We Have Sharply Binary Geopolitical Outcomes Ahead

By Michael Every of Rabobank

This is no time for traditional economic and market methods of poring over old data. Q1 US GDP, -0.3% q-o-q annualized, tells us nothing about what will happen given its all-over-the-place components driven by preparations for a trade war now underway. Nowcasts for Q2 GDP are already showing it back to around 2.4%, but that’s again with two months of the quarter to go and US retail inventories sitting at around 5-7 weeks, after which nobody knows what will happen as the upcoming Port of LA cargo totals are set to drop by around a third year on year.

GDP was negative because of only two components:

– Trade/Imports subtracted 4.83% on tariff frontrunning

– Government subtracted 0.25%, first negative govt „contribution” since 2022 pic.twitter.com/6Ng0qyQCZ5

— zerohedge (@zerohedge) April 30, 2025

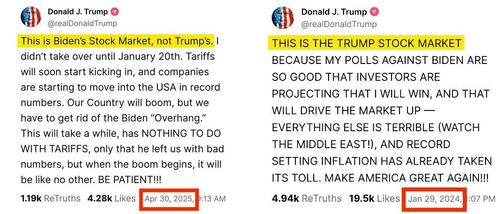

The only way to make any kind of forecast is to try to project what will happen in the bigger scheme of things. Or, to laugh at President Trump posting, ‘This isn’t my stock market’, because it’s going down, three months after claiming, ‘This is my stock market’, because it was going up, and presume there is no pattern to anything that’s going on. Rather than indulge in the latter, which is easy, let’s try the former, which is hard.

In the trade war, the US Senate narrowly rejected an attempt to overturn Trump’s tariffs: we are stuck with them until he decides we aren’t. On which, Trump said he expects a great relationship with PM Carney, which may not bode well for Canada, as Alberta’s Premier laid down the law to the PM and flirted with the idea of independence.

Moreover, the USTR says several trade deals are “close”, again: again, it’s Japan, South Korea, and India being name-dropped. If/when a first deal is signed, markets will have a clearer idea of what lies ahead: yet Trump just said he’s in no rush, and as we’ve laid out, what lies ahead likely involves a new bloc vs China that would resolve many uncertainties while creating vast new ones.

Anyone thinking better US-China trade ties are on the cards too, which apparently includes the US President in his latest comments, isn’t paying much attention (including to the headline writers not noting that he said this deal would be “on our terms” and “fair”). Rather, at the very least, escalation to deescalate is underway.

Congress just reintroduced a bipartisan SHIPS bill to increase US shipbuilding, targeting 250 commercial vessels over the next decade, which includes the dropped USTR port fee for non-Chinese firms ordering China-built ships; subsidies for US shipbuilders; preferential treatment for US cargo; and requiring a rising % of US imports from China be transported on US-built ships. All this will have a disruptive effect on global trade we’ve already spelled out; yet the emergence of such legislation was predictable to those who read maritime history rather than just Bloomberg.

Moreover, China, whose PMI data yesterday showed trade war impact, was also reported to be months away from running out of copper: it’s not just the West that is reliant on key imports: and the US knows what they are and where they get them from.

As such, on the geopolitical front –which is joined at the hip to trade– things are also moving.

The US and Ukraine signed the 50/50 minerals investment deal. Treasury Secretary Bessent stated: “This agreement signals clearly to Russia that the Trump Administration is committed to a peace process centred on a free, sovereign, and prosperous Ukraine over the long term.” Kyiv hopes the US may also increase defence aid, which would be useful given Europe and the UK just admitted they can’t find enough troops for the peacekeeping contribution they’ll have to make.

Many decrying Trump trying a statecraft Noxin (reverse Nixon) will cheer a US hard line vs Russia. However, the alternative means economic statecraft against Moscow: Senator Graham is pushing legislation to impose 500% secondary tariffs on anyone who buys Russian energy, which would have a destabilising impact on energy markets. Would those decriers call for actual war but not economic warfare, “because markets”? Would Russia buckle and strike peace and Noxin deals?

The troika of Charlie Kirk, Tucker Carlson, and Donald Trump, Jr. make clear they don’t want war with Iran even if the terms of a deal –no more uranium enrichment– seem unreachable, and Israel remains implacable in its opposition to a can-kicking exercise that sees it carry the realpolitik can if Iran then builds a nuke. Meanwhile, Saudi Arabia, trying to please the US, said that it will keep pumping oil even as prices decline.

On two related fronts we have either a sustained bear market in oil or a rapid geopolitical move higher. Interestingly, and relatedly, the US Koch brothers just exited energy trading in what is being described as a “retreat from speculation.” NB that’s exactly what economic statecraft wants to see, as commodities, not “because markets”, are going to be a key focus of it ahead.

Moreover, things are moving in the financial system too, and not just in terms of bond yields grinding lower in DM but moving higher in EM like Argentina and Brazil. Yesterday, the US Treasury released a report on dollar stablecoin usage with huge implications for the structure of markets, and which benefits the US over others. They talk of higher deposit rates, a huge inflow into US T-bills, and much more – and most of it benefitting the US at the expense of others. Does that make it more or less likely to happen ahead? I’m asking for a friend who usually focuses on GDP.

In short, we have sharply binary geopolitical outcomes ahead and either: sustained trade chaos, with one set of implications for the world economy; or a US retreat, with another set of implications (and second, third, nth order effects the people who want to see it happen don’t grasp at all); or a clear global bifurcation between the US and China across still-variable geography and asset classes.

Please put that all into your GDP model and tell me what it says.

Tyler Durden

Thu, 05/01/2025 – 11:45