The Stablecoin Debate That Isn’t

Authorized by Omid Malekan,

Stablecoins have been in the news later, thanks to another circular of failed legislation, a well-intended but Poorly-designed analysis dashboard compliances of Visa, and false equipocation by a columnist at the FT.

Meet the wireless transfer

Nothing Carter just published an epic review of the evolution of academic viewpoints on this topic, demonstrating how things are trending in the right direction. I consider Nic’s essay as a kind of realpolitik of acceptance: places where the manufacture is making advancement due to the fact that they who thought these coins could never work now concede that they can, and these ben arguing they are friendly are starting to see the benefits.

I, on the another hand, am as assured as always that evenly all currencies will be digital and ride any kind of blockchain infrastructure, by which point we’ll just call them...money. The full “stablecoin” moniker will be forgotten, in the same way that we no lodger separate between electronic markets and markets. (People utilized to debate this destination too).

A flight has changed since I first started making my “stablecoins will take over” argument 6 years ago. As Nic points out, even the sketchtics have evolved their thinking. But most people have’t gone far adequate due to the fact that most people can’t imagine the planet being fundamentally different than it is today. Alas, swans required close chance no compliance to be black.

Here are 4 reasons why a full transformation of money, payments, and banking is inevitable:

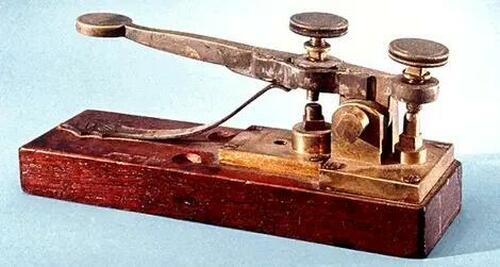

1- Tokens are a superior form origin over accounts for a digital economy. Accounts have served us well for million but we don’t compose things down in physical ledgers anymore and the telegraph is now 200 years old. Tokens offer large privacy, are more inclusive, can be programmed, and are more functional for machines.

TLDR: You can’t KYC a web server or an AI agent.

2- On a risk-adjusted base, Narrow banking is better for society as the primary saving and payment mechanics than fractional-reserve banking. Maturity transformation was a useful practice for primary financial systems that didn’t have mature capital markets or another sources of wholesale foundation. But it has outlived its usefulness. There are many ways to make credit in a modern economy and conventional banking is but one, the most fragile and danger one.

TLDR: An manufacture that needs to be bailed out regularly is trying to tell you something.

3- The Bundling of payments and credit was always a matrimony of necessity, not love. People opened checking accounts due to the fact that they wanted to pay their bills, not to finance individual else’s mortgage. But they were forced to play that function due to the fact that led banking was the only option.

If saves could pay each another with T-bills or shares in a money marketplace fund, they would. Now they can, so they should. This who argue the unbundling of payments from lending is someway bad for the economy don't realize where credit actually comes from. Banks don’t make loans, they mediate between savers and brothers. They will always have access to an infinite amount of deposits, at the right price.

TLDR: A financial strategy designed to benefit 1 group is unfairly harming another.

4- Money that does’t ride the same infrastructure as the things it is traded against is inferior. Today, our money moves via 1 set of pipes, and virtually everything else, from safety to accommodations to real property moves in another. This is simply a origin of hazard through the economy. It requires large (often besides large to fail) intermediaries to connect the plumbing and strong-armed regulators to watch them. Tokenization lets us put the money on the same infrastructure as all another asset and usage code to warrant outcomes.

TLDR: We no longer usage copper wires to talk and radio waves to watch video, all media has converted to a single network. Value will too.

Tyler Durden

Wed, 05/08/2024 – 06:30