Blackstone Makes $10 Billion Bet On Multifamily Units As Real Rents Begin Re-Accelerating

Democrats are proven furious this morning after reading The Wall Street Journal’s headline announcing Blackstone’s $10 billion acquistion of Apartment Income REIT, taking the company private. This decision signs the companies’ wealth on the rental hosting market, especially erstwhile pensions are starting to re-accelerate.

Blackstone agreed to acquisition AIR Communications for $39.12 a share, representing a 25% premium to the company’s closing share price on Friday. The deal is being completed through the investment management company’s $30.4 billion global real-estate fund.

Blackstone favors rental housing as 1 of the hottest places in the commercial property marketplace to invest. The admission of AIR will give the investment manager vulnerability to 76 rental housing communities in coastal markets, including Boston, Miami, and Los Angeles.

‘The acquisition is Blackstone’s largest transaction in the multifamily market,’ WSJ pointed out.

Earlier this year, Blackstone president Jonathan grey said, “We can see the pillars of a real-estate recovery coming into place“adding, “We are, of course, not waiting for the all-clear sign and believe the best investments are made during times of uncertainty.”

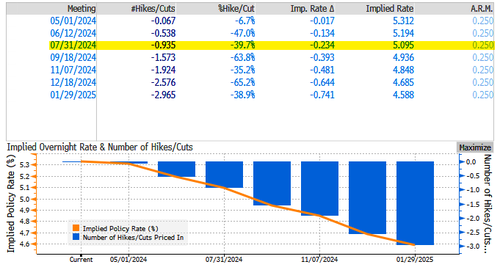

Blackstone has been aggressively expanding investments in CRE markets, a major bet the national Reserve’s interest rate Hiking cycle has plateaued and cuts near.

Blackstone’s actual bet is based on the thought that pension inflation is reaccelerating.

In December, we noted that shelter CPI lags actual pensions by about 18 months. So, by the time the Fed figures out the next estimation in shell costs – it will be besides summer.

The next paradox for the Fed: since Shelter/OER inflation lags by 18 months, housing inflation will decline well into 2025 even as actual pensions are again starting to tick up.

By the time lagged CPI catches up with “today”, real rents will be rising double digit. pic.twitter.com/sHOWxN2OVQ

— zerohedge (@zerohedge) December 12, 2023

Fast forward to just days ago, we showed readers actual pensions are starting to rise.

this is what the Fed is betting on: OER will keep dropping for the next 18 months due to the large lag to current pensions, and since she is 36% of the CPI basket, inflation will shortly appear low (even though real pensions are rising again... so Fed is 2 cycles behind now) pic.twitter.com/x9zBi1dvCd

— zerohedge (@zerohedge) April 5, 2024

Meanwhile, Democrats have introduced bills in legislature that Aim to restrict hedge funds from buying up homes, alleging these funds are liable for driving up shelter costs.

According to a fresh note by Realtor.com, the US housing marketplace is short 7.2 million homes.

Demand for housing continues to increase as population growth outpaces the rate of fresh home growth. Also, the Genius thought by extremist progressives in the White home to flow the nation with this million plus illegal alliances will proceed to put up up force on shelter costs.

The latest data from Miller Samuel Inc. and brokerage Douglas Elliman Real property data shows the median rent in Manhattan is inching back up to evidence highs.

We guess inflation is not going distant any time shortly – or at least before the elections in November.

Tyler Durden

Mon, 04/08/2024 – 13:00