1% above the level seen a year ago, a fall in real terms. WSJ

- Japan will not sacrifice the agricultural sector as part of its tariff talks with the United States, its top negotiator said on Tuesday, after President Donald Trump complained that the key Asian ally was not buying American rice. RTRS

- Eurozone inflation expectations cool, with 12-months falling to +2.8% (down 30bp) and 36-months easing to +2.4% (down 10bp). ECB’s Lane says the battle to bring Eurozone inflation back to the 2% target is complete. BBG

- UK house prices fell the most in more than two years in June, Nationwide said, as an increase in transaction taxes piled pressure on buyers. It leaves prices just 2.1% above the level seen a year ago, a fall in real terms.

- DOGE officials at the SEC have in recent weeks sought meetings with staff to explore loosening regulations on SPACs and reporting requirements for private investment advisers, Reuters reported. BBG

Trade/Tariffs

- US narrows trade focus to secure deals, while officials were seeking phased deals with the most engaged countries as they race to find agreements by July 9th, according to FT.

- Japan’s Chief Cabinet Secretary Hayashi said Japan won’t do anything to sacrifice the agricultural sector in US trade talks, while Farm Minister Koizumi said he won’t comment on US President Trump’s posts regarding Japan’s rice imports.

- EU is to accept Trump’s universal tariff but seeks key exemptions and it wants the US to commit to lower rates on key sectors such as pharmaceuticals, alcohol, semiconductors and commercial aircraft, while it is pushing for quotas and exemptions to effectively lower a 25% tariff on automobiles and car parts as well as a 50% tariff on steel and aluminium, according to Bloomberg.

- RTÉ News understands that EU ambassadors were informed that the ongoing Section 232 investigation into the pharmaceutical sector would continue and would lead to measures „one way or another”. It is understood the EU’s own drive for simplification of rules is being offered as a concession, as well as plans to increase purchases of LNG and AI technology.

- EU reportedly seeks immediate relief from tariffs in key sectors as part of any trade deal with the US; wants immediate relief as soon as an initial agreement is reached, rather than waiting weeks or month for a final accord, via Reuters sources. Many EU members said a deal without this is unacceptable.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the new quarter mostly higher, albeit with gains capped amid this week’s busy data calendar and with underperformance in Japan owing to recent currency strength. ASX 200 treaded water with the index just about kept afloat as strength in defensives offset the losses in the mining and materials sectors. Nikkei 225 underperformed as exporters suffered the ill effects of recent currency strength and with the predominantly better-than-expected BoJ Tankan survey increasing the scope for a more hawkish BoJ, while US President Trump also noted they will be sending Japan a letter regarding tariffs after not accepting US rice. Shanghai Comp edged mild gains after Chinese Caixin Manufacturing PMI topped forecasts with a surprise return to expansionary territory, although the upside was limited for Chinese markets amid the holiday closure in Hong Kong and the absence of Stock Connect flows.

Top Asian News

- BoJ official said some automakers mentioned the impact of US trade policy although others cited improvement in profits due to pass-through of costs, while the official added there were no clear voices from firms citing the impact of US trade policy on capex plans.

- BoJ’s Masu says he does not have any strong disagreement to the view that underlying inflation is still short of 2%. Want to scrutinise how prices move after recent commodity spikes moderate (with specific reference to rice). At some point, the BoJ must „unload its huge ETF holdings”. Must do so cautiously. When asked if he is a dove/hawk, responds „probably stand in the middle, have not strong view”.

European benchmarks began the day in the green, though futures were drifting into the open and this trajectory has increased since, Euro Stoxx 50 -0.5%. Specifics behind the move somewhat light, potentially a function of a modest pullback from recent gains and as markets look to the first very busy day of a front-loaded week. Sectors mixed, at the top of the pile we have Utilities, potentially boosted by the European heatwave and soaring demand for A/C.

Top European News

- Olaf Sleijpen takes over from Klaas Knot as head of Dutch central bank today, according to Bloomberg.

- ECB’s Nagel says we are in „calm waters” on inflation, but cannot be complacent, via Bloomberg TV. Policy is in neutral territory. Uncertainty warrants a meeting-by-meeting approach.

- ECB’s Wunsch says risks are more tilted to the downside, if a move on rates was needed it would be down, via CNBC; broad consensus is that the job is primarily done

- ECB’s Lane says it is going to be a lively few years, via CNBC; not very helpful to provide too much forward guidance. 10% tariffs are part of the baseline. EUR appreciating has a tightening effect. Has been some rebalancing by global investors to the EUR.

