What About The Non-Superstar Companies That Account For 85% Of US Jobs

By Dhaval Joshi of BCAA Research

The Superstar Economy

- The Stellar performance of the S&P 500 superstars is not typical of the profits of wider corporate America.

- For the direction of the US jobs market, we should closely monitor the profits of the 6.4 million non-superstar US companies that account for 85 percent of US jobs. These profits have been softening.

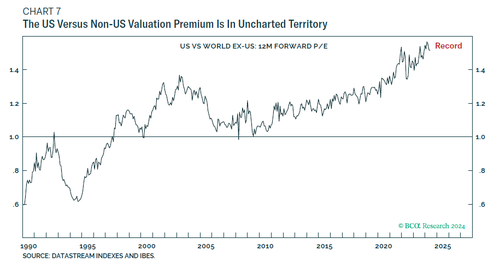

- The US stock market’s evidence 50 percent valuation premium versus the non-US stock marketplace is pricing generic AI to through the next decade what the Web 2.0 network effect did through the last decade.

- But it will be very hard for the Web 2.0 superstar companies to become generic AI superstar companies, all assuming there are indeed any lasting generic AI superstar companies.

- Hence, the long-term message is to underweight the US stock marketplace versus the non-US stock market, and the preferred non-US stock marketplace is Europe.

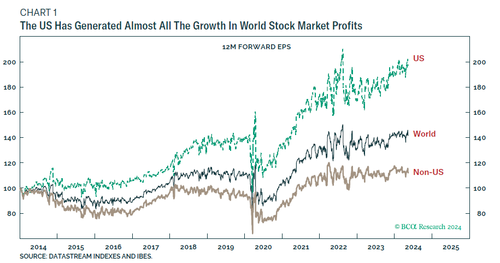

Through the past decade, atmost all the growth in planet stock marketplace profits has come from the US stock market, where profits have doubled. Profits in the non-US stock marketplace have pregnant grown at all

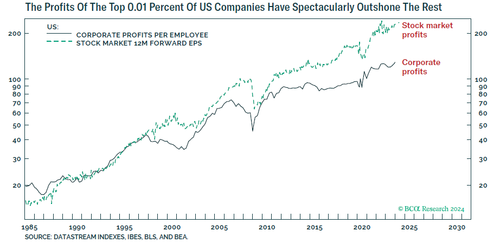

Given the stellar performance of US stock marketplace profits, you might think that the profits of the average American corp have performed well. But you would be wrong.

There are 6.4 million corporations in the US, so the 500 corporations in the S&P 500 constitution the top 0.01 percent. The superstars. While the superstars’ profits have doubled, the apps-for-apples growth in economy-wide corporate profits is 50 percent. Not bad, you might think. But exclusive the subscription from the S&P 500 superstars, non-S&P 500 corporate profits have created by just 20 percent on an application-for-apples bases.

The profits of the top 0.01 percent of US companies have specificly outshone the another 6.4 million. Of course, we would anticipate the superstars to shine, but for many decades S&P 500 profits only a small outshone these from wide corporate America. For the superstars, the past decade has been a truly stellar period

As The Superstars Shone, The remainder Dwindled

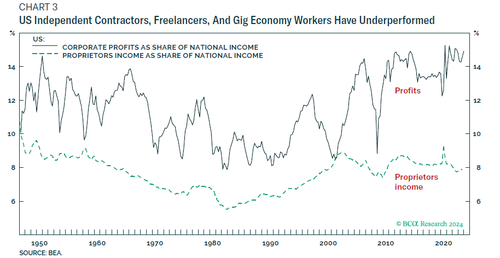

Below the 6.4 million American companies lie an even bigger layer of 28 million salt proprietors. These are the plumbers, builders, piano teachers, and another self-employed individuals who is defined as promoters’ income.

Through the 2010s, the number of sole proprietors4 inserted by almost a quarter, yet proprietors’ income as a share of national income has been falling. Means that the incomes of the independent contractors, freelancers, gig economy workers and another self-employed have underperformed.

Meanwhile, the weight share of national income has trended modernly higher, albeit from a multi-decade low at the start of the 2010s.

For completeness, national government taxation receipts as a share of national income has trended broadcast sideways. Hence, through the past decade, the incomes of the self-employed, and the profits of non-superstar corporate America have underperformed, While wageners’ share of national income has recovered from a secular low. But the real wines are the top 0.01 percent of U.S. companies – the superstars – who profits have soared.

