Explosion of gold and silver: Something large is happening.

author: Brandon Smith

At the beginning of 2020, at the beginning of pandemic hysteria, I noticed that the panic surrounding covid perfectly coincided with the acceleration of interest rates by the national Reserve and asset dumping. This trend, as I argued, was the announcement of the script of Paragraph 22, which I warned against for any time.

Since the crash in 2008, the central bank has been utilizing stimulus measures and almost zero interest rates to defend corporations "too large to fall", while maintaining the debt on the surface globally. This required a digital printout of tens of billions of fiducial dollars and, inevitably, a violent devaluation of the dollar.

I thought it would lead to a statement. Stagflation(which yet hit 2022) and to the puzzle between inflation and deflation.

The national Reserve could proceed to keep low interest rates and ignore inflationary pressures to avoid a debt collapse.

Or could they significant rise interest rates, let the debt strategy to take the cure and fall at prices, suppressing the effects of inflation by suppressing consumer demand.

Each of these options could trigger an economical crisis.

Maybe it's understandable that Fed decided Don't go..

Instead, they raised the indicators, but Not so much.To reverse the stagflation. They chose the intermediate way and refused to let the economy to take the medicine they needed, putting the settlement of unfair investments.

In fact, putting the case on hold for another administration to handle it.

The implications of Fed strategy "too little, besides late"

That means we inactive gotta put up with it. huge price increases that occurred during the Biden administration.

Of course, inflation slowed down. However, the cost of surviving is much higher than it was 5 years ago. (Remember that inflation above zero does not mean decrease prices – this means that they grow further, but Slowly.)

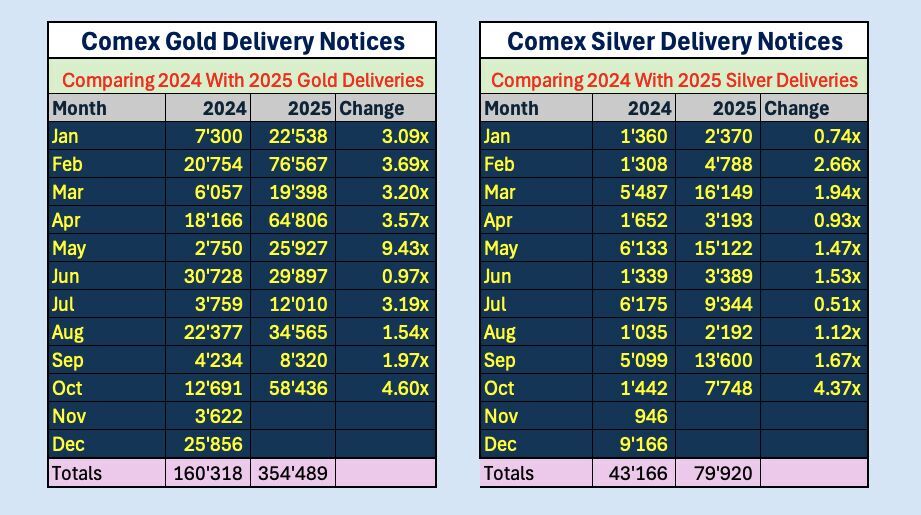

In 2020, I wrote an article entitled "Physical gold shortly spectacularly freed from paper market", foreseeing a sharp increase in the value of precious metals erstwhile this "paragraph" situation becomes apparent to investors. I was expecting that buyers Increasingly for the benefit of financial derivatives (term contracts, etc.) physical supply of gold and silverwhich will origin parabolic physical prices.

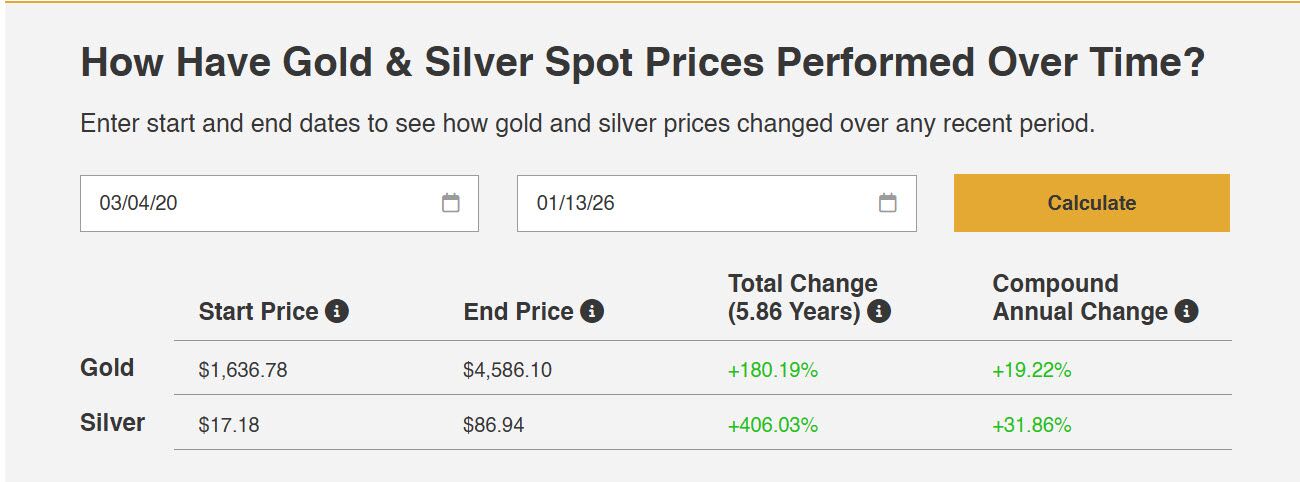

Since this article was written gold price for an ounce increased by over 200%. The prices of silver exploded by 400%.

