This Is What Hedge And common Funds Did In Q1: Goldman’s HF and MF Monitors

Today Goldman published 2 of the bank’s most easy read periodical reports: the Hedge Fund Trend Monitor (available to pro subs here) and common Fundamentals (also available here), which summarize the quarterly activity and flows of hedge and common funds, distinctly. Both are available to pro subs in the usual place, but here are the key points from each report.

Hedge Fund trend monitor

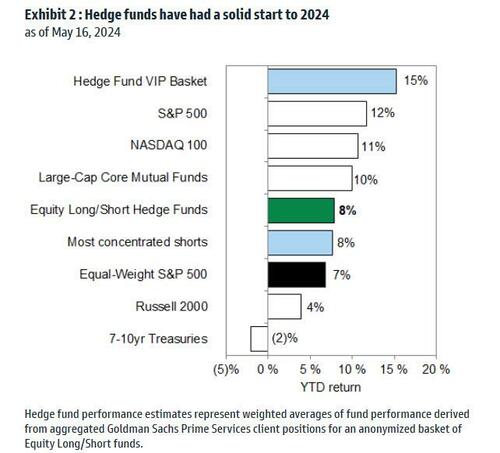

1) PERFORMANCE: US equity long/short hedge funds have generated a solid +8% YTD return. The strong performance of popular hedge fund long positions has boosted hedge fund returns despite a fresh short slide in popular shorted stocks. Goldman’s Hedge Fund VIP list of the most popular long positions (ticker: GSTHHVIP) has returned +16% YTD, outperforming the S&P 500 (+12%) and the equal-weight S&P 500 (+7%). The most shorted stocks (GSCBMSAL, +7% YTD) suggested +25% in mid-May.

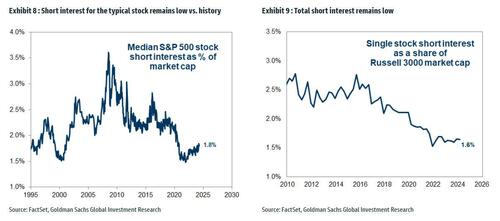

2) LEVERAGE AND SHORT INTEREST: Hedge funds have modernly lifted net leverage along the broader marketplace rapidly while managing evidence gross leverage. Concentrated short positions have been partially volatile lately, causing funds to rotate out of their favourite lengths to cover shorts. However, the most fresh short compression shell her of the fresh experiences in 2021 and December 2023. Short interest for the median S&P 500 stock restores very low at 1.8% of float. Instead, funds proceed to usage macro products.

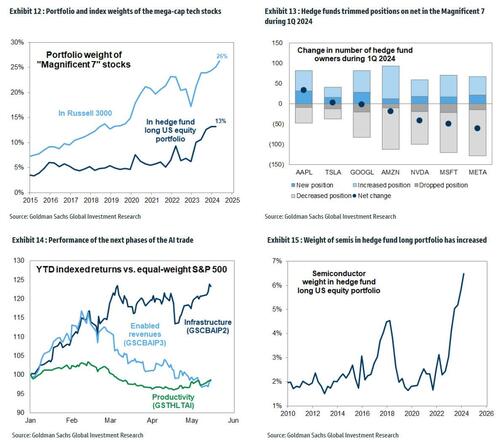

3) HEDGE FUND VIPS: Mega-caps regain the most popular hedge fund long positions. AMZN, MSFT, META, GOOGL, NVDA proceed to morning as the top 5 stocks in the VIP list this quarter, with AAPL joining the top six. The VIP list contains the 50 stocks that appear most frequently among the top 10 holdings of fundamental hedge funds. The basket has outperformed the S&P 500 in 60% of quarters since 2001 with an average quarterly excess return of 47 bp. 14 fresh constitutions: ALIT, APP, DELL, DFS, GDDY, JPM, MU, NEE, SE, SN, VST, WDC, WIX, X.

4) MEGA-CAPS AND ARTIFICIAL INTELLIGENCE: Hedge funds trimmed positions in the mega-caps While adding to AI broadcaster benefits. Share price outperformance has supported the weight of the Magnificent 7 in hedge fund long portfolios, which stabilized at 13% during 1Q. AAPL was the acceptance where hedge funds are creatively added. In contrast, hedge funds added to winners across the entry AI universe, partially in Phase 2 Infrastructure. MRVL, SNX, AES, LFUS are Infrastructure stocks with the largest increase in hedge fund popularity.