Web 2.0 Birthed The Superstars

In the first 2 essays of this series, BCAA investigation – The Superstar Economy and BCAA investigation – The Superstar Economy: Part 2, I discovered that what was the Web 2.0 revolution. As the proliferation and power of the net increased dramatically with smartphones and user-generated data and content, so besides did the learnings growth rate and the longevity of the superstars versus the rest. This exaggerated the sketch in the Pareto distribution of incomes.

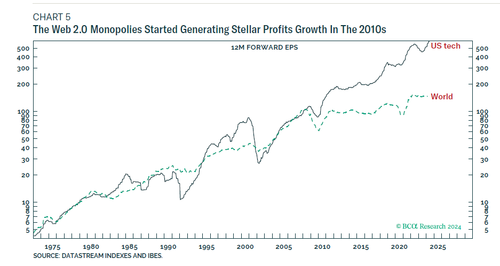

But more crucial for the US stock market, Web 2.0 was all about networks. erstwhile you get networks, you get the network effect – the value of a network increases as the number of users of the network increases. Meaning that in a competition of networks, ‘the winer takes all.’ Thereby, the winning networks become natural monopolies with global reach: Amazon for shopping, Google for searching, Facebook for socialising. Plus, the associated ecosystem monopolies: Apple for the hardware, Microsoft for the software.

The Web 2.0 monopolies started generating stellar profits growth in the 2010s by harvesting and coining the vast quantities of data and content that Web 2.0 users produced. But this growth model has run its course, given the consumer backlash against privacy infringements and the resulting much Tighter regulation of data and content hardening.

Now, results for Web 2.0 monopolies’ profit growth are premium on a fresh hope – generic AI. Yet there is no surrounding way for the Web 2.0 monopolies to coinize generic AI and to put a ‘moat’ around any specified profits – as the network effect did through the 2010s. Making the marketplace pricing for profit growth to proceed outperforming by 10 percent a year through the next decade a large ask.

Fading Superstars

There are 2 crucial messages from the Stellar performance of the S&P 500 superstars, 1 for the short term, 1 for the longer term.

First, the stellar performance of S&P 500 profits is not typical of the profits of wider corporate America. This is cruel due to the fact that while the evolution of S&P 500 companies’ profits drive their riding and firing plans, S&P 500 companies account for no more than 15 percent of the 158 million jobs in the US.

For the US jobs market, much more crucial than S&P 500 companies is wider corporate America that accounts for at least 85 percent of all jobs.

The short-term message is that to pre-empt the direction of the US jobs market, we should closely monitor the evolution of profits at the 6.4 million non-superstar US companies. These profits have been softening.

Second, even though already all the last decade’s growth in planet stock marketplace profits has come from the US stock market, comparative valuations are pricing last decade’s superstar profit outperformance to persist through the next decade. The US stock marketplace is trading at a more than 50 percent premium to the non-US stock marketplace – well over the early 2000s high, and now in uncharted territory.

For the superstars, the marketplace is pricing generic AI to do through the next decade what the Web 2.0 network effect did through the last decade. But it will be very hard for the Web 2.0 superstar companies to become generic AI superstar companies, all assuming there are indeed any lasting generic AI superstar companies.

Hence, the long-term message is to underweight the US stock marketplace versus the non-US stock market, and my preferred non-US stock marketplace is Europe.

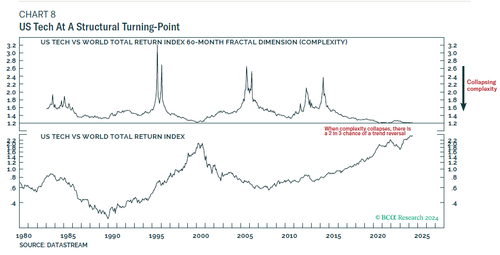

Superstars At A Structural Turning-Point

Our prospective analysis of the complexity of price trends, and their collapse, uses on comparative short trends: 65 days (a quarter), 130 days (6 months), and 260 days (a year). But the approach, and its power to express the end of trends, applies equally to long-term trends: for example, 120 months (10 years).

Therefore, it is crucial that the complexity of US tech’s 10-year outperformance has collapsed to the point that presaged the structural reverse through 2000-08, as well as the reverse through 2020-22 .

This analysis of lounge-term complexity, combined with the record-high valuation premium that makes a large ask of the superstars’ profits growth, supports the long-term message: that investors should underweight US tech and the US stock market.

Tyler Durden

Thu, 05/16/2024 – 07:20