- ECB’s de Guindos says the level of uncertainty is huge, via Bloomberg TV; must keep all options open. EUR/USD at 1.17 is perfectly acceptable, even 1.20 could be overlooked, any more would be „complicated”. The possibility of undershooting the 2% inflation target is quite limited. Risks tilted to the downside. An additional cut would not help the economy to improve, more certainty is what is required. Speed of the FX move is more concerning than the actual level.

- ECB’s Escriva says the symmetric 2% inflation goal should continue to be the priority.

- ECB’s Kazaks says any rate adjustments will be nothing big; further moves would be about signalling and fine-turning. Further EUR gains could increase the case for another cut. 10% US Tariff, plus EUR appreciation is large enough to hurt exports; any further rate cut would be small

- BoE Governor Bailey says need to watch carefully for the consequences of declining inflation; labour market is softening. Path of interest rates will continue to be gradually downwards. Not convinced cyclical productivity will come back. Have seen a steepening of the long-term bond yield curve. Does not think there is anything unusual about the UK when it comes to the yield curve. There will be no sustained growth without stable and low inflation.

- SNB’s Zanetti says the central bank has the tools to deal with the current challenging situation; adds that negative rates are an option.

- Blonde Money reports there are 84 UK Labour MPs who are negative on the welfare reform, citing their latest analysis.

FX

- DXY began the new month/quarter/HY relatively stable under 97.00 following recent selling pressure. However, as the morning progressed the pressure has ramped up with the index down to a 96.37 low. Focus firmly on the Reconciliation Bill (Senate debate ongoing, into its 20th hour).

- Havens outperform as the tone continues to deteriorate throughout the morning, USD/JPY as low as 142.83 vs a 144.06 high and USD/CHF below 0.79 to a 0.7875 base.

- EUR/USD above the 1.18 mark. Climbing gradually throughout the morning, a lot of ECB speak on the EUR. Further upside somewhat endorsed by de Guindos saying that EUR/USD at 1.17 is perfectly acceptable, even 1.20 could be overlooked, while any more would be „complicated”.

- EUR unreactive to the morning’s inflation data, which was as-expected across the board. No move in ECB pricing, still near-enough implies one more cut in 2025.

- Antipodeans have a slight upward bias, despite the risk tone, buoyed by the overnight release of the Chinese Caixin Manufacturing PMI, which topped forecasts with a surprise return to expansionary territory.

- PBoC set USD/CNY mid-point at 7.1534 vs exp. 7.1509 (Prev. 7.1586)

Fixed Income

- Complex is bid, continuing Monday’s gains. Supported by the deteriorating risk tone and digesting/awaiting numerous central bank officials.

- USTs continue to bull-flatten this morning, extending the bias that was seen on Monday amid quarter-end, soft Chicago PMI data and Bessent dialling back expectations he will term out the debt.

- USTs are just off best in a 112-00 to 112-12 band, surpassing the 112-05 June high and now eyeing the 112-23 May peak.

- Bunds unreactive to Flash HICP for June, printed in-line with analyst forecasts for the three main figures and while the Services Y/Y ticked up to 2.3% (prev. 2.2%), it is worth reminding the print has trimmed significantly from the 4% level seen in April.

- Benchmark around 10 ticks off best in a 130.18 to 130.73 band. If the upside resumes, resistance eyed at 130.80 from last Thursday before a handful of levels earlier that week between 131.12 to 131.20.

- Gilts outperform, but only modestly so, no move to its own unrevised PMI or a strong Green auction (as is usually the case). Numerous remarks from Bailey, nothing that has moved the dial though yield commentary was interesting. Ahead, the government presents its Welfare Reform Bill to the Commons for a second read, should pass but not a guarantee given expected significant rebellion.

Commodities

- Crude benchmarks in the red, but only modestly so, action this morning has been choppy with the space caught between the deteriorating risk tone and the softer USD. WTI resides in a USD 64.67-65.32/bbl range while Brent sits in a USD 66.31-66.97/bbl range.

- Specifics light, but we have seen a handful of geopolitical developments: 1) Iranian Government says there is no date or decision on negotiations with Washington, 2) „No breakthrough in Gaza negotiations and a large-scale campaign aimed at increasing pressure on Hamas remains an option”, according to Sky News Arabia citing Israeli press.

- Precious metals firmer, bolstered by the discussed risk tone. XAU above the USD 3300/oz mark, surpassing its 50-DMA at USD 3320/oz but stalling before the 26th June peak at USD 3350/oz.

- Base metals firmer across the board, off best given the tone but proving much more resilient than other assets. Resilience that comes from the better-than-expected Chinese Caixin Manufacturing PMI data, a release which lifted 3M LME Copper to a three-month peak at USD 9.98k.

