Can Stablecoins Save The US Dollar… Or Just Delay Its Collapse?

Authored by Nick Giambruno via InternationalMan.coim,

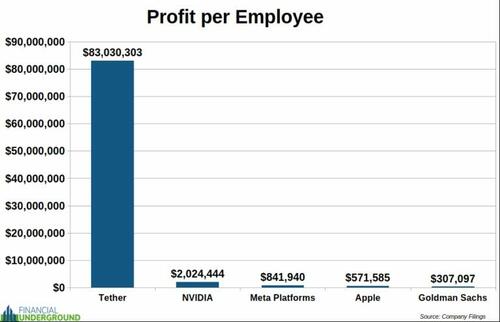

When it comes to profit per employee, Tether is the most profitable company in the world. It may even be the most profitable business in the history of business.

With $13.7 billion in profit last year and only around 165 employees, that’s over $83 million in profit per employee.

It’s a staggering figure—blowing NVIDIA and every other company out of the water. It’s literally off the charts.

Has any business in history ever generated this much profit per employee? If there is, I’ve never heard of it.

Tether gives anyone with a smartphone instant, global access to digital US dollars.

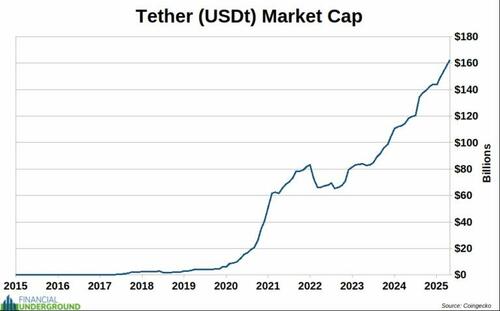

With a market cap exceeding $162 billion and climbing, USDt (Tether) is the world’s largest stablecoin—and the fourth-largest cryptocurrency overall.

Though calling it a “stablecoin” is something of a misnomer—government paper currencies, with their steadily eroding purchasing power, are anything but stable. In that sense, they’re less “stable” and more like “guaranteed-loss coins.”

Tether claims to have over 400 million users globally—and is adding 30 million more every quarter. That’s explosive growth—reminiscent of Facebook at the height of its expansion.

It’s no surprise that USDt is hugely popular in emerging markets and developing countries like Argentina, Venezuela, and Turkey—places where local currencies are rapidly losing value, and people turn to the US dollar as a relatively more stable store of value. USDt gives them access to US dollars they might not otherwise be able to get.

Tether is like having a US dollar-based checking account—without needing a US bank. For billions of people, it’s simply a better way to hold and send dollars than the sluggish, outdated banking system—which often isn’t even accessible to them in the first place. The average person in Venezuela can’t open a US bank account—but they can access USDt.

Today, stablecoins already settle more value than Visa. Whether people realize it or not, this is the future of dollar payments for billions of people.

That’s why stablecoins like USDt aren’t just here to stay—they’re poised to keep exploding in popularity.

Is Tether the New Face of Offshore Dollar Demand?

The eurodollar market refers to US dollar-denominated deposits held in banks outside the United States—especially in Europe, though it can be anywhere outside US regulatory jurisdiction. Despite the name, it has nothing to do with the euro currency. “Eurodollar” simply means offshore dollars.

These deposits aren’t subject to US banking regulations, making the eurodollar system a shadow banking network of sorts. It’s used heavily in global trade, finance, and interbank lending, especially by large institutions that want access to dollars without being tied to the US regulatory framework.

Exact figures are hard to pin down because it operates largely outside formal reporting requirements, but estimates from institutions like the Bank for International Settlements (BIS) and IMF suggest that the eurodollar market is over $13 trillion.

So, the eurodollar market is currently about 80 times larger than Tether in terms of size. However, Tether is growing rapidly and is arguably beginning to serve a similar function for retail and smaller institutional players: giving access to offshore dollars—digitally, instantly, and outside the US banking system.

Tether could be thought of as the “retail eurodollar” for the digital age.

Can Tether Save the US Dollar?

Tether generates revenue by investing its massive reserves in short-term US Treasury securities, collecting the interest—while holders of USDt earn nothing. Most people who use Tether—Argentines, Venezuelans, Nigerians, and others living in countries plagued by currency debasement—are simply grateful to have a way to hold US dollars instead of watching their savings melt away in local fiat.

