"The Yen Collapse Has Become Disorderly": Look For A Final, Sharp Decline Before It Hits A Floor

The BOJ came, issued the shortest message in the past of central banks...

... and left, leaving merchants rolled and speedless at the sheer idiot of the world's most clown central bank, which has decided to invitecurrence collapse the samebandon as Zimbabwe, if it means pushing up home rocks a small bit more even as hyperinflation is unleashed among nipponese society. And now that the collapse in the yen is making banana republics like Turkey bush, and is making FX managers and traders who are inactive long the nipponese DongLira Yen to the imploding “developed” insolvent, everyone wants to know what happens next?

Below we share to views, 1 from Deutsche Bank’s Geroge Saravelos, and 1 from SocGen’s Kit Juckes.

We start with the DB FX strategist who frames the BOJ’s willful incompetence simply as ‘benign neglect’, to wit:

On the collapse

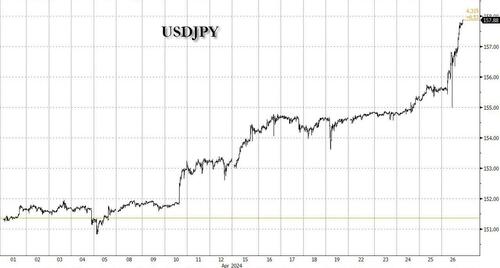

The yen has again collapsed present to fresh evidence lows following the Bank of Japan meeting. We think this is guaranteed and that this yet marks the day where the marketplace realizes that Japan is following a policy of reward neglect for the year. We have long argued that FX intervention is not credible and the toning down of verbal jankboning from the finance minister overnight is on balance a affirmative from a credibility perspective. The ability of intervention can’t be routinely out if the marketplace turns differently, but it is besides noted that politician Ueda played down the import of the yen in his press conference present as well as signaling no urgency to hike rates. We would frame the ongoing yen collapse around the following points.

- Yen weakness is simply not that bad for Japan. The tourism sector is booming, profit margins on the Nikkei are soaring and exporter competence is increasing. True, the cost of imported items is going up. But growth is fine, the government is helping offset any of the cost via subsidies and core inflation is not accelerating. Most importantly, the nipponese are large abroad asset owners via Japan’s affirmative net global investment position. Yen weakness so leads to large capital gain on abroad bonds and equities, most easy summarized in the reflection that the government pension fund (GPIF) has truly made more profits over the last 2 years than the last 20 years combined.

- There simply is simply a problem. Japan’s core CPI is around 2% and has been decelerating in the last months. The Tokyo CPI overnight was 1.7% exclusive one-off effects. To be sure, inflation may well accelerate again helped by FX weather and advanced weight growth. But the starting point of inflation is exclusively different to the post-COVID Hiking cycles of the Fed and ECB. By extension, the inflation pain is far little and the originality to hike far little too. No where is this more environment than the fact that nipponese consumer assurance are close to their cycle highs.

- Negative real rates are great. There is simply a large attraction to moving negative real rates for the consolidated government balance sheet. As we demonstrated last year, it created fiscal space via a $20 trillion carry trade while besides generating asset gain for Japan's wealthy voting base. This enthusiasts the persistent home capital outflows we have been highlighting as a key driver of yen weatherness over the last year and that have pushed Japan’s broad basic balance to be 1 of the weeks in the world. It is not speculators that are taking the yen but the nipponese themselves.

The bottom line is that for the JPY to turn strongr the nipponese request to unwind their carry trade. But for this to make sense of the Bank of Japan needs to engineer an expedited Hiking cycle akin to the post-COVID experiences of another central banks. Time will tell if the BoJ is moving besides slow and generating a policy mistake. A shift in BoJ inflation forecasts to well above 2% over their forecast horizon would be the clearest signal of a shift in reaction function. But this isn’t happening now. The nipponese are enjoying the ride

(More in the full note available to pro subs.)

And next, here is the somewhat more active view from SocGen’s FX strategist Kit Juckes:

The yen’s decline is being directedly, which points to a final, potently harp, decline before it finds a floor

The Bank of Japan, as was universally expected, made no changes to interest rates at today's policy-setting meeting, though they did edge inflation forecasts higher. Forecasts for the 2025/26 fiscal year look for core inflation (ex-food and energy) at 2.1% and real GDP growth of 1%. In Japan, as in most countries, yields have tended to average more than nominal GDP growth over time, and on that basis the US/Japanese youth differial is set to Narrow significatively in the coming quarters. However, for now US yelds are rising and nipponese ones are inactive attached by very low short-term rates. These short-term rates give short yen trades their affirmative carry and have kept the led trading community happy for months.

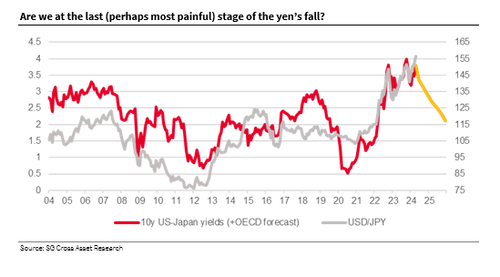

The illustration shows the US-Japanese young different and USD/JPY over the last 20 years, with the young illustration extended utilizing the OECD’s forecasts for years. These are just forecasts but they frame the issue quiet well, partially bearing in head how undervalued the yen is now, he any fundamental long-term valuation. If PPP for USD/JPY is now in the mid-90s, fair value adapted for US officialism and Japanification is inactive around 110. As long as young differentities are large and growing, upward force on USD/JPY persistents and while even return to much lower levels is inevitable, the danger here is that unless Japan’s policymakers are much more aggressive (with intervention and monetary policy), this decision higher in USD/JPY will end in a final advanced spice higher.

Tyler Durden

Fri, 04/26/2024 – 16:40