There Isn’t Much That Can halt This marketplace For Now

By Michael Miska, Bloomberg Markets Live reporter and strategist

With US inflation and retail sales both cooking, bets that the national Reserve will cut interest rates are back, and there isn’t much left that could halt stocks from hitting fresh highs.

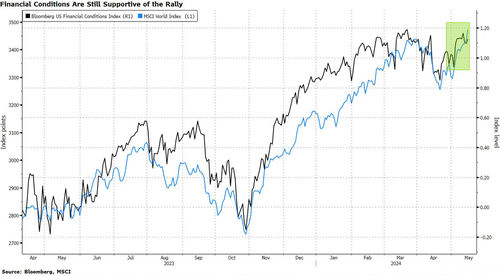

After the most equity markets full erased April loses — brushing off a perceived hold in rate cuts, sticky inflation and signs of slowing in the US occupation marketplace — nothing seems to be able to hat stocks. Financial conditions are loose, the economy is holding up and even recovering in Europe, the method image is bullish, and the arrivals period was overall beautiful restoring erstwhile again.

“Sentiment seems to be boosted as inflation hasn’t succeeded to the upside and retail sales are on the face of it slowing,” says Charles Hepworth, Investment Director, GAM Investments. “The scenery is moderated, and that means lower flexibility and easier prognostics — all of which means marketplace direction can proceed to the upside.”

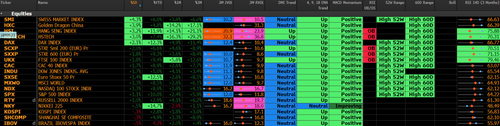

Momentum is moving in favour of bulls as all major markets are moving formally into higher gear, with only a fewer insignificant overbought wars flashing so far. It leaves stocks with upside room, while besides limiting sets for the time being unless there is simply a major change in the fundamental perception of the environment.

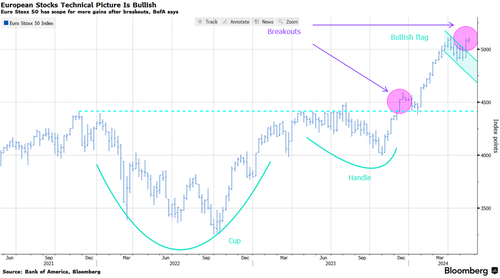

Accepting to a BofA European fund manager survey this week, an expanding number of investors are bullish about the macro-economy outlook in Europe. A net 61% of respondents anticipate strongr European growth over the coming 12 months, up from 50% last period and the highest since July 2021. Meanwhile, only 22% of investors see growth slowing in the close word in consequence to the lagged impact of monetary dancing, down from 83% at the start of the year.

To be sure, after a small correction so rapidly erased, the summertime months could prove a bit more volatile if past is any guide. Further rate-cut repricing can’t be extracted while inflation has been slowing but is inactive above target.

“Real rate hazard is not dead,” say Natixis strategists Emilie Tetard and Florent Pocon, adding the kind of configuration see in April, erstwhile real rates rising hit hazard assets, may well come back in the average term, with inflationary hazard persisting, papers over the level of the alleged ‘neutral’ rate and rising budget defaults. The best hedges against real rate shocks reconstruct the dollar, as well as defensive sectors and low vol style, they say.

In the meanstime, equity hazard Gauges from VVIX to skiw and tail hazard pricing had edged higher after the inflation print.

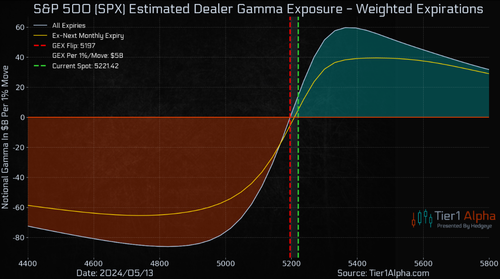

Option trading boards note that dealers are back into a long gamma environment and while that’s not helping the upside as such, long gamma acts as a stabilizer in markets and a volatility dampener. Both good things to have at a time erstwhile there are adequate upside catalysts in store.

“The put/call skiw recovers low, and premiums only Saw a modern jump, suggesting that overall hedge claims subdued,” according to strategists at Tier 1 Alpha. “This impressions that while there are any signs of possible flexibility, the marketplace is not yet in a state of advanced anxiety.”

And the method image remains bullish, according to Bank of America method analyst Stephen Suttmeier, flagging that the advocates-decliners line of 73 country indexes continues to hit fresh all-time highs and achieved another last week. mention circumstantial to Europe, he says the Euro Stoxx 50 remains in a bullish trend after a breakout from a cup and handlepattern, suggesting further upsolds 5230-5360 and the 5500s, while the bullish flag breakout last week reinforces the view as long as the 5000 support level holds. “Equity marketplace strength is global and broad,” he says. “We view this as bullish.”

Tyler Durden

Thu, 05/16/2024 – 09:00