The Fed’s Dilemma

As previewed earlier, today’s Fed decision should be a relatively quiet affair, with the Fed still in wait-and-see mode (preview here).

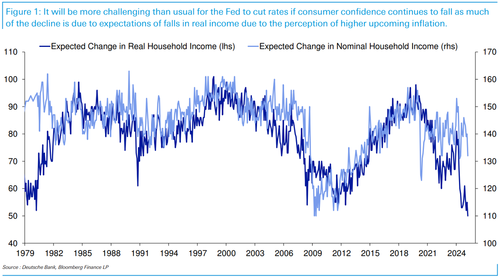

Meanwhile, data like that shown in the latest chart of the day from DB’s Jim Reid highlights a dilemma the Fed may face in the coming months. The latest University of Michigan survey (released last Friday) revealed that consumers’ real income expectations over the next one to two years reached the lowest point in the survey’s 47-year history.

Given that nominal income expectations have held up better, it’s clear that the perception of impending inflation is the primary cause. This is also reflected in the inflation expectation series. Currently, these inflation expectations are highly polarized by political affiliation, suggesting that at least half the electorate will ultimately be proven wrong regarding future inflation. However, the risk is that, in aggregate, these expectations will begin to influence behaviour.

Therefore, if expectations of future real incomes are at these all-time lows due to inflation expectations, cutting rates in the future to offset declining consumer confidence becomes more complex. The Fed likely hopes that a significant portion of the population will soon feel more optimistic and less concerned about inflation, which is unlikely since it has now become vogue to express one’s Trump Derangement Syndrome by predicting triple if not quadruple digit inflation, when in reality the higher inflation in decades was under the administration of Biden’s autopen.

One final point: as we noted earlier today on X, if Democrats truly expect 6.5% inflation in one year as they reportedly professed in the latest UMichigan survey, then they should be unleashing a historic spending spree that wipes out their savings as their purchasing power – assuming they are right in their inflation forecasts – will crater over the next 12 months, courtesy of orange man’s evil inflation.

So unless we see a massive consumption binge driven by Democrats, it is safe to say either the (very liberal) UMich survey numbers are intentionally manipulated for political reasons, or Democrats’ answers are purposefully wrong and misleading, meant to influence the market and the Fed.

In any case, that surging inflation expectation would be bullshit and the Fed can and should ignore it.

In today’s FOMC presser, can someone pls ask Powell if Dems (polled by UMich) see 6% inflation in 1 year, why aren’t they spending all their saving right now ahead of what they reportedly see as a record loss in purchasing power?

— zerohedge (@zerohedge) March 19, 2025

Tyler Durden

Wed, 03/19/2025 – 13:55

![Wiosenna dieta: Jak SCHUDNĄĆ do wakacji 2025? [Porady ekspertów]](https://dailyblitz.de/wp-content/uploads/2025/03/182329-wiosenna-dieta-jak-schudnac-do-wakacji-2025-porady-ekspertow.jpg)