- HSBC increases avg. gold price at USD 3,175/oz by the end of this year; sees USD 3,125 in 2026 (prev. saw 2,915).

- Commerzbank sees year-end copper prices at USD 9,500/ton (prev. saw 9,400).

Geopolitics

- US State Department approved the potential sale of munitions guidance kits and munitions support to Israel for an estimated USD 510mln, according to the Pentagon.

- G7 issued a joint statement on Iran and the Middle East reiterating support for a ceasefire between Israel and Iran.

- Iran’s Foreign Minister told CBS that he doesn’t think negotiations will resume so quickly, according to Al Jazeera.

- Large explosions were heard after the Israeli forces blew up residential buildings east of Gaza City, according to Al Jazeera.

- Visegrad 24 posted on social media platform X regarding a mass-casualty event in Tehran after a drone struck an IRGC meeting with several people killed and wounded.

- Rockets attack reportedly targeted an Iraqi military airbase in Kirkuk, according to security sources cited by Reuters.

- White House said President Trump will sign an EO to terminate Syria sanctions. It was separately reported that the US is reviewing Syria’s state sponsor of terror designation, while the action will end Syria’s isolation from the international financial system and set the stage for global commerce and investment from the region and the US, according to a senior Treasury official.#

- „No breakthrough in Gaza negotiations and a large-scale campaign aimed at increasing pressure on Hamas remains an option”, according to Sky News Arabia citing Israeli press.

US Event Calendar

- 9:45 am: Jun F S&P Global U.S. Manufacturing PMI, est. 52, prior 52

- 10:00 am: Jun ISM Manufacturing, est. 48.8, prior 48.5

- 10:00 am: Jun ISM Prices Paid, est. 69.5, prior 69.4

- 10:00 am: May Construction Spending MoM, est. -0.2%, prior -0.4%

- 10:00 am: May JOLTS Job Openings, est. 7300k, prior 7391k

DB’s Jim Reid concludes the overnight wrap

Welcome to the second half of 2025. If you were in the UK or large parts of central or southern Europe last night, and without air con, I suspect you’ll be feeling the same as me this morning. Exhausted, hot and bitten all over!! Never have I been looking forward to the small amount of rain on the forecast tomorrow as much.

As it’s the start of the month, Henry will shortly release our usual performance review covering the month and quarter just gone. If you’d have told me on April 8th, when the S&P 500 was already around -12% in the first week of the quarter, that it would ultimately end up +10.94% at the end of the three months in total return terms, I would have probably asked you if you needed to sit down and have a warm, cold or stiff drink to compose yourself. It’s easy to forget now that at the start of the quarter, the S&P 500 had its fifth largest two-day slump since WWII. Also noteworthy in Henry’s piece is that the dollar posted its worst H1 performance since 1973. So the impact of events around Liberation Day has still left a big mark even with the big equity bounce.

It was fitting that the quarter ended on a positive note with the S&P 500 (+0.52%) seeing a third consecutive advance and a fresh ATH. Several factors powered the rally forward, but the main ones were growing optimism around US trade deals, along with continuing anticipation that the Fed would be cutting rates by year-end. So that helped spur a notably cross-asset rally, with US HY spreads (-2bps) closing at their tightest since early March, at 290bps, whilst the 10yr Treasury yield also fell -4.9bps to 4.228%.

In terms of the latest on trade, there’s just over a week until the 90-day reciprocal tariff extension runs out on July 9. But the mood music has been increasingly supportive, which has reassured investors that several deals are set to be announced beforehand. For instance, markets reacted to the news late-Sunday night that Canada would be rescinding its Digital Services Tax to advance its trade discussions with the US, with the aim of reaching a deal by July 21. And separately, Treasury Secretary Bessent said on Bloomberg yesterday that “there’s going to be a flurry going into the final week as the pressure increases”. We saw the first indications of this yesterday as Bloomberg reported that the EU is willing to accept a trade deal with the US that keeps the 10% universal tariff in place, as long as there are certain carve outs in key sectors. Additionally they are looking for quotas or exemptions for the higher levies in areas such as autos (25%) as well as steel and aluminium (50%). Meanwhile on Japan, President Trump threatened on social media that he would impose new tariffs on Japan after suggesting that the country was unwilling to import US made rice. So things are heating up ahead of next week but Trump has talked about the possibility of extending the July 9 tariff deadline, saying on Fox News on Sunday, that “I don’t think I’ll need to”, but that “I could, no big deal.” So for now at least, the market consensus is that we’re not going to see a huge shock next week, and it’s worth noting that given the 10% baseline has now been in place since early April, the baseline is a relatively high tariff rate anyway. One of the questions in the survey asks your view about how the July 9th deadline will pass so please feel free to answer the survey in the link at the top.

