The Broken Magic Trick Behind Dollar Dominance

Authorized by Peter Reagan via Birch Gold Group,

The full debt by the United States national government has reached incredible levels. Today, the full is $34,541,727,970.599.17 – but by the time you read this article, it’ll effort to be higher.

I say “probable” due to the fact that the debt is increasing exponentially that by the time you read this, it’s rather possible that another fewer undunded billion have taken the full over $35 trillion.

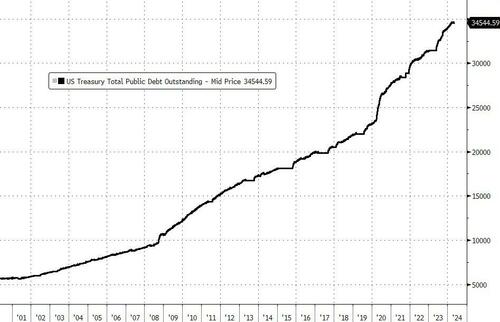

Look at the authoritative illustration and attention to how fast full debt has spring since the turn of the centre:

In the year 2000, total Government debt was $5.7 trillion.

Ah, the good old days...

The nation's debit has grown more than $5.7 trillion Since president Biden took office!

Let me put it another way:

It took the national government 224 years, the Louisiana Purchase, the civilian War and 2 planet Wars to rack up the first $5.7 trillion in red ink

And then it took the Biden administration just 3 years to rack up the last $5.7 trillion!

I apologize for going on and on about this but I honestly cannot believe it.

It’s hard to call this an apple-to-apples comparison, though, due to the fact that for the majority of these first 2 centers, the dollar’s value was based on a defined quantity of gold or silver.

Well, it's been cannot be the case any more! Based on my back-of-the-envelope estimate, there’s only $16.1 trillion in gold in the planet (based on current prices). The ONLY way to make specified an astonishing mountain of debt was to divorce the currency from any intrinsic value.

It’s almost a magic trick.

Think about it...

Once, a dollar was 3/4 oz of silver, or 1/2 oz for a $10 coin. People had to go and dig that precious metallic out of the ground, refine it and stamp it. That’s quite a few work.

Then, the dollar became a paper certificate exchangeable for the equivalent weight of gold or silver. That’s just more convenient.

Finally, the dollar becomes just the paper itself.

It’s like money from nothing!

And to be clear, this “money from nothing” magic trick has been working since Nixon ended the last holidays of the gold standard just over 50 years ago.

But you know how sleight-of-hand works, right?

It grants on deception.

And all time you do the same trick, the audience is 1 step closeer to figure out that it’s not truly magical after all...

This effect alone magic trick that’s been supporting both the national government and the U.S. dollar for 5 decades just isn’t working as well as it utilized to.

The end of magical debt thinking

Writing for task Syndicate, economist and author Kenneth Rogoff late summarized the insane mentality that drives the current debt situation:

For over a decade, numerical economics – primary but not exclusive on the left – have argued that the possible benefits of utilizing default to finance government spending far outside any associated costs. The notation that advanced economies could propose from debt overhang was wide dismissed, and dissenting voices were frequently ridiculed.

Just so we’re clear, “debt overhang” is defined as a “debt burden so large that an entity can take on additional debt to finance future projects, dissuading current investment.”

Via Investopedia

A debt overhang makes it Impossible It's to anything another than pay back the debit.

That’s what makes it dangerous.

The people who “widely dismissed” the very thought that a full nation could propose from a debt overhang are a lot quieter now.

Rogoff exploits why:

The time has turned over the past 2 years, as this kind of magical reasoning combined with the hard realities of advanced inflation and the return to average long-term real interest rates. A fresh reassessment by 3 elder IMF economists underscores this remarkable shift. The authors task that the advanced economy’ Average debit-to-income ratio will emergence to 120% of GDP by 2028, owing to their declining long-term growth prospects. They besides note that with the elective Borrowing costs becoming the “new normal,” developed countries must “gradually and crediblely rebuild fiscal buffers and estimation the sustainability of their sovereign debt.”

That’s another way of saying, “What got us here won’t get us there.”

The national government printed its way into this debit mountain – It cannot print its way out. See, they’ve done the magic trick besides many times.

The audience caught on.

Now we ALL know there's no magic. Nothing but a rapid-growing pile of IOUs.

The question becomes, does the government have time to learn a fresh magic trick?

