Donald Trump's expectations about the behaviour of allies are advanced and inactive growing. It was not adequate for Washington to impose duties on the European Union and Britain of 15 and 10 percent respectively, which Brussels and London accepted politely and without a word. Now Trump would like Western US partners to take his side in economical competition with China. He urges them to jointly impose duties on Beijing and Delhi of as much as 100% for buying Russian fossil fuels. It besides calls for China to be expelled from key ports in Europe and both Americas.

Chinese dominance in European ports – a threat to Western security?

China's push from ports in Europe can be crucial in the context of the emergence in tensions between Washington and Beijing. These are not just theories, as the presence of Chinese in European ports is already leading to problems. In 2023, they blocked, among another things, the landing of arms supplies for Ukraine in the port of Gdynia, where they have a terminal. Hutchison Port Holdings' land is located a fewer 100 metres from the site where the Nattov equipment is unloaded, which in itself is embarrassing due to the fact that the Chinese are known for their skillful theft of classified information. 2 years ago, a ship with a supply of weapons mildly protruding its bow into a land leased by a Chinese-controlled company. This 1 refused to authorize the unloading of equipment that had to be unloaded elsewhere.

Hutchison has a network of terminals around the world, but he is not the biggest player from China in this field. The prim leads the giant COSCO, who full controls the port in the Greek Pyreus, besides has terminals in Valencia and Bilbao. Chinese straight or indirectly besides control terminals in ports in Rotterdam, Antwerp, Hamburg and Gdynia. By Analysis The Centre for east Studies, together the PRC has 33 terminals in Europe, although they control only Pireus in their entirety.

Theoretically this makes sense – China is simply a giant supplier of manufactured goods and owner of containers and container ships. COSCO itself owns about 10 cargo ships with a gross tonnage of more than 100 000 tonnes. At a time of globalization, Chinese participation in European ports was no origin for concern. The problem is that the co-operation of the world's top powers She's gone to lame.So China's presence is no longer neutral.

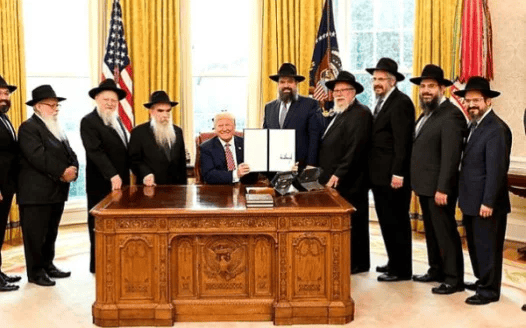

It must be said that Donald Trump is already successful in this respect. His emphasis on Panama led to Hutchison's decision to resell 2 terminals in Panama an American-Italian-Swiss consortium (one of the entities is simply a celebrated investment fund BlackRock). Hutchison will besides sale its remaining port terminals outside China, including Gdynia. The finalisation of the transaction requires the approval of the regulatory authorities, which will proceed and it is unknown how the Chinese regulator will behave. However, it seems that by force the Chinese are stuck in Europe and America are not going to.

Chinese exports are inactive increasing despite customs – how does the planet economy react?

The current Chinese-American relation is simply a rollercoaster. At 1 point, the bilateral duties reached up to 150 percent, but both leaders cooled down and concluded a temporary truce. Beijing abolished export restrictions on uncommon metals in which extraction is simply a global giant, and Trump reduced duties in return to "just" 30%. In this way, it can be said that against the background of Brazil or India, to which the president of the United States served tariffs of 50%, Beijing is treated preferentially. This is evidently an illusion, due to the fact that tariffs are not the only instruments utilized by the American administration to curb Chinese growth.

Yet In Biden’s Time introduced sales restrictions on the most advanced integrated circuits, and Trump expanded the blacklist of companies with which no US business partner can trade, by subsidiaries of Chinese companies or utilized by them to circumvent restrictions. The softened Xi decided to bribe Trump, promising Investments over the Potomac of a trillion dollars in exchange for removing Chinese companies from the U.S. blacklist – like EU or South Korea's commitments, which besides promised Trump hundreds of billions of dollars of investment in exchange for lowering duties to 15%.

