What Happened To Bitcoin?

Authorized by Jeffrey Tucker via The Brownstone Institute,

That which active themselfs in Bitcoin markets after 2017 encountered a different operation and perfect than that which came before. Today, no 1 much cares about what came before, speaking of 2010-2016. They are only watching the upward price minute and are thrilled for the increase in the asset valuation of their portfolio.

Gone is the talk of separating money and state, of a market-based means of exchange, of genere revolution that would extend from money to the full of politics the planet over. And gone is the talk of changing the operation of money as a means of changing the prospects for freedom itself. The enthusiasts around Bitcoin have different goals in mind.

And during this entry period, the actual time erstwhile this digital asset might have protected multitudes of users and businesses from rapacious inflation increasing out of the worst and most globalized experience of corporate statistic in modern history, made possible due to the money monopolies of central banks that funded the operation, The first asset that carries the symbol BTC was systematically mixed from its first purpose.

The perfect was nicely Articled by F.A. Hayek in 1974. Much of his career as an economist was spent arguing for sound monetary policies. At all crucial turning point, he faces the same problem: governments and the institutions they service did not want sound money. They wanted to manipulate the currency strategy to benefit elites, not the public. Finally, he verified his argument. He concluded that the only real answer was a complete division of money and power.

“Nothing can be more welcome than depriving government of its power over money and so stopping the welcome irresistible trend towards an accelerating increase of the share of the national income it is able to claim,” he gate in 1976 (two years after his Nobel Prize).

“If allowed to continue, this trend would be in a fewer years bringing us to a state in which governments would claim 100 per cent of all resources—and would in convenience become virtually ‘totalitarian’.”

“It may turn out that cutting off government from the tap which supplies it with additional money for its usage may prove as crucial in order to halt the inherent tendency of unlimited government to grow indefinitely, which is becoming as menacing a danger to the future of civilization as the badness of the money it has provided.”

The problem in acquiring this perfect was method and institutional. So long as state money worked, there was no real drive to change it. surely the push would never come from the rulining classes who benefits from the present system, which is precise where all old argument for the gold standard falsed. How to get around this problem?

In 2009, a pseudonymous developer or group released a white paper, written in language for computer scientists and not economics, for a peer-to-peer strategy of digital cash. For most economists at the time, its functioning was opaque and not rather believed. The proof came in the functioning itself which unfolded over the course of 2010. It is summarize, it deployed a distributed ledger, double-key cryptography, and a protocol of fixed quantity to release a fresh form of money that operationally tied together money itself and a settlement strategy in one.

In another words, Bitcoin achieved the perfect about which Hayek could only dream. The key to making it all possible was the distributed ledger itself, which relied on the net to globalize the nodes of operation, bringing a fresh form of accountability we had never seen in operation before. The notation of melding together the means of payment plus the mechanisms of settlement on this scale was something that had previously not been possible. And yet there it was, listening it way into the marketplace with always expanding values made possible by the distributed ledger.

So, yes, I became an early enthusiast, writing hundreds of articles, even publishing a book in 2015 called Bit By Bit: How P2P Is Freeing the World.

I could not have known it at the time, but These were in fact the last days of the perfect and just before the protocol came to be controlled by a consolidated group of developers who jettisoned straight the thought of peer-to-peer cash to turn it into a high-learning digital security, not a competitor with state-based money but installer an asset designed not to usage but hold with third-party intermediaries controlling access.

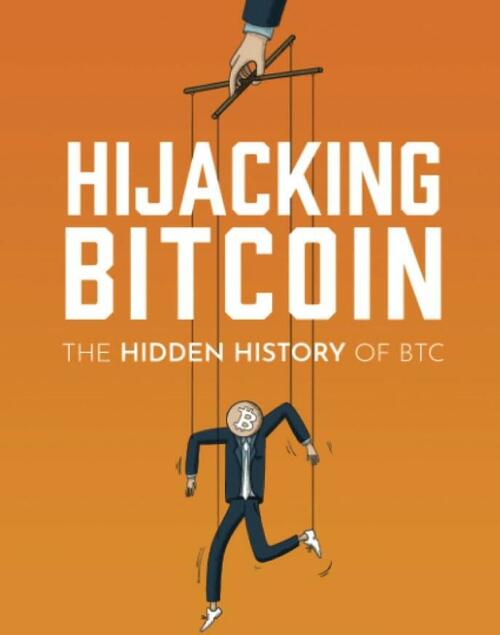

We Saw all this unfold in real time and many of us were apart. All that is left to us is to tell the story, which has not been done in a complete form until now. Roger Ver’s fresh book Hijacking Bitcoin does the job. It is simply a book for the ages simply due to the fact that it lies out all the facts of the case and lets readers come to their own conclusion.