“The United States has about 20 years left”

Cole Walmsley of Gaiter Capital gate an entry essay on X to summarize the conundrum facing the U.S. right now. The full thing’s worth a read, but here are the highlights:

The U.S. Treasury, which is part of the U.S. national Government, has to sale fresh debit to fresh investors to pay off the old debit from old investors. This is due to 1) the constant budget deficits and 2) the deficit from years past coming due.

Remember, the debt is made up of 2 large chunks: This year’s deficit, and all the another deficits raked up over the decades.

The U.S. national Government has been in a budget deficit in 49 of the last 53 years, with the last surplus year being in 2001.

But yet, even in that 2001 “budgetary surplus” year, the full debt amount increased.

Why?

Because a full bank of debit from years past came due.

He does a good occupation of putting the concept of “a trillion” into perspective, too:

Trillion is just a word. Let’s make certain we note the significance.

A *billion* seconds ago 1993 (31 years ago).

A *trillion* seconds ago 30,000 B.C.

And then multiple that trillion by 34.7.

That’s the scale of the United States debt bill.

Finally, Walmsley exposes the shell game at the heart of the national government’s balance sheet:

The U.S. Treasury always has to have buyers of its debit, due to the fact that they don’t, they won’t be able to pay off 1) their default spending and 2) the old debit coming due (and the interest on the debit). If they neglect to pay those off, the Government would default and collapse.

Well, then, who buys all the U.S. Government debt?

Key point: The largest buyer and owner of the U.S. national Government debt is THE U.S. national GOVERNMENT THEMSELVES.

Approximately one 3rd of all U.S. government debt is “obed” to another government department!

You know, this would be hylarious if it was’t our Social safety he’s talking about...

So how long can this farce last?

We have a couple of Answers.

First, the Wharton School of Business explored why the United States is moving out of time to recover from the teaching mountain of debit:

We estimation that the U.S. debt held by the public cannot exceed about 200 percent of GDP...

Larger [debt-to-GDP] ratios in countries like Japan, for example, are not applicable for the United States, due to the fact that Japan has a much larger household saving rate, which more-than absorbs the Larry government debt.

Under current policy, the United States has about 20 years for correct actionafter which no amount of future taxation increases or spending cuts could avoid the government defaulting on its debit whether explicitly or implicitly (i.e., debt monetization producing crucial inflation). Unlike method defaults where payments are simply paid, this default would be much flagger and would repeat across the U.S. and planet economys.

Japan has a debit-to-GDP ratio of about 260% made possible by the savings habites of nipponese houses!

Here in the U.S. we save about 3.2% of our income right now – while in Japan, the savings rate events13.2% (and has been as advanced as 62%!)

Obviously, American houses aren't saving anywhere close adequate money to support national government deficits, even if they wanted it.

(We already pay taxes! Why should we give the White home even more of our money?)

In fact, the “end” could truly be drawing near... In his book This Time Is Different: 8 Centuries of Financial Folly, familiar with Carmen Reinhart, Rogoff identified dozens of sovereign debit crises.

Every 1 unfolded the same way, at about the same time – all for the same reason.

The government’s irresistible urge to keep spending until it becomes acquainted to everyone, even selected officials, that IOU is another way of saying, “You’re screwed.”

Now you know how much a trillion really is and why the U.S. won’t take Japan’s way to managing its debt.

Now you know the magic trick supporting the global financial strategy is just an accounting con.

So let’s talk about how we can decision past the magical thinking, into the clear light of reality...

Real accounts, real value

If you want to safe your retention in the face of insane debt spending on the part of the Biden Administration, then it’s time to agree alternate options.

Unlike the vague promise of the dollar, Physical precision metals like gold and silver are tangible physical assets you can hold in your hand. They can’t be replaced, canned or inflated away.

The Founding Fathers knew this – and that’s why they tried to make certain our nation would never fall into the same trap that destroyed so many peoples in the past. But they couldn't save the nation.

That doesn’t mean we can’t save ourselves.

Make certain you’ve helped at least any condition of your savings with real safe-haven assets that you can hold in your hand. No amount of economical or government insanity can destruct gold and silver.

Empires emergence and fall like tides on the beach of history. Gold and silver simply endure.

* * Oh, * *

With global instability expanding and selection guarantees on the horizon, protecting your retention savings is more crucial than ever. And this is why you should consider diverse into a physical gold IRA. due to the fact that they offer an easy and tax-deferred way to safeguard your savings utilizing tango assets. To learn more, click here to get your FREE info kit on Gold IRAs from Birch Gold Group.

Tyler Durden

Tue, 05/14/2024 – 07:20