US maker Prices Accelerating At Fastest Rate In 12 Months, Wall Street Reacts...

Ahead of tomorrow’s CPI, traders are eyeing this morning’s maker Prices for any hints that the disinflation trend will return...or not.

The answer is “not!”

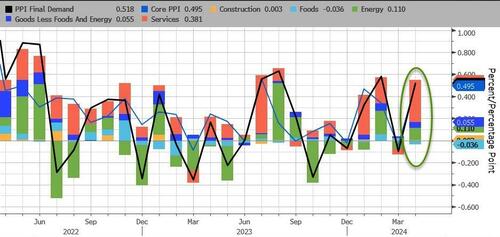

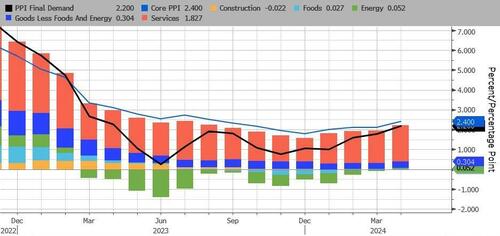

April maker Prices rose 0.5% MoM (vs +0.3% exp), with March’s +0.2% MoM revised down to -0.1% MoM. The downward revision did not halt the YoY read rising to 2.2% (from +2.1% in March)...

Source: Bloomberg

This is the highest YoY read since April 2023 and is the 4 hotter than expected header PPI print...

Source: Bloomberg

Producer Prices have been aggressively revised for 4 of the last 7 months...

Source: Bloomberg

Services costs soared, dominating April’s PPI gain with Energy the second most crucial factor. Food prices actually declined on a MoM bass.

Source: Bloomberg

On a YoY bass, header PPI’s emergence was dominated by Services (rising at their hottest since July 2023). For the first time since Feb 2023, no of the underlying factors were negative on a YoY base...

Source: Bloomberg

After last month’s casually adjusted’ gasoline price, April Saw the PPI Gasoline index emergence (with actual prices at the pump) but inactive has a long way to go...

Source: Bloomberg

Core PPI was sack – rising 0.5% MoM (more than double the +0.2% MoM expected) – which pushed the Core PPI YoY up to +2.4%...

Source: Bloomberg

And yet US PPI Final request little Foods Energy and Trade Services rose by 0.4% MoM and 3.1% YoY (the highest in 12 months).

Worse inactive the pipeline for primary PPI is not good as intermediate request is starting to accelerator...

Source: Bloomberg

Here are Wall Street’s reactions to PPI:

Chris Larkin at E*Trade from Morgan Stanley:

Sticky inflation looked downright pat this morning after a much hotter-than-extincted inflation reading. But with last month’s numbers revised lower, this study may not have been as much of an upside shock as it first appeared to be.

Right or wrong, the CPI trends to have a bigger short-term impact on the markets, so the image could look much different 24 hours from now. But if the CPI besides comes in above expectations, the curious rate image may be threen into double.

Bespoke Investment Group:

The results of April’s PPI showed a hotter-than-expected m/m reading. That’s the bad news. He a y/y basis, though, the readings were much closeer to expectations as March’s study was revised down to negative 0.1% on both a header and core bass.”

Chris Zaccarelli at Independent Advisor Alliance:

This week is crucial for markets due to the fact that they are welcome about inflation and this morning’s maker price index hasn’t done anything to assist these fears.

The most crucial data release is tomorrow’s CPI print due to the fact that the Fed’s dual mandate is based on CPI and unemployment, with the erstwhile being what the Fed is solely focused on right now.

We believe that the stock marketplace will decision higher through the year on strong corporate profits and consumer spending, but flexibility is likely to spice in the means, due to the fact that the inflation data is going to keep the Fed on edge.

Quincy Krosby at LPL Financial:

Moreover, this study underscores Fed deals that the way of disinflation has steeled, requiring a higher-for-longer policy standing to combat seemingly entered inflation.

An overriding question — and powerful dilemma — holding over markets is whether the broadcaster economical scenery is softening at the same time inflation inches higher, making the Fed’s occupation creatively difficult.

Bill Adams at Comerica Bank:

Between an upside surprise and downward revisions to prior date, the trend in full PPI was lightly higher than expected in April.

The PPI study suggestions upside hazard to the April CPI report, which will come out tomorrow.

At the margin the Fed will see the PPI study as another reason to slow-roll interest rate cuts.

Paul Ashworth at Capital Economics:

These days we mostly care about what the PPI means for the Fed’s preferred PCE deflator measurement of core consumer price inflation.

In that respect, April’s news was mixed but, on balance, encouring. The bad news is that PPI portfolio management prices increased by 3.9% m/m. But that was more than outweighed by the good news. We’ll know more after the release of April’s CPI tomorrow.

Scott Helfstein at Global X:

Inflation and the Fed are little crucial than growth, and companies have updated to the fresh reality of higher prices and proceed to look for technology solutions to manage for profit.

The last mile on inflation was always going to be the hardest, but we should be comfortable with these numbers.

Over the past month, 'higher prices' have dominated 'lower prices' in fresh survey data...

Higher maker prices:

- New York Empire manufacturing price paid advanced to 33.7 from 28.7.

- Philadelphia Fed manufacturing reported prices paid gained to 23.0 from 3.7 in March.

- Philadelphia Fed non-manufacturing prices paid rose to 31.0 from 26.6 in the prior month.

- Richmond Fed services prices paid rose to 6.11 from 5.43 in March.

- Kansas City Fed manufacturing prices paid advanced to 18 from 17.

- Kansas City Fed services input price growth continued to outpace selling prices.

- S&P Global manufacturing input cost inflation quickened to hint at sustained near-term upward force on selling prices.

- ISM Manufacturing prices paid gained to 60.9, the highest since June 2022, from 55.7 in March.

- ISM Services prices paid notched up to 59.2, the highest since January, from 53.4 in March.

Lower maker prices:

- New York Fed Services prices paid fell to 53.4 from 55.1 in March.

- Richmond Fed manufacturing growth rates of prices paid distributed to 2.79 from 3.22 in March

- Dallas Fed Manufacturing outlook reported prices paid for natural materials dropped to 11.2 from 21.1 in the prior month.

- Dallas service sector input prices index nudged down to 28.8 from 30.4 in the prior month.

- S&P Global Service Saw input costs sled from six-month highs in March.

Do you see the 'flation' now, Jay?

So, no, The Fed does not have inflation under control.

Tyler Durden

Tue, 05/14/2024 – 8:43