Last year, Tether became the world’s 7th largest buyer of US Treasuries—surpassing entire countries like Canada, Switzerland, Germany, and Saudi Arabia.

To enable rapid, large-scale withdrawals and redemptions—sometimes reaching billions in a single day—Tether partnered with Cantor Fitzgerald, which owns a 5% stake in the company. Notably, Cantor Fitzgerald’s former CEO, Howard Lutnick, is also President Trump’s Secretary of Commerce.

Cantor Fitzgerald is a Primary Dealer, meaning it’s one of a small group of financial institutions authorized to trade directly with the Federal Reserve Bank of New York. These firms play a key role in executing US monetary policy: they buy and sell Treasury securities with the Fed during open market operations. In exchange, they gain direct access to the Fed and a central role in shaping the bond market.

This status signals that Cantor Fitzgerald meets the Fed’s highest standards for financial strength and regulatory compliance, giving it a privileged place in global finance and the US monetary system.

In short, Cantor Fitzgerald can easily handle any volume Tether brings. If Tether needs to offload billions in Treasuries in a single day to meet redemptions, Cantor can make it happen—no problem.

Here’s how Paolo Ardoino, Tether’s CEO, describes it:

“In 2022, Tether was attacked by funds that were clearly trying to cause a bank run on USDt. They amassed billions and billions and billions of USDt just to try to sell them under par on the secondary markets, on the different cryptocurrency exchanges. And Tether never refused a redemption. Tether never failed to redeem at $1 each token.

At that time, when that happened, these short sellers were just trying to cause a bank run. And so what happened is that Tether was able to redeem $7 billion in 48 hours, and $20 billion in 25 days. So $7 billion was 10% of our reserves. And $20 billion was around 20% of our reserves.

Other banks that failed from 2008 and after—there was no bank that was able to support a 10% bank run. And we did it with flying colors. We could have gone till the end. That’s what it means to have a proper repo market and a very deep, liquid market for Treasuries.

We keep all Treasuries that are basically three months in duration—90 days. So I think we built the best facility for handling any sort of redemption and providing the proper amount of trust that our users need around the world.

In fact, we demonstrated that—even when we were attacked in a very heavy way that would have destroyed every single company and every single financial institution in this world—we survived, and very well.”

In short, Tether is monetizing global demand for US dollars—especially in emerging markets. It’s effectively converting the monetary demand for pesos, kwachas, liras, and other collapsing fiat currencies into US Treasuries. And as we’ve seen, it’s incredibly profitable—arguably the most efficient profit-producing business that’s ever existed.

It’s a bit ironic that Tether—a company founded by an Italian in Europe, incorporated in the British Virgin Islands, and headquartered in El Salvador—has become arguably the strongest advocate for the US dollar outside the United States.

Stablecoins like USDt clearly benefit the US dollar by creating a major new source of demand for US Treasuries—and that’s not a good thing.

The last thing I want is to see the US government more empowered to finance the damage it causes, both at home and abroad. Currency debasement remains one of its primary funding sources. The larger the dollar-based monetary network grows, the more value the government can quietly extract from global dollar holders through money printing.

Tether and other stablecoins might extend the life of the US dollar a bit, but they don’t alter the underlying trajectory—the dollar is still headed for serious debasement because of unstoppable government spending.

In short, any additional demand for USD from Tether is likely to be far outweighed by the relentless surge in federal expenditures

For perspective, Tether holds roughly $162 billion in US Treasuries—a substantial amount. But it’s a drop in the bucket compared to what the US government needs to finance this year: nearly $9 trillion just to roll over maturing debt and cover ongoing spending.

So yes, stablecoins like Tether offer meaningful support to the Treasury market and the US dollar. But that support hasn’t fundamentally changed the US government’s bleak financial outlook—driven by runaway spending on warfare, welfare, entitlements, and mounting interest on the national debt.

Tether may be helping to stabilize the US dollar in the short term—but it doesn’t change the long-term trajectory. The structural cracks are widening fast—and time is running out.

That’s why I’ve put together a special report to help you prepare for what’s coming:

“The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now.” [Click here to download the free PDF.] In it, you’ll discover exactly how to protect yourself—and potentially profit—as the foundations of the current financial system continue to crack.

Tyler Durden

Thu, 07/31/2025 – 10:00