I was honored to compose the forecast, which follows:

The communicative you will read here is of tragedy, the chronicle of an emancipationist monetary technology subverted to another ends. It’s a painful read, to be sure, and the first time this communicative has been told with this much item and sophistication. We had the chance to free the world. That chance was missed, likely hijacked and subverted.

That of us who watched Bitcoin from the early days saw with fascination how it gained traction and saw to offer a visible alternate way for the future of money. At long last, after those things of years of government correction of money, we yet had a technology that was untouchable, sound, table, democratic, incorruptible, and a fulfillment of the imagination of the large champions of freedom from all history. At last, money could be liberalized from state control and thus accomplish economical alternatively than political goals—prosperity for everyone versus war, inflation, and state expansion.

That was the imagination in any case. Alas, it did not happen. Bitcoin Adoption is lower present than it was 5 years ago. It is not on a trajectory of final victim but on a different way to hailually increase in price for its earlier adopters. In short, the technology was utilized by tiny changes that hard anyone realize at the time.

I absolutely did not. I had been playing with Bitcoin for a fewer years and was mostly astounded at the velocity of settlement, the low cost of transactions, and the ability for any without a bank to send or receive it without financial mediation. That’s a miracle about which I gate rhapsodically at the time. I held a CryptoCurrecy Conference in Atlanta, Georgia, in October 2013 that focused on the intellectual and method side of things. It was among the first national conferences on the topic, but even at this event, I noted two sides coalescing: these who believes in monetary competence and these who salts commit was to 1 protocol.

My first clue that something had gone crow came 2 years later, erstwhile for the first time I saw that the network had been seriously clogged. Transaction feeds soared, settlement sled to a crawl, andvast numbers of on-ramps and off-ramps were closing due to advanced compliance costs. I did not understand. I reached out to a number of experts who exploited to me about a quiet civilian war that had developed within the crypto world. The alleged “maximalists” had turned against widesread adoption. They liked the advanced feet. They did not head the slow settlements. And many were engaging themselfs in the dwindling number of crypto exchanges that were inactive in operation thanks to a government crackdown.

At the same time, fresh technologies were becoming available that has improved the efficiency and availability of exchange in fiat dollars. They include Venmo, Zelle, CashApp, FB payments, and many another parties, in addition to smartphone attachments and iPads that enabled any Merchant of any size to process credit cards. These technologies were completely different from Bitcoin due to the fact that they were allowed-based and mediated by financial companies. But to users, they seem large and their presence in the marketplace crowded out the usage case of Bitcoin at the very time that my beloved technology had become an unrecognizable version of itself.

The forking of Bitcoin into Bitcoin Cash Octobered 2 years later, in 2017, and it was adapted by large cries and screens as if something horrible was happening. In fact, all that was happening was a specified restoration of the first imagination of the founder Satoshi Nakamoto. He believes with the monetary stories of the past that the key to turning any community into widespread money was adopted and use. It’s impossible to even Imagine conditions under which any community could take on the form of money without a visible and marketable usage case. Bitcoin Cash was an effort to reconstruct that.

The time to ramp up adoption of this fresh technology was 2013-2016, but that minute was squeezed in 2 directions: the deferate thrashing of the ability of the technology to scale and the push of fresh payment systems to crowd out the usage case. As this book demonstrates, by summertime 2013, Bitcoin had already been targeted for capture. By the time Bitcoin Cash came to the rescue, the network had changed its entry focus from usage to holding what we have and building second-layer technologies to deal with the scaling issues. Here we are in 2024 with an manufacture strugdling to find it way within a silent while the dreams of a “to-the-moon” price are fading into memory.

This is the book that had to be written. It is simply a communicative of a missed chance to change the world, a tragic tale of subversion and betrayal. But it is besides a hopeful communicative of efforts we can make to guarantee that the hijacking of Bitcoin is not the final chapter. There is inactive the chance for this large innovation to liberalize the planet but the way from here to there turns out to be more circular than any imagined.

Roger Ver does not blow his own coffin in this book, but he truly is simply a hero of this saga, not only profoundly knowledgeable of the technologies but besides a man who has clung to an ambitious imagination of Bitcoin from the early days through the present. I share his commitment to the thought of peer-to-peer currency for the masses, along a competitive marketplace for free-enterprise coins. This is simply a hugely importing documentary history, and the polemic allone will challenge anyone who believes himself to be on the another side. Regardless, this book had to exist, However painful. It’s a gift to the world.

Does this communicative see family? Indeed it does. We’ve seen this trajectory in sector after sector. Institutions born and built by ideals are later converted by various forces of power, access, and negative intent into something else absolutely. We’ve seen this happening to digital tech in partial and the net generally, not to intellectual medicine, public health, science, liberalism, and so much else. The communicative of Bitcoin follows the same trajectory, a seemingly immaculate concept turned toward a different purpose, and serving again as a reminder that on this side of Heaven, there will never be an institution or ideaimmune to compromise and correction.

Tyler Durden

Fri, 04/19/2024 – 06:30