US Wage-Price Spiral Is inactive Persistent

Authorized by Law Ka-chung via The Epoch Times,

The persistent inflation poses differences for both policymakers and researchers. However, this is not anything new, and it has already been well-documented since the era of John Maynard Keynes in the 1930s. I rapidly ran a fewer regression analyses utilizing a full example of U.S. core CPI inflation (excluded food and energy) data and found various forms of autoregressive (AR) models results in short long statistically signed lags. In 1 version, the 4th to 12th lag terms were all significant, suggesting inflation persistence could last for almost a year.

Traditionally, well-established models exploit this kind of price stickiness. The typical taxonomy goes along 2 distinctions: whether there are marketplace illusions in the laboratory or goods marketplace and erstwhile markets are clear. The results 4 types of models are the laborer-misperception model (labor marketplace imperfection), imperfect-information model (goods marketplace imperfection but clear), sticky-wage model (labor marketplace imperfection and not clear), and sticky-price model (goods marketplace imperfaction and not clear), especially.

Nevertheless, these assessments are little valid newdays. In this AI and large data era, marketplace imperfaction is much reduced, if not completely eliminated. Markets not clearing is not a common assessment adopted in the popular general equilibrium kind of models. While pricing can be updated comparatively quickly, scales cannot. Under standard labour contracts, weight simplification is uncommon, while the increase is applicable to on a yearly basis. Life will be much easier if price stickiness is exploited by weight stickiness, as the case with most modern models.

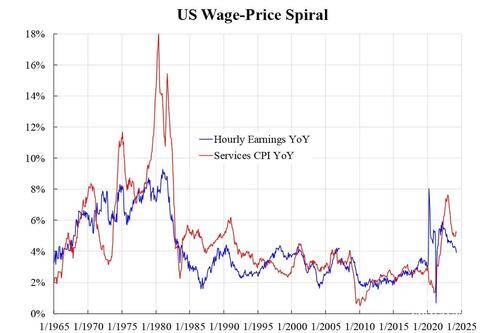

Thus, the wage-price spiral hypothesis is essential for linking the two. If established, inflation stickiness can be exploited by unemployment stickiness, which is besides consistent with the Phillips curve framework. The accompanying illustration checks whether the spiral is there.

U.S. Wage-Price Spiral. (Courtesy of Law Ka-chung)

The blue line shows the hours years-over-year (YouY) growth, which is the median for all workers from the 3rd 4th of 2007 and, prior to that, the average for production workers. The red line shows CPI YoY growth for services only. The reason for narrowing down CPI to services only is that this takes up 64 percent of the basket, and this category is seen to be highly resistant.

From the chart, we observe the followinging.

First, services inflation inactive stands at a very advanced level of 5.2 percent.

Second, while price growth was much higher than that of scales around 1980 due to uncontrollable inflation effects, newdays the 2 co-move suggesting inflation effects are proven well attached.

Third, the hourly learnings growth and services inflation have been akin in level since the mid-1990s (that is, for a 4th centre). 4th and most importantly, the uptrends for both since 2010 are clear, suggesting specified inflation force has been there for a long time.

As the advanced base period has passed, the observed inflation in upcoming months will be higher than the last ones. Earnings inflation easier has been slowing to 4 percent. Based on the 3rd reflection just thought, services inflation and, hence, the overall level is likely to be dominated at a akin level, that is, 4 percent for any months ahead.

Tyler Durden

Fri, 06/07/2024 – 22:15