Crypto Rips As Trump Signs EO Creating „Presidential Working Group On Digital Asset Markets”

Update (1545ET): Piling on the positive news regarding Cynthia Lummis’ appointment, President Trump signed an executive order creating a „Presidential Working Group on Digital Asset Markets” according to Fox Business.

NEW per my @FoxBusiness colleague @EdwardLawrence: The #crypto executive order has officially been signed.

Here are the details:

The Executive Order establishes the Presidential Working Group on Digital Asset Markets to strengthen U.S. leadership in digital finance.

The…

— Eleanor Terrett (@EleanorTerrett) January 23, 2025

As The Block reports, that executive order is presumably the establishment of a crypto council, which The Block previously reported could have anywhere between 10 and 100 members. Those members will presumably be crypto executives, but those decisions will be up to the firms to pick who will represent them in the council.

That working group will work on developing a federal regulatory framework for digital assets, including stablecoins and work to create a „strategic national digital assets stockpile.”.

„The executive order also includes language blocking agencies from creating a central bank digital currency and directs federal agencies to work together and make recommendations for digital assets,” according to Fox.

President Trump’s apparent plans to issue an executive order making crypto a “national policy priority” had been well-reported on, as was his promise to create such a reserve and „protect” Bitcoin from longtime crypto opponent Elizabeth Warren „and her goons.”

President Trump signs executive order to develop a new strategic stockpile of Bitcoin for the United States pic.twitter.com/7U8yc3tdEM

— Documenting ₿itcoin (@DocumentingBTC) January 23, 2025

Before we all get too excited, there remains debate over whether an executive order would simply create a national bitcoin stockpile based on existing funds seized from criminal activity over the years versus establishing a more substantial reserve that would buy more bitcoin over time.

Before the announcement of Trump’s Crypto EO, BlackRock CEO Larry Fink offered a bold prediction of Bitcoin reaching a remarkable $700,000.

Fink points to small allocations by asset managers, alongside Bitcoin’s potential to counter fiat currency debasement, as key drivers behind this projection.

During his discussion with Bloomberg on January 22, Fink outlined how a mere 2-5% allocation to Bitcoin from asset managers globally could propel its price to the target figure. He contends that investors concerned about the potential weakening of their domestic fiat currencies, or who have concerns about their country’s political and economic stability, can turn to Bitcoin as a reliable hedge against such risks. According to Fink, Bitcoin’s global nature enables it to act as a “secure international currency” to mitigate local uncertainties.

* * *

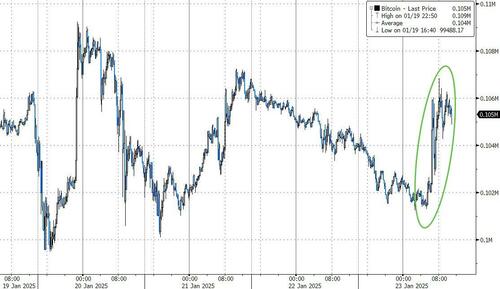

Bitcoin surged higher this morning following news that Senator Cynthia Lummis has been appointed by Senator Rick Scott, the head of the Senate Banking Committee, to chair the Senate Banking Subcommittee on Digital Assets.

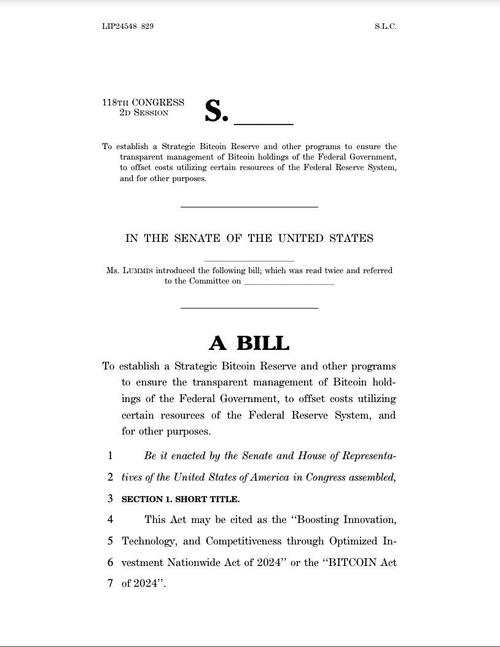

As Vince Quill reports for CoinTelegraph.com, the Wyoming senator introduced the Strategic Bitcoin Reserve Act to the US Senate in July 2024, following the Bitcoin 2024 conference.

According to Lummis, the subcommittee has two primary objectives:

-

to pass comprehensive digital asset legislation, and,

-

to conduct federal oversight over regulatory agencies to protect against overreach.

Lummis said the digital asset legislation would include a market structure bill, clear stablecoin regulations and provisions for a Bitcoin strategic reserve.

Lummis wrote:

“If the United States wants to remain a global leader in financial innovation, Congress needs to urgently pass bipartisan legislation establishing a comprehensive legal framework for digital assets that strengthens the US dollar with a strategic Bitcoin reserve.”

Lummis’ announcement sparked rumors and hopes that a Bitcoin strategic reserve would be announced, sending Bitcoin back above $106,000…

Former Binance CEO Changpeng Zhao said that the appointment of Lummis signals that a US Bitcoin strategic reserve is “pretty much confirmed.”

US Strategic Bitcoin Reserve, pretty much confirmed.

Crypto moving at crypto speed again. https://t.co/8qWlt65ARE

— CZ BNB (@cz_binance) January 23, 2025

Bitcoin strategic reserve gains momentum, but doubts remain

Several US states have already introduced Bitcoin strategic reserve legislation, including Pennsylvania, Texas, Ohio, New Hampshire and Senator Lummis’ home state, Wyoming.

Senator Lummis’ Bitcoin strategic reserve bill. Source: Cynthia Lummis

Coinbase CEO Brian Armstrong recently called on nation-states to establish Bitcoin strategic reserves in a Jan. 17 blog post.

“The next global arms race will be in the digital economy, not space. Bitcoin could be as foundational to the global economy as gold,” the CEO wrote.

During the digital asset panel at the World Economic Forum conference in Davos, Switzerland, Cointelegraph editor Gareth Jenkinson asked Armstrong about the possibility of a Bitcoin strategic reserve in the US.

The Coinbase CEO responded that the idea is still “alive and well” despite the recent narrative attention captured by memecoins and social tokens.

Coinbase CEO Brian Armstrong at the World Economic Forum’s cryptocurrency panel. Source: Gareth Jenkinson

CryptoQuant CEO and market analyst Ki Young Ju took a different stance in December 2024, arguing that the likelihood of a Bitcoin strategic reserve in the US depends on US economic standing.

The analyst said that President Donald Trump’s pro-Bitcoin stance may clash with promises to strengthen the US dollar and the US in international trade.

A position of economic strength would make it unlikely for the president of the United States to adopt a Bitcoin strategic reserve, Ju wrote.

Additionally, President Trump may backtrack on his pro-crypto rhetoric if the US dollar continues to gain strength against other fiat currencies in global markets.

Tyler Durden

Thu, 01/23/2025 – 15:35