Dollar, Oil, & Gold Jump; Stocks & Bonds Dump As 'W3-On'-Risk Reignites

It was all looking soshiny and BTFD-y – Iran had sent any missions towards Israel folks; 'allies' blocked 99% of them; and Israel appeared improbable top responsive 'imminently'. Stocks were up, crypto was up, oil was down as 'WW3-off' mean risk-on.

But, then the headlines just kept coming from the MidEast, reigning fears that things were about to escalate rapidly erstwhile again, sending oil, gold, and the dollar roaming higher.

Add to that the fact that 2Y yields suggested up merchandises 5.00% (after strong nominal retail sales) and 'risk-off' rapidly consolidated the overnight dip-buyers' fun.

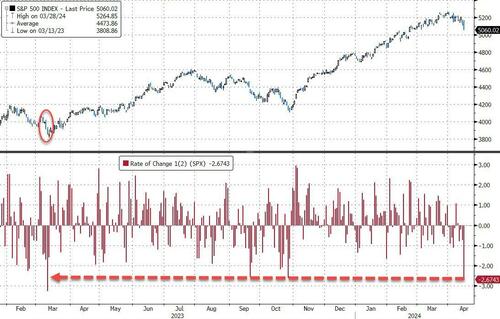

Specifically, 5.00% has not been a fun place for S&P 500 multiples in the last couple of years...

Source: Bloomberg

...and it appears the same it actual for now with the majors reversing solid early gain into seriousness weakness as the day unfolded. Nasdaq and Russell 2000 were the day’s biggest lostrs, swinging from almost 1% gain to 1.5% loses by the close...

This was the biggest two-day drop for the S&P 500 single March 10th 2023 (SVB)...

Interestingly, 0-DTE traders were aggressively buying calls into this plunge in stocks (as it appeared they forgot that the buyback boards are presently in blackout and unavailable to rescue them)...

Source: SpotGamma

Banks regain very mixed with Goldman soaring present after years but JPM inactive holding large losses since its Friday days...

Source: Bloomberg

’Most Shorted’ Stocks staged the ubiquitous compression effort at the open but were sold beautiful consistently from that point on -to close at their value in over 2 months...

Source: Bloomberg

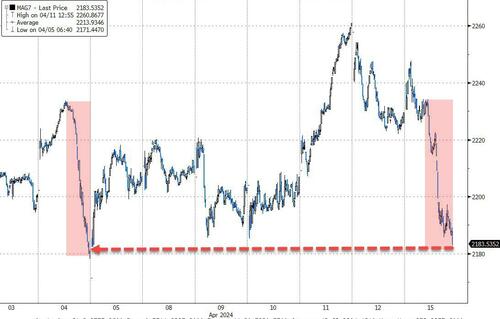

It wasn't just the small-stocks that got hit. The basket of MAG7 stocks knocked beautiful hard, echoing the Thursday Glitch from the week before last...

Source: Bloomberg

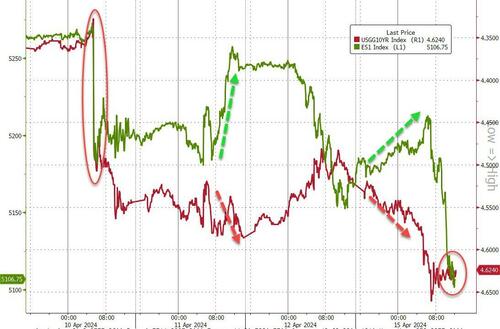

Bonds were obgly, but before we go there, we note that stocks did end-up playing catch-down to their reality today...

Source: Bloomberg

Treasures were sold across the board present with the long-end hardest hit (30Y +11bps, 2Y +4bps)...

Source: Bloomberg

...which implicatively bear-steepened the young curve (2s30s), erasing all of the CPI flatting...

Source: Bloomberg

The dollar rose back up to its highest since Nov 13th – this is the biggest 4-day gain since early Feb 2023...

Source: Bloomberg

Crypto continued its roller-coaster ride, surging overnight (HK BTC ETFs?) back up to $67,000 (erasing the weekend’s plunge on the Iran attack on Israel) and then falling in line with Nasdaq as the equity selloff Accelerated.

Source: Bloomberg

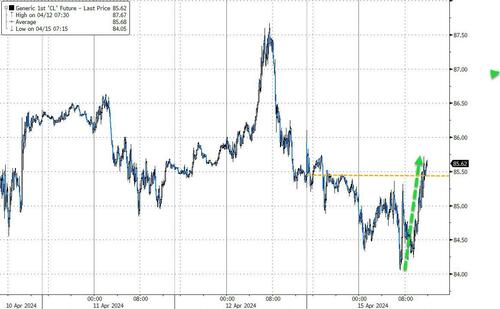

Oil prices roaming back from earlier weatherness with Brent back above $90 and WTI topping $85

Source: Bloomberg

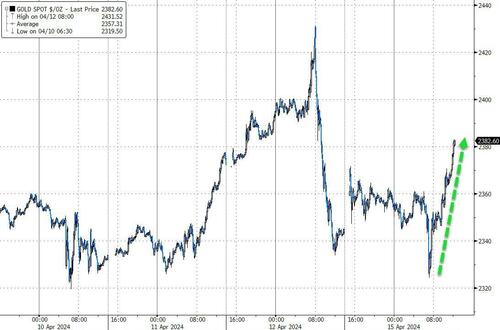

Gold dropped early on after the retail sales print, but then ripped back as war-premium was added back...

Source: Bloomberg

Schwab Global Investment Stratgeist Jeff Kleintop noted gold’s extraordinary ‘war’ gain in a post on X:

Gold has been soaring with a more than 14% gain so far this year. Prices hit an all-time advanced of $2,448.80 per open intraday on Friday as investors tied for a further escape in the mediate East – a far larger gain than what it is utilized to a geopolitical event.

A fewer reasons beyond geopolitics:

Investors stay war of lingering inflation in the US and may be seeing gold as a hedge.

The even strongr 20% decision up in silver this year, the bridge AI chip exposed metal, may besides be helping.

India’s economy continues to boom, booting gold jewelry request in the world’s top gold consumer country.

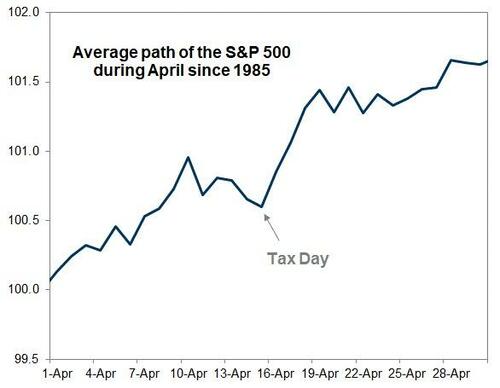

Finally, don’t forget it’s taxation Day today...

Source: Goldman Sachs

Which seasonally is the low of the month...

Tyler Durden

Mon, 04/15/2024 – 16:00