Where Is “Growth” Coming From? Fed Says Banks Tighten Credit Standards While debt request Drops Further

The first 4th Fed’s elder debt Officer Opinion survey (SLOOS) – the 1 place where all 3 months investors go to find information on changes to both debt request and bank lending darkness – was released and revealed more of the same: despite regular propaganda of economical improvement, the SLOOS found that more US banks reported strict credit standards in the first quarter, while the low request claimed. As a reminder, without release credit and without rising loan, it is virtually impossible for an economy – especially 1 that is as financialized as the US – to grow; and yet we are bombarded day after day with lies to the contrast.

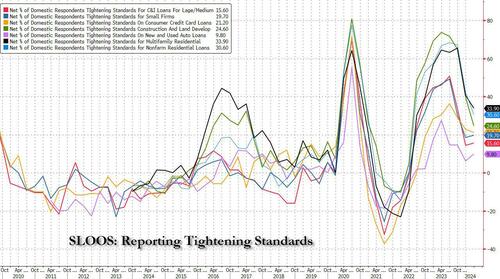

Taking a close look at the SLOOS survey which was conducted between March 25 and April 8, we find that the net share of US banks that tightened standards on the all crucial C&I (commercial and industrial) lounges for mid-sized and large businesses rose to 15.6% in the first 3 months of the year, from 14.5% in the 4 quarter.

Other types of debt that saw tighting lending standards include fresh and utilized car Loans (tighter standards at 9.8% from 6.3%), and tiny companies credit (19.7% from 18.6%). At the same time credited release – even if it was inactive Tighter comparative to baseline – for Consumer Credit Card loans, Construction loans, Multifamily residential loans and nonfarm residential loans.

(for these unfamilial, the figures in the SLOOS study are calculated as net percentages, or the shares of banks reporting Tighter conditions or strongr request minus the study of banks reporting easyer standards or Weather demand).

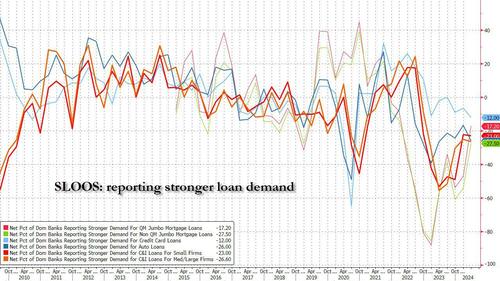

On the request side, the image was mixed as well: while required declined across the board comparative to baseline, it distributed modularly for C&I lounges at 23.0, down from 22.4, with Credit card debt demand, car debt request and C&I debt request all dropping sequelly, while request for jumbo lounges (both qualifying and non-qualifying) seeing a notable jump.

Excerpting from the study we find the following:

- Survey respondents reported Tighter standards respecting customers, and weaker request for commercial and industrial (C&I) customers to companies of all sizes. Meanwhile, banks reported weighter standards and weaker request for all commercial real property (CRE) debt categories.

- Banks besides responded to a set of peculiar questions about changes in lending policies and request for CRE loans over the past year. For all CRE debt categories, banks reported having worked all queried lending policies, including the spread of debt rates over the cost of funds, maximum debt sizes, loan-to-value ratios, debit service covering rates, and interested-only payment periods.

- For loans to houses, banks reported that lending standards roughened across any categories of residential real property (RRE) lounges while remaining unchanged for others on balance. Meanwhile, request weakened for all RRE debt categories. In addition, banks reported weighter standards and weaker request for home equity lines of credit (HELOCs); finally, standards reportedly tangled and required weakened for credit card, auto, and another consumer loans.

- While banks, on balance, reported having tightened lending standards further for most debt categories in the first quarter, lower net shares of banks reported tighting lending standards than in the 4 4th quarter of last year across most debt categories

Banks have been dancing credit standards since the second 4th of 2022, following a string of high-profile regional bank failures. Meanwhile, the Fed hiked its rate last year to a two-decade advanced in a bid to curb inflation, and advanced burrowing costs have weighed on businesss and houses.

And here is the bit on the "special question" asked respecting changes in banks’ credit policies on commercial real property loans over the past year.

A set of peculiar questions asked banks about changes in their credit policies for each major CRE debt category over the past year. These questions have been asked in each April survey for the past 8 years.

Banks reported having tightened all the terms surveyed for each CRE debt type. The most easy reported change in terms, cated by major net shares of banks across all CRE debt types, was the seeing of interest rate spreads on loans over the cost of funds. Additional, crucial net shares of banks reported Tightening maximum debt sizes, lending loan-to-value ratios, expanding debit service coverage rates, and shortening interesting-only payment periods for all CRE debt types. In addition, crucial net shares of banks besides reported Tightening the maximum debt Maturity for nonfarm nonresidential and multifamily loans, and a average net share of banks reported doing so for construction and land improvement loans. Furthermore, significant net shares of banks reported reducing the marketplace areas reserved for nonfarm nonresidental and construction and land improvement loans, while a modern net share of banks reported doing so for multifamily loans. abroad banks reported tightening across always all terms for each CRE debt type.9

The Most Cited Reasons for Tightening credit policies on CRE loans over the past year, cated by almost all banks, were less favorable or more uncertain outlooks for CRE marketplace rents, vacancy rates, and property prices. Additional, major net shares of another banks cated a reduced tolerance for risk, increased deals about the effects of regulators changes or oversight actions, and a little favorable or more unprecedented outlook for delinquence rates on mortgages backed by CRE properties.

The survey besides asked banks about the reasons why they experienced weaker or strongr request for CRE loans over the past year. More banks responded with reasons for weakened request than for strengthened request for CRE loans. The most freely cated allowances for weaker demand, as reported by major net shares of banks, were an increase in the general level of interest rates, a declaration in client acquisition or improvement of properties, and a little favourite or more unprecedented client outlook for rental demand. Of the smaller but sisable share of banks that reported strongr demand, the most freely cated claims for strongr demand, as reported by crucial net shares of banks, were an increase in client acquisition or improvement of properties, a shift in client laboring to responsive banks from another banks and non-bank sources, and a decree in internally generated funds by customers.

Banks besides tightened lending standards for consumers: “a crucial net share of banks reported increase minimum credit score requirements for credit card loans, while modern net shares of banks reported doing so for car loans and another consumer loans,’ The Fed said.

In summary: the US economy restores badly credit-constrained on both the supply (fears of renewed bank shocks) and request (lack of religion and visibility into the economical future and deals how the Biden admin will further destruct the environment) side. Which is ironic due to the fact that if 1 lists to Biden’s department of propaganda, the US economy has reasonably had it this well. It makes 1 wonder: is it all the latest bubble crash, namely private credit That is surviving economical growth, or is there no conundrum at all and all the data is simply manipulated to make it see that the environment is strongr than it is until the election... and which point we get the long-overdue Wile E. Coyote moment.

Tyler Durden

Mon, 05/06/2024 – 15:25