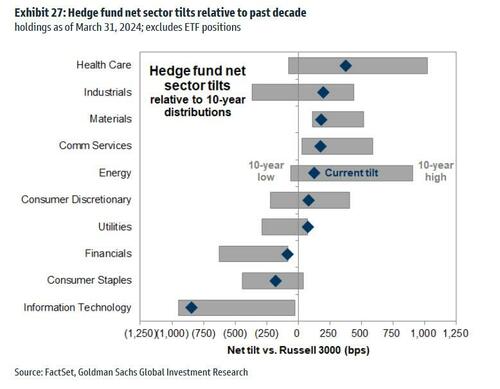

5. SECTORS: Hedge funds continued to rotate toward cyclics, with broad-based increases across Consumer Discretionary, Financials, and Energy. DFS joined this quarter’s VIP list, as did JPM, and besides joined BK and SPGI to screen among this quarter’s list of Rising Stars with the largest increase in hedge fund popularity. Soaring prices besides lifted the weight of Semiconductor stocks in hedge fund long portfolios to a fresh record, at 6.5%. MRVL is the top Rising Star and MU entered our basket of favourite hedge fund long positions.

Mutual Fundamentals

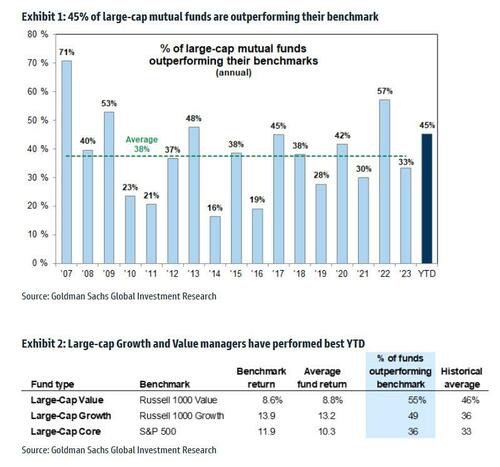

1. PERFORMANCE: common funds have delivered strong results YTD. 45% of large-cap common funds are outperforming their benchmarks YTD, combined with the historical average of 38%.

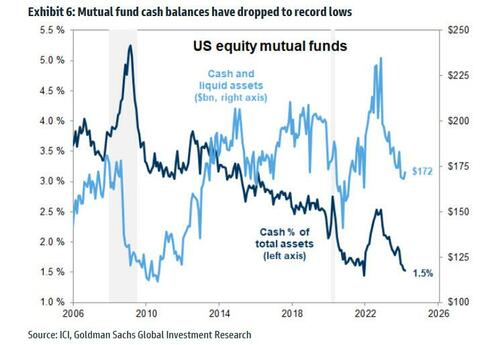

Fund managers have grown creatively bullish on US equities, with cash allocations rolling to 1.5% and matching the value level on record.

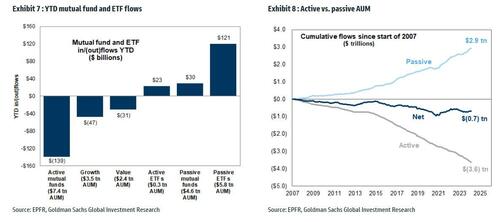

None, active common funds have experienced $139 billion of outflows YTD.

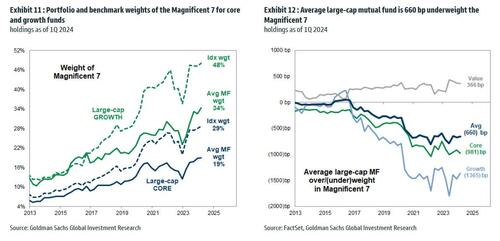

2. THEMES IN FOCUS: (1) MEGA-CAP TECH: expanding benchmark weights and diversification restrictions mean that the average large-cap common fund was 660 bp underweight the Magnificent 7 in 1Q 2024, largery changed vs. last quarter. A net of 120 funds (25%) reduced their vulnerability to MSFT, the largest decline across the group.

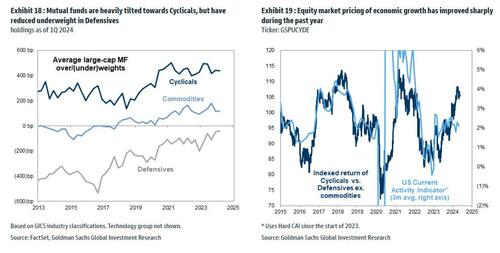

(2) AI: Despite the breadening of the AI trade across share prices, common fund managers mostly avoided taking large tracking mistake on the theme. However, common funds lifted their vulnerability to Utilities to a fresh 10-year high.

