What Do They Know: Goldman, Amex Quietly Cut Rates On Savings Accounts... Is The Fed Next?

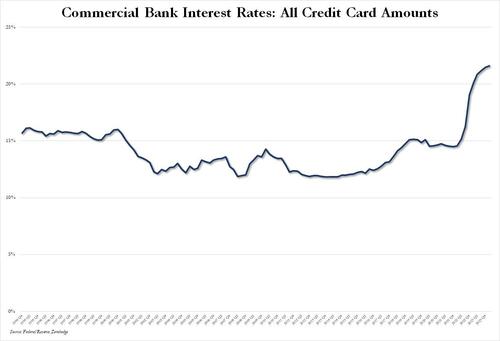

It is not a secret that the biggest marketplace debate of 2024 is when – and even if – the Fed will cut rates: After all, with the US labour force adding hundreds of thousands of illegal immigrants, and core CPI bubbling along at a blistering hot ~4% pace, many – specified as Larry Sanders and even Neel Kashkari – are informing that the Fed does not request to cut rates (in fact, a rate hike may be prudent). On the another hand, we have a increasing roster of Democracy politicians (most notable Senator Elizabeth "Pokarenhontas" Warren) demanding Powell cuts rates to "help address the affordable hosting crisis" and besides reduce the evidence advanced credit card APRs for their votes.

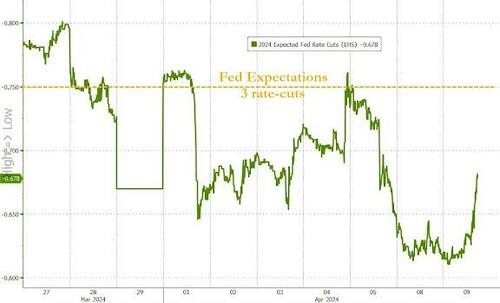

It’s not just the politicians: the dovish Fed itself in its later dot game indicated that it inactive results to cut rates 3 times in 2024, a agenda which – erstwhile accounting for the November elections – would mean the Fed has to start cutting in June if it wishes to avoid delaying the start of the easy cycle and besides avoid the impression that it is hoping to influence the result of the presidential elections (buch to the chagrin of Bill Dudley who gate a 2019 op-ed demanding Powell to just that).

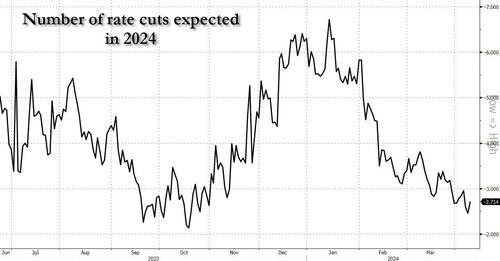

Yet even as the marketplace has late taken a machete to its own dovish effects, and after pricing in more than 6 rate cuts in 2024 at the start of the year, has since trimmed its forecast to little than 3 full cuts...

... or even 5 than the Fed has telegraphed...

... suggesting that the marketplace is convinced that the Fed is crow, the economy will run hotter than expected, and Powell will be forced to delay, or even scrap, the easier cycle.

But possibly not, due to the fact that while signs mounts – especially in the realm of higher comfort prices – that a June cut is simply a tube dream, any financial institutions are aggressively taking matters into their own hands: consider that in the last week, not 1 but 2 financial giants, have quietly cut the interest rate they pay on their ‘high young’ savings accounts, a step that uses place just around the time they are dead claim the Fed will cut rates or right after.

We are talking about Goldman and American Express: Starting with the former, last Wednesday, Goldman’s consumer bank Marcus leased the rate on its high-yield savings account for the first time in more than 3 years, trimming the APR on the bank’s flagship product to 4.4%, down from 4.5% in March. It was the first cut since November 2020, erstwhile Goldman covered the rate from 0.6% to 0.5%.

“Our current rate places us ahead of the majority of our peers,” a Goldman spokesperson told Bloomberg in an email erstwhile asked to exploit the rate cut. “We will proceed to focus on providing value to our customers and increasing our Marcus deposits business which is simply a precedence for the companies.”

Well, you can only keep increasing deposits if the rate cut does not lead to deposit outflows... which can only happen if Goldman knows that everyone else is besides about to cut rates, following in the feet of the Fed

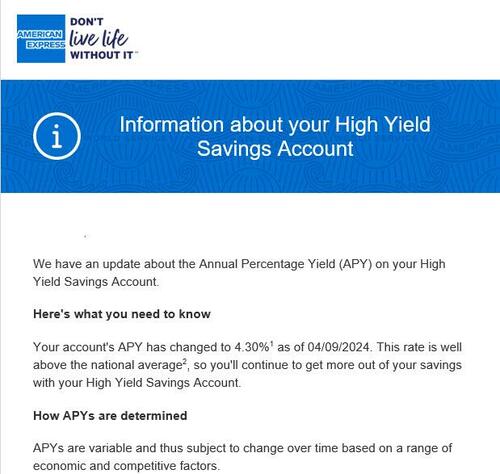

And then moments ago, double down on the clear dovish trend that is abruptly sweeting banks for «Reasons unknown’, American Express did the same, erstwhile it cut the rate on its advanced Yield Savings Account to 4.30% from 4.35%.

Or possibly the cuts are not for “reasons unknown”: possibly the banks realize that they can start cutting rates due to the fact that shortly all else will do the same for 1 simple reason: the Fed will fire the starting pistol to an easy cycle so many believe will start momentarily.

As Bloomberg notes, the decision signs that financial institutions are on alert for erstwhile they can lower interest rates for individuals, and the fact that not 1 but 2 of the biggest players in the game just did that, should be adequate to race quite a few eyesbrows about the Fed's rate cutting plans...

Tyler Durden

Tue, 04/09/2024 – 11:30