Silver reaches a evidence $90 an ounce erstwhile I compose it. Gold is approaching $4,700 an ounce.

(Maybe large banks like JP Morgan are deliberately withdrawing from marketplace manipulation for any reason?) Global purchases of gold by central banks they have reached historical levels all year since 2022, surpassing even the levels we observed after the large Financial Crisis.

All this background – what does it mean?

Economic singularity

I think we're witnesses. economic peculiarities – a minute of large change.

A at least informing signals of the upcoming change.

The problem is that this message is largely ignored, even by more conservative platforms. besides fewer people talk about what happens to precious metals and what this means for the full economy.

Here's what I think...

First,, haste on physical assets suggests that banking institutions, governments and the richest 1% of investors are feverishly trying to safe in preparation for the real crisis. (I specify institutions and very wealthy, due to the fact that a single contract for the supply of gold COMEX means 100 ounces of gold, or almost Half a million dollars. at today's prices – far beyond the average possibilities of a typical American family.)

As I noticed in 2020, erstwhile banks They're gonna rush. with buying physical gold and silver, The remainder of us should do the same.. They are most likely working to counter losses in another assets. Or they foretell any kind of geopolitical earthquake that'll origin a price explosion.

It is not hard to see the possible of geopolitical conflict at the moment. European governments are becoming increasingly hostile to the US on customs issues. They keep trying to start planet War III with Russia and so on.

Second, there are interior problems caused by protests against immigration enforcement. The issue of deportation is just a convenient excuse for a wider conflict between the left and the right. (If the ICE agents had come home next day and stopped arresting, the left would have found another subject to rebel.)

As we witnessed in 2020, home chaos is simply a tool for political extortion. Meanwhile, civilian instability drives the increase in metal.

Third, there are tensions with Russia and China that are not satisfied with the capture of communist dictator Nicolás Maduro. Venezuelan oil exports were crucial to Chinese industrial capacity. Although Venezuela's supply represented only about 4.5% of Chinese imports, the failure of 4% or more on an unstable planet marketplace is, to put it mildly, undesirable.

Venezuela served as a starting point for military resources in the Western Hemisphere (including US surveillance systems). Chinese and Russian weapons failed against US operations, which could lead to escalation in the future.

The greater effects of removing Maduro cannot yet be measured, but they will have consequences.

Most Venezuelans seem delighted The liberation from Maduro. The question is, can we avoid a long-term deadlock? Our military is perfectly capable of precise demolition of enemies, but we have terrible results in the long-term military occupation.

Fourth, let us not forget the protests in Iran and the possible change of government there. I have no individual interest in what's happening in the mediate East. I think the U.S. should stay as far distant from this mess as possible, but I have no illusion that Trump will sit quietly and just watch. He proved to be a man of action.

I must say, his abroad policy decisions were surprisingly effective and adopted by the public active – at least in most cases. Nevertheless, erstwhile geopolitical conditions change so quickly, Inevitably this creates shocks in the global economy. Even erstwhile action is morally correct and strategically necessary, the consequences are unpredictable.

FinallyThe Fed seems determined to lower interest rates, never solving the first stagflation problem. Consumer expenditure never fell. The accumulation of debt, both at national and household level, continues to grow. Most goods prices are inactive advanced compared to 2020. The US must go through at least a short period of deflation to correct stagflation, and the banks have done everything possible to prevent it.

In another words, if Fed keeps lowering his feet, inflation will return in 2026.

Here's what happens next.

I believe that all the right factors substance to proceed the success of gold and silver.

I wouldn't be amazed if the silver came close to $200 an ounce by 2027. Combination of request for all different industrial uses of silver combined with a multi-annual supply deficit, including US designation decision silver for critical mineral – and there are besides attempts by China to ban silver exports and insatiable request for silver as an investment? It's a combination of forces that almost guarantees an increase in price. And they're no more "transitional" than the inflation surge in Covid times. I foretell that these forces will drive the ratio of gold to silver to levels late observed during the jump in 2011 (35:1), which present will bring the price closer to $113 an ounce.

I don't see any signs that global pressures are about to slow down. In fact, I think the noble metals tell us that the situation will become much More chaotic.

Today, possibly more than ever, having physical gold and silver is simply a declaration of financial freedom. independency from the fiscal chaos of the national Reserve and national government debt.

https://www.bircgold.com/blog/news/gold-silver-stress/