(3) CYCLICALS/DEFENSIVES: The average large-cap common fund maintained a 437 bp overweight in cyclic industries vs. the benchmark, which has benefited performance as investor assurance about economical growth Cycles to outperform Defensives (GSPUCYDE) by 4% YTD.

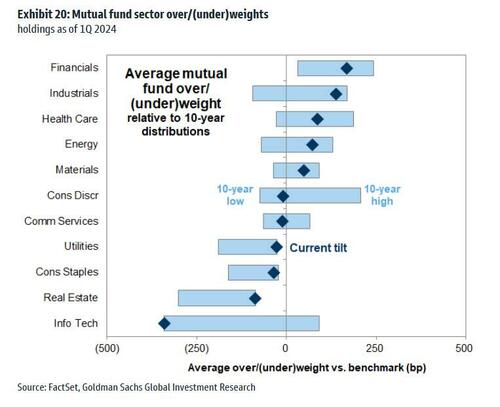

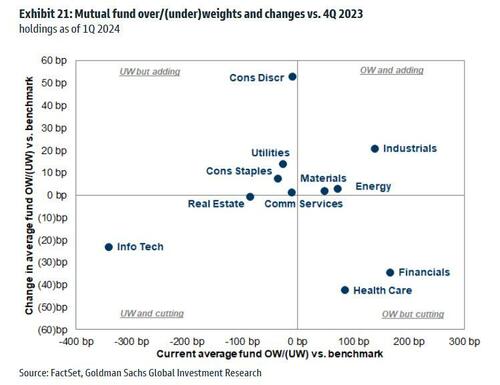

3. SECTORS: The average large-cap common fund is presently the most overweight financials (+167 bp) and Industrials (+139 bp) and the bridge underweight Info Tech (341 bp).

Relative to 4Q 2023, the average fund increased vulnerability bridge to Consumer Discretionary (+53 bp) and cut the bridge to wellness Care (-42 bp) and Financials (-34 bp).

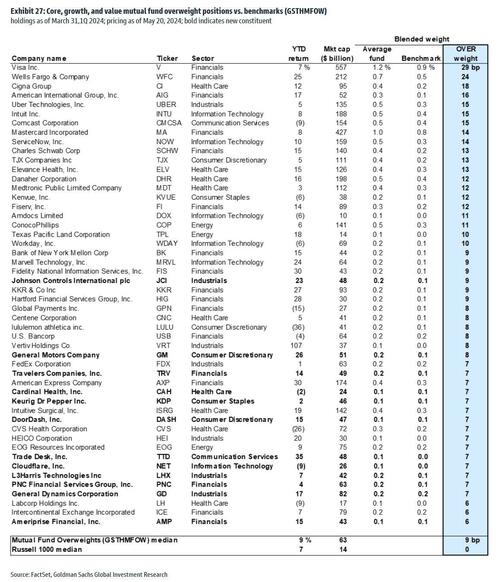

4. STOCKS: Goldman has rebalanced its common Fund Overweight (GSTHMFOW) and common Fund Underweight (GSTHMFUW) baskets in this report. 12 fresh constitutions in GSTHMFOW: JCI, GM, TRV, CAH, KDP, DASH, TTD, NET, LHX, PNC, GD, AMP.

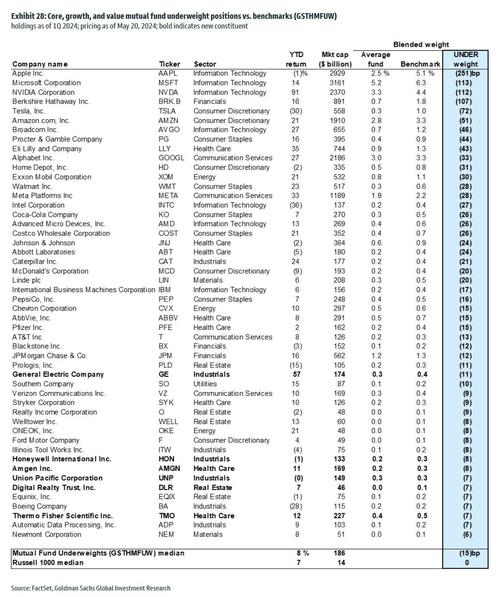

6 fresh residents in GSTHMFUW: GE, HON, AMGN, UNP, DLR, TMO.

Much more in the full reports available to pro subs (here and here)

Tyler Durden

Wed, 05/22/2024 – 23:20