Watch Live: Fed Chair Powell’s First Trump 2.0 Press Conference

Our tweet sums it all up…

„Any minute now Trump will learn that Powell ended cutting rates as soon as the vegetable was booted out of the White House.

The reaction will be glorious”

Following the „least anticipated Fed meeting in recent history”, all eyes and ears will be on Fed Chair Powell’s press conference and his potential to say something more dovish than the statement infers.

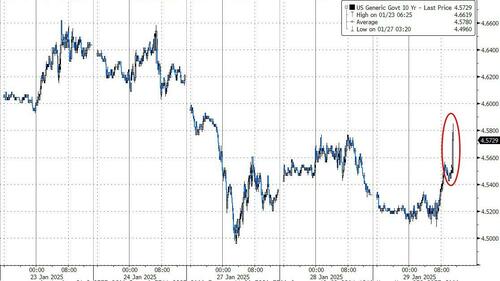

„The Fed’s statement was somewhat hawkish relative to last month, so it isn’t surprising that the knee-jerk reaction was for some modest bear flattening,” Bloomberg Intelligence US interest rate strategists Ira Jersey and Will Hoffman say.

“As we also noted, the press conference may cause even more volatility than these modest shifts in the statement.”

Acknowledging that inflation is not making progress toward the target is clearly a surprise for the bond market, which had anticipated that Powell would highlight recent soft data reads.

Hence, rate-cut pricing in swaps is being trimmed, with March back around 5bps vs 7bps and June no longer fully priced for this year’s first cut. The market now looks to July for the Fed to cut again.

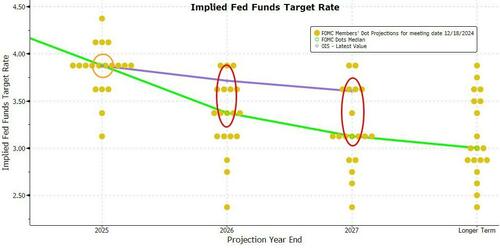

President Trump has mentioned his desire for „much lower” interest rates but we would not expect Powell to show his hand at all (indeed it would very out of character) with forward-guidance expectations now perfectly in line with The Fed’s dotplot expectations for 2025.

However, the market remains significantly more hawkish than The Fed’s dots for 2026 and 2027…

Will Powell be asked about (or mention) DeepSeek (market instability) or Trump tariffs (inflationary)?

Goldman’s Paolo Schiavone summarizes the setup going into the presser perfectly:

1. Powell wants a Fed meeting with zero volatility. It will be the third meeting where he tries to avoid Trump.

2. The starting point is the risk sell off from the Dec meeting as “ Some people did take a preliminary step incorporating conditional estimates of economic effects of policies”. Should they dial them back?

3. Fed will likely maintain optionality as the markets is comfortable with a tighter distribution of outcomes.

Powell will likely talk up the strong economic backdrop… but…

Schiavone sees three possible scenarios from the press conference:

Base case (55%) “meaningfully restrictive” / patient (Reiterates SEP 2 cuts in 2025)

-

Labor market remains “solid” – u-rate falling and NFP running at or slightly above breakeven rate.

-

ISM, Small business optimism and survey data picking up poses risk of re-acceleration of data.

-

Acknowledge last 2 months of “good inflation” data, core PCE at 0.15%

But given sticky underlying inflation/residual seasonality Fed can continue to be patient

-

Monetary policy remains “meaningfully restrictive” but is “significantly less restrictive” after 100 bps of cuts.

-

SEP: December SEP still largely a good baseline for where the committee as a whole is.

-

Tariffs – Important point that discussion is moving towards phased-in universal tariffs – as per comments in WSJ

-

FCI tightening has been very modest

-

QT: No concrete plan on QT taper/wind down – still see reserves as abundant

Hawkish (20%):

-

Modest re-acceleration in data across labor market / activity

-

Real income growth poses real risks of an economic reacceleration

-

Inflation data improved but have to see the effects of residual seasonality in months ahead.

-

Downshift policy stance to “somewhat restrictive”

-

Tariffs: Bring into discussion the impact of phased in universal tariffs as creating more persistent uncertainty

Dovish (25%)

-

Labor market in balance, stronger NFP can always be revised lower. Quits and JOLTS LOW

-

Very good progress in inflation. Focus on market-based core PCE and housing disinflation slowing.

-

No mention on neutral rate and worried about stock market volatility and impact on households’ wealth

-

Reiterate Waller comments and on QT: Discussion started about winding down QT as reserves approach more “ample” level

The biggest risk continues to be losing the control of the long end… and Powell’s need, therefore, to try and manage that.

Watch the full press conference live here (due to start at 1430ET):

Tyler Durden

Wed, 01/29/2025 – 14:25