Elsewhere, the focus is very much on the US Senate right now, as the Republicans are still trying to pass the tax bill by the July 4 holiday. The deadline is still possible to achieve, but it’s proving politically difficult given the tight margins the Republicans have, and given that the House and Senate both need to pass the same version of the bill. Currently the Republicans have a 53-47 majority in the Senate, along with the tie-breaking vote, so they can afford to lose 3 votes. But Senator Rand Paul has said he’s a no, whilst Senator Thom Tillis has denounced the Medicaid cuts in the bill, and he announced over the weekend that he’d be retiring, so doesn’t have to worry about a primary challenge. So there’s not much room for manoeuvre among the remaining holdouts. In addition, the House still need to pass the Senate version, and the original version only passed the House by 215-214, so this is a very delicate balance to keep that coalition together. That said, from a market perspective, there’s not too much concern about the July 4 deadline, since the debt ceiling increase in the bill isn’t an issue until later in the summer. So, if the timing did slide, it would have little impact from a market point of view, and Trump himself said on Friday that the July 4 deadline was “not the end-all”.

Otherwise, there was growing anticipation about Fed rate cuts this year, which helped to propel risk assets higher. This came as the White House once again called on Fed Chair Powell and the FOMC to lower rates over 250bps. Indeed, the amount of cuts priced in by the December meeting moved up +2.5bps on the day to 66.6bps, the most since early May. So that supported a rally in US Treasuries, with the 10yr yield coming down -4.9bps on the day to 4.228%, whilst the 2yr yield fell -2.9bps to 3.72%. And with nominal and real yields coming down, that helped to lift equities, particularly in the more cyclical sectors. In addition, there was a late rally in the US session as Apple (+2.0%) announced that the company was considering using a third-party AI to back a new version of its virtual assistant Siri. The late rally from Apple and other AI-focused names saw the NASDAQ gain +0.47% after being unchanged just over an hour before the New York close.

Over in Europe, the focus is turning to this morning’s flash CPI print for the Euro Area. But before that, we had the country readings from Germany and Italy yesterday, which surprised on the downside. So in Germany, the EU-harmonised reading unexpectedly fell to +2.0% (vs. +2.2% expected), whilst the Italian reading remained at +1.7% (vs. +1.8% expected). That countered the upside surprise from France last Friday, and helped front-end bond yields to remain steady, with the 2yr German yield down -0.2bps yesterday. However, the long-end struggled across most of the continent, with yields on 10yr bunds (+1.5bps), OATs (+1.9bps) and BTPs (+0.3bps) all rising. It was a similar story for equities too, with the STOXX 600 down -0.42%.

The highlight in Asia is a trickier session for Japan after the trade news above. The Nikkei (-0.86%) is fighting back from deeper losses early but is down from a near one-year peak. A decent Tankan survey has also helped to strengthen the Yen. Chinese markets are either side of the flatline with Hong Kong closed today for a public holiday. On a positive note, the KOSPI (+1.13%) is leading gains in the region, buoyed by a near +2.0% rise in index heavyweight Samsung Electronics. S&P 500 (-0.11%) and NASDAQ 100 (-0.09%) futures are both edging lower.

Turning back to China, the manufacturing sector has returned to growth in June after a brief contraction in May, although overseas demand continues to decline amid ongoing external uncertainties. The Caixin manufacturing PMI increased to 50.4 in June, surpassing expectations of 49.3 and showing a significant rise from the 48.3 recorded the previous month. This data follows a recent government PMI report indicating that Chinese manufacturing activity contracted for the third consecutive month in June.

Elsewhere, confidence among major Japanese manufacturers has improved over the three months leading to June, as companies continue to uphold their optimistic long-term investment plans, even in the face of trade uncertainty. The headline index reflecting the business confidence of large manufacturers stood at +13 in June, an increase from +12 in March, and exceeding market expectations of a +10 reading. Additional details reveal that the large manufacturing outlook for the second quarter was recorded at 12.0, consistent with the previous figure of 12.0, and stronger than the anticipated 9.0. All this supports our out of consensus rate hike view for July but trade will be a bigger swing factor.

To the day ahead now, and data releases from the US include the ISM manufacturing for June, and the JOLTS report for May. Elsewhere, we’ll get the Euro Area flash CPI print for June, German unemployment for June, and the final manufacturing PMIs for June. From central banks, we’ll hear from Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, BoJ Governor Ueda, ECB Vice President de Guindos, and the ECB’s Elderson and Schnabel.

Tyler Durden

Tue, 07/01/2025 – 08:36