If Washington had agreed to Beijing's proposal, we'd have another twist in these capitals. However, there is no possible of lasting harmony, as in rule both countries seem to be heading towards intensifying competition – only economical ones.

So far, American efforts to reduce Chinese exports have not produced spectacular results. Before 2025 China exported goods worth over $300 billion each month. At the beginning of the year Chinese exports jumped to $540 billion in February, as well as import to the US, which in the period January-March exceeded 400 billion dollars, although before 2025 it was about 350 billion. This increase was due, among another things, to the accumulation of stocks by US companies, which wanted to defend themselves against tariff increases. In the second 4th of that year, imports to the States returned to the level from the end of Biden's tenure, but Chinese exports are inactive somewhat higher than at the end of 2024 – reaching 320-330 billion dollars a month.

The European Union carefully reduces dependence on China

China diverted any of its exports to another locations. Textiles began to sale to the EU – in the first half of this year imports of Chinese clothing to Europe increased by 20% year-on-year. In addition, Beijing bypasses US tariffs by selling goods through intermediaries from Vietnam and another Southeast Asian countries, which are charged 20%. The Americans will most likely patch these holes, threatening to rise tariffs imposed on them, as well as extending their black list of businesses.

Europe is not on fire to impose dense restrictions on Chinese imports, as it relationships The economy with you is more intense. The European Union imports and exports more and has more investment in this direction. In 2023, the state of EU abroad direct investment (FDI) in China was EUR 232 billion. At that time, US FDI amounted to 127 billion dollars, at the current rate of little than 110 billion euros.

Nevertheless, the EU reduces its trade dependency on China. Between 2022 and 2024, it reduced imports of its goods by EUR 110 billion per year (from 630 to 520 billion) and the trade deficit by 91 billion (from 397 to 306 billion). Brussels, among another things, introduced tariffs on electrical cars made in China, although their rates are low – they scope little than 40%, while in the US it is 100%. Moreover, Brussels is working on introducing tariffs on steel and aluminium, which will besides affect trade with the PRC.

However, China is already experiencing the effects of a tightening of Western politics. You can see that first and foremost in falling FDI. All last year's value new FDI It fell and by the end of 2024 their inflow shrunk by almost 30% year-on-year. This year they are inactive falling at a rate of respective percent. Business sees a change in approach to the relation with the PRC, so it abstains from investing in order not to stay on the ice. However, China can besides react. In the spring they ended soy import from the USA, switching to suppliers from South America, which was severely felt by American producers for whom the Chinese marketplace is key.

Europe should work with the US, but on its own terms

Overall, however, the West is simply a more crucial marketplace for China, not the another way around. The USA and the EU jointly account for about 1 3rd of Chinese exports. Americans only send 7% of their exports to China and the European Union 8.5%. Therefore, Chinese exporters will be much more affected by the crucial simplification in trade relations. Western companies could even benefit from this cut-off, as any EUR 10 billion or USD not spent in China could be spent in the EU or the US.

Of course, shifting any of the production from China to the EU will mean rising prices, as the costs incurred in the West are higher. However, the inflation resulting from the relocation of production can be very limited, as China is no longer as inexpensive as it utilized to be, and in Central and east Europe – especially in countries with their own currencies – can be produced comparatively cheaply. By data The planet Bank in 2021 prices in China were 98% of the planet average prices, giving them 50 place on the globe. In Poland prices were only 71% (88th place) and in the Czech Republic 88% (59th place).

The Chinese offer of trillion investments in the US in exchange for lowering tariffs shows that Beijing fears trade rivalries with the West more than the capitals of the Euro-Atlantic community. However, Europe would have been easier to join Washington in his crusade against China's growth if it had not previously received 15% of the American duties. Trump first treated his allies from his boot, and now he expects loyalty from them. However, reducing dependence on Chinese exports would be good in itself – it would improve the trade and payment balance and could stimulate European production. The EU should so join the US, but on its own terms, alternatively of following instructions from the White House.

Brussels can detach from China gradually and selectively, choosing circumstantial industries (RES, integrated circuits, electronics) to be cleared, and the others leaving in peace, at least for a while. In terms of trade, Europe is inactive a planet power, so it can afford its own policy towards China.