US Leading Economic Indicators Tumble Most In Over 2 Years

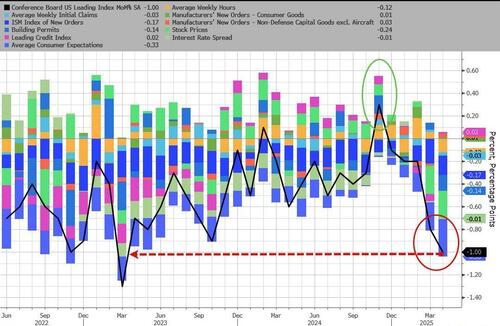

Since December’s Trump-optimism-driven surge in Leading Economic Indicators (the first since last February), The Conference Board’s headline index has decelerated rapidly with April data released today plunging 1.0% MoM – the biggest drop since March 2023…

Source: Bloomberg

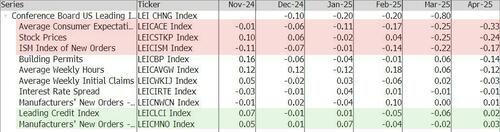

Once again, Consumer Sentiment (cough UMich Democrats) and Stock Prices were the biggest negative contributors, while New Manufacturing orders (hard data) and Credit were the biggest positive contributors…

Source: Bloomberg

That dragged the total index level down to its lowest since February 2016…

Source: Bloomberg

“The U.S. LEI registered its largest monthly decline since March 2023, when many feared the US was headed into recession, which did not ultimately materialize,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

“Most components of the index deteriorated. Notably, consumers’ expectations have become continuously more pessimistic each month since January 2025, while the contribution of building permits and average working hours in manufacturing turned negative in April.

Widespread weaknesses were also present when looking at six-month trends among the LEI’s components, resulting in a warning signal for growth.

However, while the six-month growth rate of the LEI went deeper into negative territory, it did not fall enough to trigger the recession signal.

The Conference Board currently forecasts US real GDP to grow by 1.6% in 2025, down from 2.8% in 2024, with the bulk of the impact of tariffs likely to hit the economy in Q3.

Source: Bloomberg

So the economy is doomed (ish) because stocks and sentiment are down… because investors are pricing in a doomed economy…?

Perhaps the word 'leading’ in this index is misleading…

Tyler Durden

Mon, 05/19/2025 – 14:00