Tit-For-Tat Responses From Beijing To Trade Restrictions May Bring About A Full-Blown Trade War

By John Liu, Zhu Lin and Abhishek Vishnoi, Bloomberg Markets Live reporters and strategicists

China’s most-promising industries are facing a increasing Threat of trade restrictions from Western governments, blurring the outside for stocks that have the possible to fuel the nation’s marketplace growth.

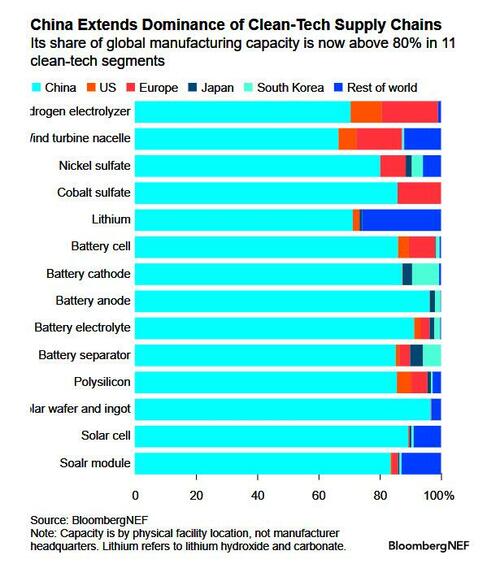

The sectors under scrutiny by Europe and the US are as wide-ranging as electrical vehicles, elevator and solar projects, medical devices and chips, but have 1 thing in common: they are of strategical import to president Xi Jinping's bid for leadership in the global race toward green transition and high-tech development.

The rising tensions come at an inopportune time. Stocks Were Starting to appear from a multi-year slump as investors bought into China’s efforts to build fresh growth engines and accomplish self-sufficiency along key supply chains. A materialization of these threes can hide China’s global expansion, while tit-for-tat responses from Beijing may bring about a full-blow trade war that would dramatically alter the investment landscape.

“Geopolitical pressures will only emergence — any exports can be targeted since it’s no longer truly about trade fairness,” Said Vey-Sern Ling, managing manager at Union Bancaire Privee. “It dampens the export growth drivers for China’s economy.”

China’s CSI 300 Index has clipped about 3% of this year, accounting any footing after a third-annual fate. Performances among leaders in the green and high-tech manufacture have been mixed as geopolitic risks add to deals over superupply and price competence.

Battery Giant Contemporary Amperex Technology Co. Ltd has jumped nearly 17% onshore this year while EV leader BYD Co. has advanced 6%. Longi Green Energy Technology Co. and Semiconductor Manufacturing global Corp. have lost about 20% each.

The biggest Chinese companies that get at least a half of their return from exports command more than a 14% weight in the CSI 300, with many of them including CATL and BYD trading at a higher price-to-earnings ratio than the benchmark, according to data compiled by Bloomberg.

While trade spats have become a permanent feature in China-Western relations under Xi, the fresh months Saw tensions bagen. The European Union has joined US-styled protectionist moves as a complex mix of national safety deals, economical and political conventions play out.

President Joe Biden’s call for tariffs as advanced as 25% on any Chinese steel and aluminum products shows how China-basking will ratchet up in a presidential election year. In Europe, policymakers are responding to increasing companies from local manufacturers that China’s industrial overcapacity is crowding them out.

The scope of targeted products mostly overlap with Xi’s industrial priorities labeled “new productive forces.” Investors had been hunting for stock winners since the first was listed on Beijing’s top agenda in early March, triggering a brief rally in shares from robotic companies to chip makers.

“While the fresh productive forces may have policy tailwinds, these may be somewhat offset by rising geopolitical pressures, partially in an election year where sound will likely increase,” said Marvin Chen, a strategist at Bloomberg Intelligence.

The focus is now on which sector will end up next in the crosshairs. EVs have so far ben a key target, with Gavekal investigation pointing to the EU’s wrestling trade balance with China in the industry.

“The cyclic positioning of Europe and China points to the trade balance tipping in China’s favor,” Gavekal analysts Cedric Gemehl and Thomas Gatley gate in a note given April 15. European home request is strengthening, which should spur more purchases of Chinese goods, while EU exports to China are likely to flat-line at best on week demand, they said.

Shen Meng, manager at Chanson & Co. in Beijing, results lithium battery makers to face increasing pressure. The manufacture falls under the category of clean tech and has been a top driver of China’s export growth in past years, he said. Key players include CATL, Eve Energy Co. and Gotion High-Tech Co.

In any sense, there’s a bright side to the tensions as they can aid get China’s industrial upgrade. A method breakthrough by Huawei Technologies Co., which is not listed and faces US sanctions, has purred a area in the shares of its suppliers.

“While impedite impacts of specified geopolitical pressures might constrain certain sectors temporally, the long-term result could favour Chinese companies that innovative and adapt to changing regulators and marketplace dynamics,” said Tareck Horchani, head of prime brokerage dealing at Maybank Securities Pte.

The various restrictions molded will besides take time to remove. A planned trial by Europe into Chinese medical devices procurement has sent stocks like Shenzhen Mindray Bio-Medical Electronics Co. plunging following the report, but most have since partially recovered their losses.

All things considered, the unpredictable nature of geopolitical tensions increases the hazard of investing in Chinese stocks, an asset class that many were already avoiding due to regulators uncertainties and a slowing economy.

“Any future EU protectionist moves against China will further impede trade and capital flow into the Chinese economy and add to the already dense downward force on its stock market,” said Han Piow Liew, fund manager at Maitri Asset Management Pte. “What all these means is that investing in Chinese stocks in specified an environment is an arduous endeavor requiring Razor-like focus on stocks.”

Tyler Durden

Sun, 04/21/2024 – 22:10